XRP falls below key $2.81 support amid heavy liquidations and weak sentiment

Market-wide sell-off triggers $1.5B liquidations, driving XRP down 9% in 7 days

ETF approval sparks profit-taking, leaving short-term outlook under pressure

The crypto market is flashing red once again. As of September 26, global market cap sits at $3.74 trillion, down 2.27% in 24 hours. The Fear & Greed Index has slipped to 32 (Fear), showing clear risk-off sentiment. Altcoins are particularly hit, with the average RSI at 35.85 indicating oversold conditions. XRP is no exception, falling to $2.76, down 3.3% in a day and over 9% in a week. So why exactly is XRP under pressure today? Let’s break it down.

Factors Behind XRP Price Fall

1. Macro Liquidation Cascade

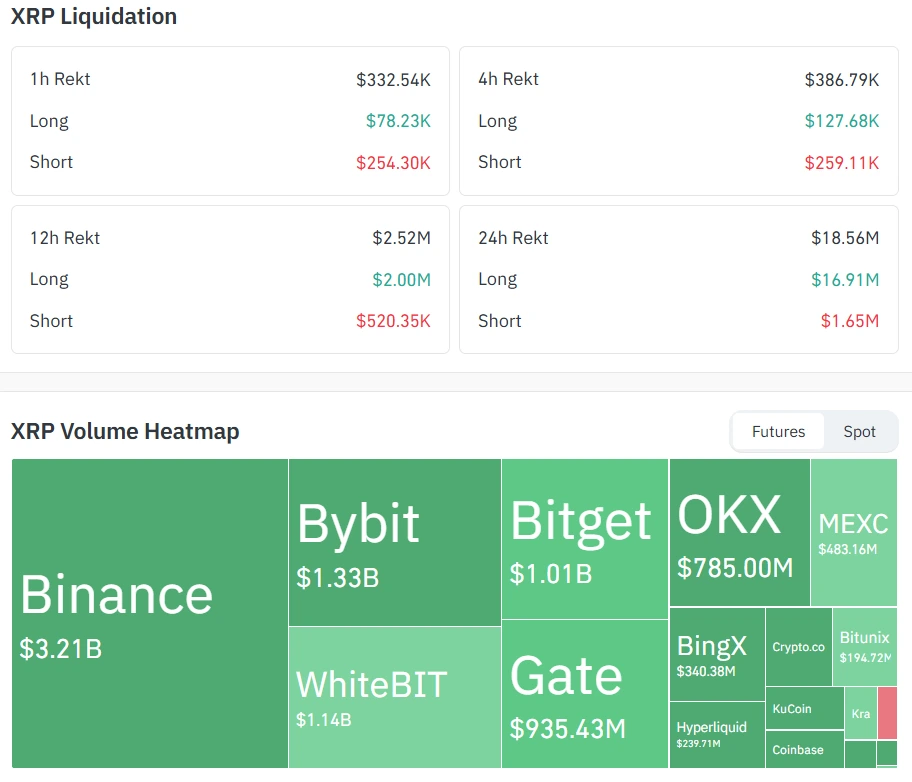

The broader crypto market just faced a $1.5 billion liquidation wave after Ethereum dropped below $4,000. With XRP closely tied to market sentiment, it suffered sharp outflows as leveraged positions unwound. XRP’s 24-hour volume spiked 30.7% to $8.73B, signaling panic-driven selling. Adding to the pain, open interest rose 7.92% to $1.11T, suggesting traders were caught on the wrong side of the move.

2. Technical Support Failure

On charts, XRP broke down below the $2.81 Fibonacci retracement and its 100-hour moving average. This invalidated a bullish setup that had defended the $2.71 floor since July 2025. The RSI dipped to 29.24 (oversold) while the MACD flipped negative, showing clear bearish momentum. Analysts now warn that a decisive close below $2.71 could drag XRP toward the $2.50–$2.55 zone.

3. ETF Approval Profit-Taking

Ironically, positive news also played a role in the drop. The SEC approved a Hashdex ETF holding XRP/SOL/XLM on September 25, but instead of a rally, XRP saw heavy selling. Traders had already priced in the event after an 8% run-up earlier in the week and rushed to “sell the news.” While the ETF drew $37.75M in spot volume on its launch day, it was modest compared to BTC and ETH products, muting optimism.

XRP Price Analysis

At the time of writing, XRP price is at $2.76, with a market cap of $165.21B. It has posted a daily low of $2.74 and a high of $2.87. Trading volumes remain elevated, which highlights both panic selling and speculative positioning.

The $2.71 level is now the key short-term support. A bounce here could stabilize XRP, especially if broader market sentiment recovers. However, a clean break below $2.71 opens the door to $2.55, a level last tested in June. On the upside, reclaiming $2.81 on a daily close would be an early sign of strength, while a move above $2.99 could neutralize bearish momentum.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Because traders used the approval as an opportunity to lock in profits after a pre-announcement rally.

$2.71 is the make-or-break level. Holding it signals accumulation, but losing it may lead to $2.55.

Yes, RSI readings are near oversold territory, but bearish momentum remains strong until $2.81 is reclaimed.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.