Cardano's price has shown a high correlation with Bitcoin and the wider altcoin market.

The re-opening of the U.S. government is likely to turn into a classic sell-the-news event.

On-chain data analysis shows that whales and retail investors have been dumping aggressively over the past few weeks.

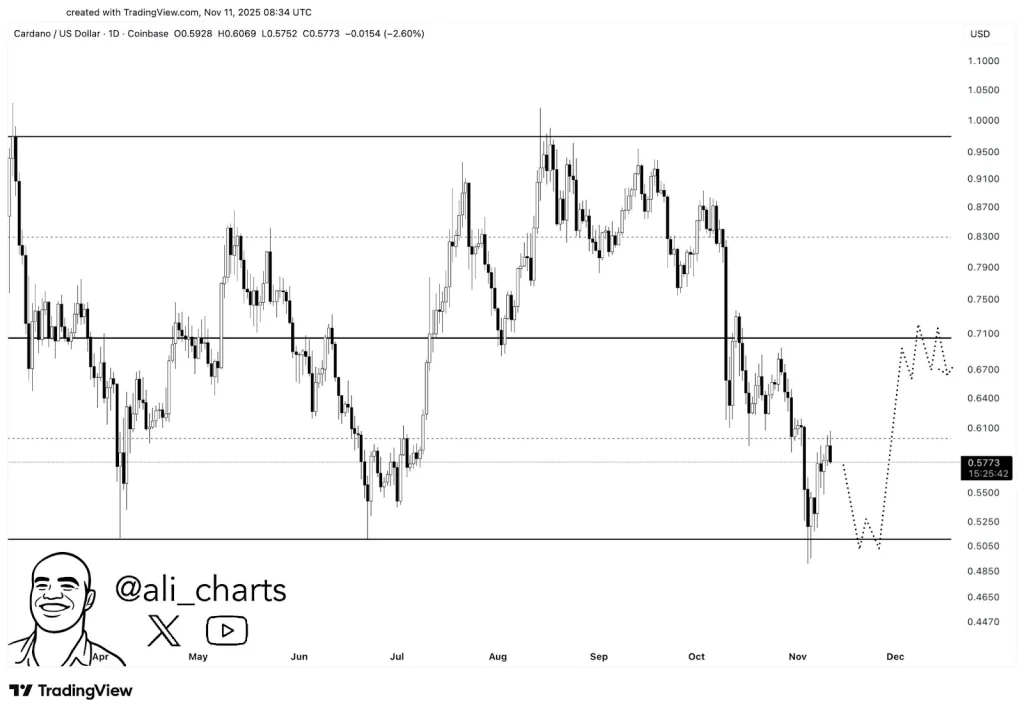

Cardano (ADA) price is on the cusp of breaching its 2025 support. The large-cap altcoin has weakened its support range of between $0.57 and $0.51 every time it retested year-to-date (YTD).

This support range was pierced during the October 11, 2025, crypto crash. Ever since, the ADA price has continued to weaken on a weekly basis. According to crypto analyst Ali Martinez, ADA price must hold its last line of defense around $0.51 to validate a rebound towards $0.7.

Two Reasons Why Cardano Price Will Drop Below $0.5 Soon

Low crypto liquidity amid heightened fear of further capitulation

According to on-chain data analysis from Santiment, whale investors and retail traders have been selling aggressively in the recent past. As such, the fear of further crypto capitulation has remained high, as shown by CoinMarketCap’s Fear and Greed Index, which hovered around 31/100 at press time.

The reopening of the U.S. government after 40 days of shutdown is a huge relief for the markets. However, the overall liquidity has not reached the crypto market as investors continue to bet on stocks focused on artificial intelligence (AI).

Nevertheless, the highly anticipated Federal Reserve’s Quantitative Easing (QE) next month, amid rising global reserves, will be bullish for the wider crypto market including ADA.

Fractal pattern repetition: the current bull market is similar to the 2020/2021 cycle

From a technical analysis standpoint, ADA price has been following a similar fractal pattern to its 2020/2021 bull cycle.

In the weekly timeframe, it is evident that ADA’s parabolic rally to the price discovery phase began after retesting its multi-year support/resistance level established through the bear markets.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.