Despite the bearish market sentiment, crypto whales are showing strong interest in Ethereum (ETH). Data from the blockchain-based transaction tracker Lookonchain reveals that ETH whales are on a buying spree.

Whales Buy 15,563 ETH Amid Price Crash

In a recent post on X (formerly Twitter), it was revealed that a crypto whale who previously bought 3,195 ETH for $5.97 million has now purchased another 4,100 ETH for $7.32 million on April 4, 2025.

It appears that this whale is averaging its ETH purchases. The post also revealed that since March 26, 2025, the whale has accumulated 33,441 ETH worth $65.5 million at an average price of $1,959.

In addition to this whale, another crypto whale recently created a new wallet and spent $20.78 million to purchase 11,463 ETH at an average price of $1,813 in the past six hours, as reported by Lookonchain on X.

These massive ETH purchases by crypto giants raise a question and suggest that this might be an ideal time to buy ETH at a lower level.

Current Price Momentum

At press time, ETH is trading near $1,790 and has recorded a modest price surge of over 0.90% in the past 24 hours. However, during the same period, the asset’s trading volume dropped by 30%, indicating lower participation from traders and investors compared to the previous day.

Ethereum (ETH) Technical Analysis and Upcoming Levels

According to expert technical analysis, ETH appears bearish after recently breaking below a crucial support level of $1,810. Based on recent price action, if ETH remains below the $1,810 level, there is a strong possibility it could decline by 15% to reach $1,500 in the coming days.

Currently, the altcoin is trading below the 200-day Exponential Moving Average (EMA) on the daily timeframe, indicating a strong bearish trend.

Major Liquidation Levels

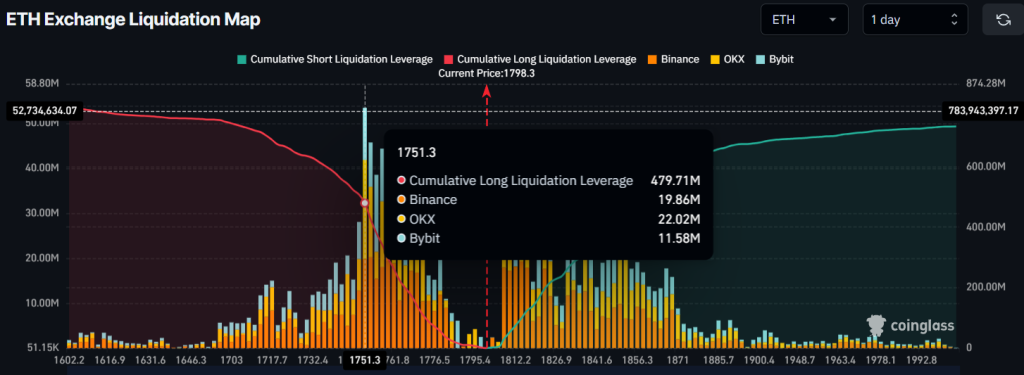

In addition to the bearish price action, traders are currently over-leveraged at the $1,751 support level and the $1,822 resistance level, as reported by the on-chain analytics firm Coinglass.

Data further reveals that traders have built $480 million worth of long positions and $195 million worth of short positions at these over-leveraged levels, clearly reflecting the current market sentiment.