TRON price stables near $0.308 showing relative resilience, while broader momentum remains selective.

TRX’s price breakout and on-chain metrics points to a bullish outlook.

TRON (TRX) is showing inherent strength and is holding firm after rising higher in this week. Instead of retracing sharply or giving back gains, Tron price has settled into a higher range, with buyers accumulating to push toward higher levels. This signals more short-term enthusiasm among market participants, suggesting growing confidence.

While broader momentum across the market remains selective, TRX has continued to gain traction, indicating that the capital is not merely passing through. TRON’s ability to hold above the prior resistance zone of $0.300, underlying rising demand rather than short-term positioning.

To understand whether the shift is sustainable, let’s look at the drivers beneath the surface: technical structure and on-chain metrics.

TRX Price Action Confirms Bullish Continuation Setup

TRX’s recent price action reflects a sign that has shifted decisively out of consolidation and into a recovery-driven expansion phase. After trading several months capped below a descending trendline resistance, price has now pushed through multiple hurdles, signaling a structural change rather than a short-lived bounce

A key level now sits around the $0.32 region, which previously acted as resistance. TRX is currently testing this zone and eyes to flip into support. A clean break above this level would mark a meaningful transition into a 20% surge to $0.3680.

As long as TRX holds above the breakout base, the structure remains skewed toward continuation rather than exhaustion. However, a drop below $0.30 may trigger a profit booking move, which may push TRX price toward $0.2900 level ahead.

On-Chain Data Shows Bullish Outlook

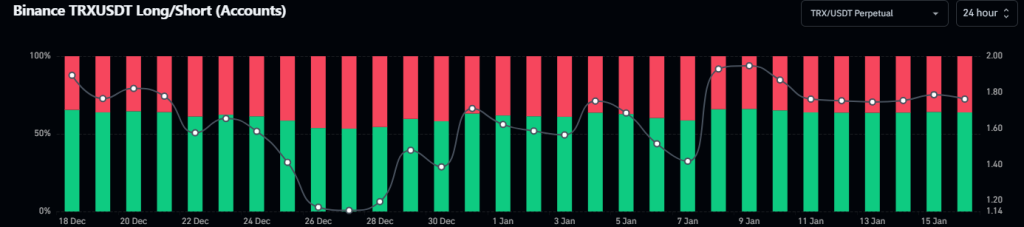

Data from Coinglass shows that traders have been betting more on long positions, as Long/Short accounts data represents 63% of long accounts compared to 37% in shorts. The resulting 1.76 long-to-short ratio represents a clear bullish outlook.

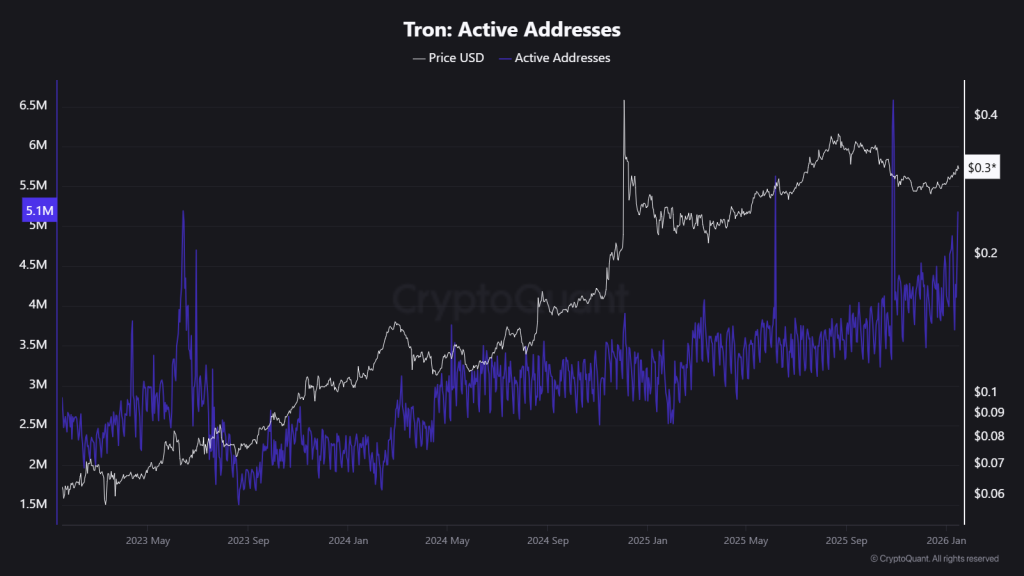

Moreover, a growing number of active addresses reflects a positive sign, which could lead to increased demand for Tron and bolster price increases.

The growth in active addresses, particularly those with balances, signals a positive outlook for TRX, suggesting a bullish trend as network participation expands.

FAQs

TRX is expected to trade between $0.55 and $1.10 in 2026, supported by strong adoption, technical trends, and bullish market momentum.

In 2027, TRX could range from $0.77 to $1.49, with an average around $1.13, continuing its steady upward trend.

By 2030, TRX could hit a high of $3.55, with a potential low of $1.82, reflecting long-term growth in payments and blockchain adoption.

TRX shows strong long-term potential, with projected growth through 2030, backed by real-world use in payments, stablecoins, and global adoption.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

![Why Is Crypto Crashing Today [Live] Updates](https://image.coinpedia.org/wp-content/uploads/2026/02/23165659/Why-Is-Crypto-Crashing-Today-Live-Updates-1-1-390x220.webp)