Tron price drops 3.65% in a week, testing key support zones

Active addresses dip as sentiment shifts and trading volume stays strong

Chart signals point to possible volatility with clear targets and timing

Looking at Tron’s price performance this week, the action feels more like a roller coaster for holders and traders alike. TRX started with a slight uptick, but quickly turned red, registering a 3.65% loss over the last seven days. Market participants watched as the price hovered near $0.2881, pushing against support.

Even as the 24-hour volume held firm at $794.3 million and the market cap stood tall at $27.25 billion, Tron faced pressure from technical headwinds and lower network activity. Why this sudden shift? Traders notice a mix of macro volatility, reduced bullish momentum, and a visible slowdown in network engagement, as seen from on-chain statistics.

Active Addresses Hint At Caution?

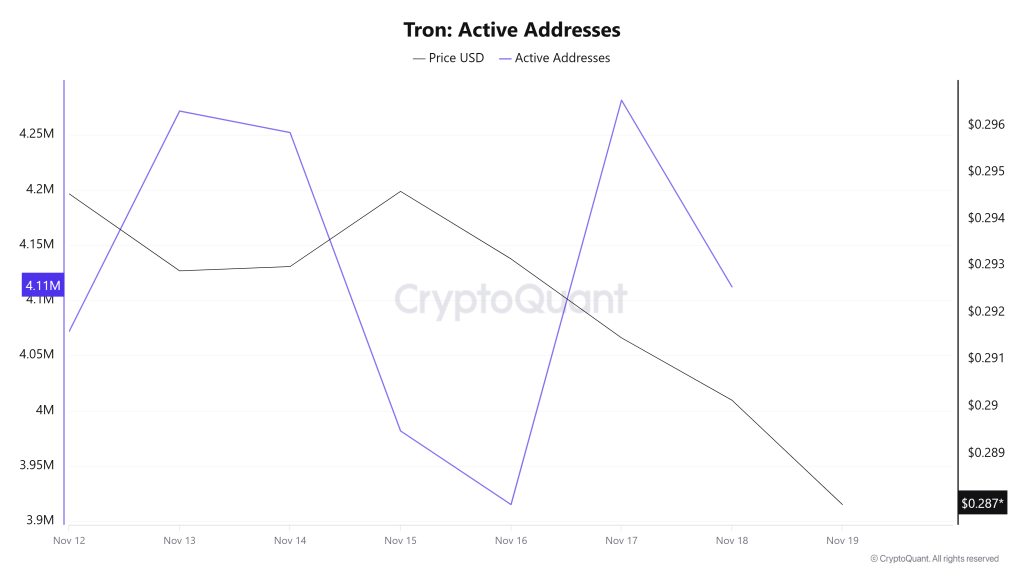

On-chain indicators often tell a story more crucial than price alone. As per CryptoQuant, over the past week, Tron’s active addresses dropped to around 4.11 million, breaking below recent highs. While spikes and drops have happened before, the recent downward slide is noteworthy, hinting at waning enthusiasm and reduced network activity.

Users seem less eager to participate, possibly echoing skepticism or simply taking a breather after robust activity earlier in the month. The price eased from near $0.296 to $0.287, confirming that Tron’s on-chain movement is mirroring the sentiment seen in the market. If addresses remain calm, further price contraction is possible.

Price Analysis

TRX’s price chart is painting a mixed picture right now. The price is hovering near the critical $0.2918 resistance while sitting just above key support at $0.2843 and $0.2784. The Bollinger Bands show tightening volatility, and the current candle rests at $0.2878, slightly below key moving averages. RSI levels at 39.31 and 43.89 suggest the asset is moving close to oversold, adding weight to the bearish argument for now.

If sellers gain momentum, the Tron price could dip toward $0.2843, and a harsher decline might push it down to $0.2784 before the weekend. Conversely, if buyers jump back in, a break above $0.2918 may happen, potentially pushing Tron toward the $0.2990 mark in the coming days.

Given the on-chain weakness and technicals, bearish pressure feels stronger at the moment. However, Tron has surprised us before. If support holds and active addresses pick up, TRX might stage a comeback. For now, expect the price to range alongside these support zones through the week, with major targets likely to be hit by Friday, barring a sharp reversal.

FAQs

Tron trades at $0.2881, down 3.65% this week. The trend leans bearish with support near $0.2843, unless buyers reclaim momentum.

TRX price fell this week due to lower active addresses, reduced network engagement, and bearish sentiment.

If bearish momentum persists, TRX may test support at $0.2843 by Friday. A sudden bounce could push it above $0.2918 this week.

No strong bullish signals yet. Technicals favor bears, though a spike in volume or active addresses might flip the trend quickly.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.