Market volatility reveals the top altcoin to buy in December 2025 as smart money often buys in chaos.

Chainlink benefits from CCIP, Bittensor’s halving is coming, & Solana sees major liquidity inflows despite short-side dominance.

Liquidation maps for LINK, TAO, and SOL signal possible sharp reversals ahead.

As volatility dominates the December start, the search for the top altcoin to buy in December 2025 has intensified. This is because, despite heavy drawdowns across major assets, the latest market noise is creating rare opportunities as smart money quietly moves its money and accumulates in the fundamentally strong projects at a discount. With liquidation imbalances rising, three assets now stand out as potential recovery candidates.

Chainlink: Interoperability Strength Amid Market Stress Makes It The Top Altcoin to Buy in December 2025

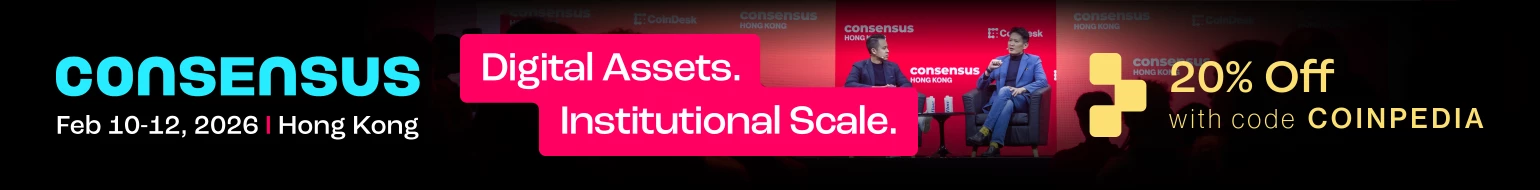

Chainlink continues to gain institutional relevance even as short positions stack aggressively on the LINK Liquidation chart. Its Cross-Chain Interoperability Protocol (CCIP) already connects more than 70 chains, which is offering one of the most secure frameworks for transferring assets and messages across independent networks.

Similarly, the Chainlink Runtime Environment (CRE) strengthens its role in powering institutional-grade smart contracts, and it is deeply embedded in the rapidly expanding Real-World Asset (RWA) segment, as well. Where experts project that it will hit $16 trillion by 2030.

Various RWA platforms rely on Chainlink’s Data Streams for high-throughput and verifiable feeds. However, the LINK Liquidation chart currently shows that cumulative short volumes outweigh long positions, indicating that traders are heavily shorting LINK during the broader downturn.

If the market rebounds and LINK climbs back above the $12.86 region, liquidation pressure could trigger over $25 million in shorts, potentially amplifying a recovery. With its fundamentals and relevance to RWAs, the LINK price USD outlook still remains structurally constructive for a medium-term LINK price prediction.

Bittensor: Rising AI Demand and Halving Dynamics

AI remains one of the most talked-about narratives of 2025, making Bittensor (TAO) a notable contender for the top altcoin to buy in December 2025. Bittensor incentivizes decentralized AI and machine-learning contributions, giving it a differentiated use case compared to conventional altcoins.

A standout factor is its Bitcoin-like tokenomics. The 21 million max supply, combined with a halving schedule, creates recurring supply squeezes. The next halving is scheduled to occur in approximately two weeks, reducing block rewards from 1 TAO to 0.5 TAO. That reduction from 7,200 TAO per day to 3,600 TAO per day could support upside if demand remains firm.

Yet the TAO Liquidation chart also mirrors the broader market imbalance, with short positions dominating. If TAO rebounds above $291.2, cumulative short liquidations could exceed $16 million. Such a move may fuel a sharp upward reaction in the TAO price USD, supporting a more optimistic TAO price prediction into 2026.

Solana: Strong Ecosystem Activity Despite Short Pressure

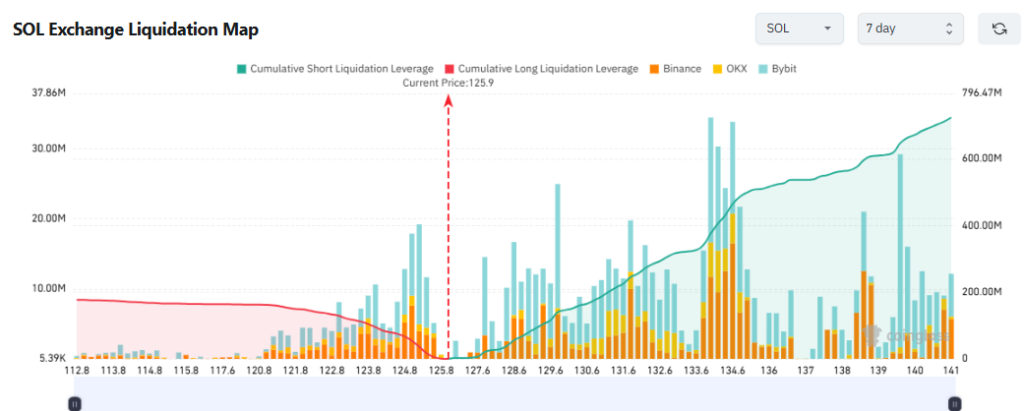

Solana remains another strong candidate for the top altcoin to buy in December, as it shows a significant imbalance on the SOL Liquidation chart, signaling intense short interest. In early December, traders heavily shorted SOL, yet the blockchain continued to outperform on-chain activity metrics.

According to DeFiLlama, Solana now holds the second-largest TVL after ETH, nearing $8.50 billion. Its core advantages are high speed and low transaction costs that continue to attract new liquidity and developer momentum.

In fact, Circle recently minted approximately 750 million USDC on Solana within 24 hours, pushing issuance above 1.35 billion USDC and signaling renewed inflows into the ecosystem.

If SOL/USD rebounds to $139.6, cumulative short liquidations could surpass $600 million. This level would place strong upward pressure on SOL price USD, potentially triggering a larger move in the broader SOL price prediction outlook.

To conclude, while the broader market faces heightened volatility, the combination of liquidation imbalances, ecosystem growth, and upcoming catalysts positions Chainlink, Bittensor, and Solana among the top altcoins to buy in December for strategic investors seeking discounted opportunities before market noise fades.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.