TWT price rallies 40% overnight with trading volume up by a remarkable 2,595%

Breakout above resistance eyes $1.37–$1.50 next targets

CZ mention and FlexGas update boost adoption and demand

Trust Wallet is a versatile, non-custodial crypto wallet that allows users to store, send, receive, and stake digital assets directly from their mobile devices. With support for both fungible tokens and NFTs, it has become a go-to choice for millions of users worldwide. Android users benefit from a built-in DEX and DApp browser, while iOS users connect through WalletConnect to access the decentralized web.

Acquired by Binance in 2018, Trust Wallet has grown into the official wallet of the BNB Smart Chain. It supports more than 4.5 million crypto assets and over 25 million users globally. At the heart of its ecosystem is the Trust Wallet Token (TWT), which has just staged one of its biggest breakouts in months.

A New Wave of Attention?

Trust Wallet Token also benefited from renewed attention after Binance co-founder Changpeng “CZ” Zhao highlighted it publicly. This endorsement helped push TWT to a 3-month peak, coinciding with the release of a fresh white paper.

Interestingly, TWT began as an experimental token, with its fully diluted valuation rising too quickly in its early days. In response, developers burned 99% of the total supply, but the token initially lacked significant use cases. That narrative is now shifting, with new utility features like FlexGas and broader ecosystem integrations giving TWT stronger fundamentals to support its rally.

TWT Price Analysis

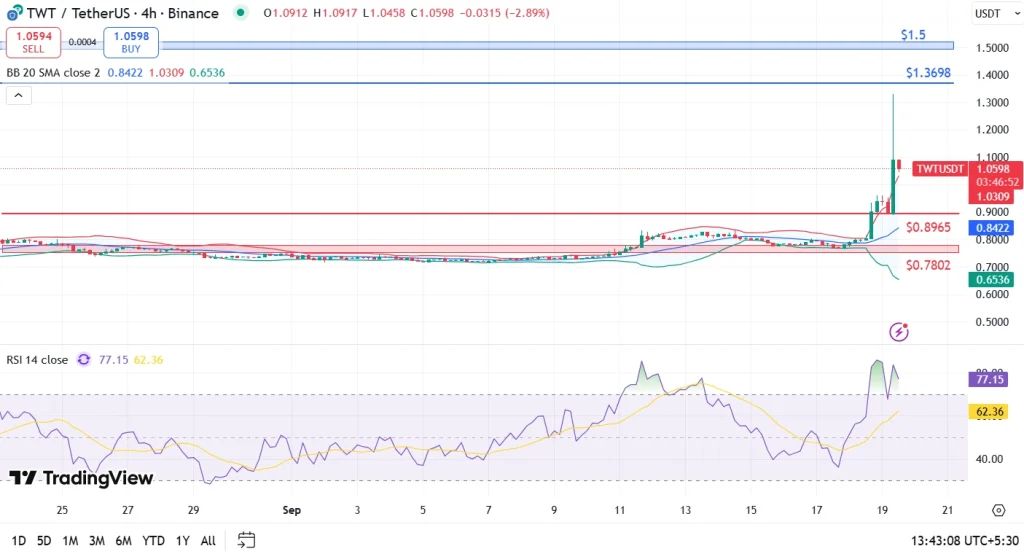

TWT is trading at $1.11, up 40.72% in a single day and 39.09% over the past week. Its market cap stands at $481.89 million, while 24-hour trading volume has zoomed to $345.2 million, marking a 2,595% surge. The token’s daily range stretched from a low of $0.7987 to a high of $1.30, highlighting intense volatility.

Looking at the technical side, the TWT price broke out of a long-term descending resistance line on July 20, 2025. This move set the stage for targets between $1.37 and $1.50. The recent surge has also pushed the TWT token above the 127.2% and 161.8% Fibonacci extension levels at $1.02 and $1.10, respectively. A sustained close above $1.12 could accelerate gains toward the $1.37 mark.

The RSI at 77 signals overbought conditions, but the strong trading volume suggests persistent buying pressure rather than a short-lived spike. A hold above the psychological $1.00 support would reinforce bullish momentum, while a dip below $0.95 could spark profit-taking.

FAQs

The FlexGas update, higher adoption, and CZ’s mention boosted demand.

The next resistance lies between $1.37 and $1.50 after breaking $1.12.

Yes, if it falls below $0.95, profit-taking could trigger a pullback.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.