The US Federal Reserve's interest rate decisions significantly impact Bitcoin prices, with rate changes or pauses often leading to market fluctuations.

From mid-2022 to mid-2024, the Fed aggressively raised rates to combat high inflation, followed by a reversal and rate cuts in late 2024.

Bitcoin's price generally reacted positively to rate cuts, leading to bull runs.

In its latest Federal Open Market Committee (FOMC) meeting, the U.S. Federal Reserve announced yesterday that it will keep interest rates unchanged at 4.25%-4.5%. Every Fed decision impacts financial markets, and Bitcoin is no exception. Over the past 24 hours, BTC has climbed 3.1%, reflecting investor optimism.

But how has Bitcoin reacted to past rate changes? And what might happen next? Let’s take a closer look.

The Fed’s Tightening Cycle

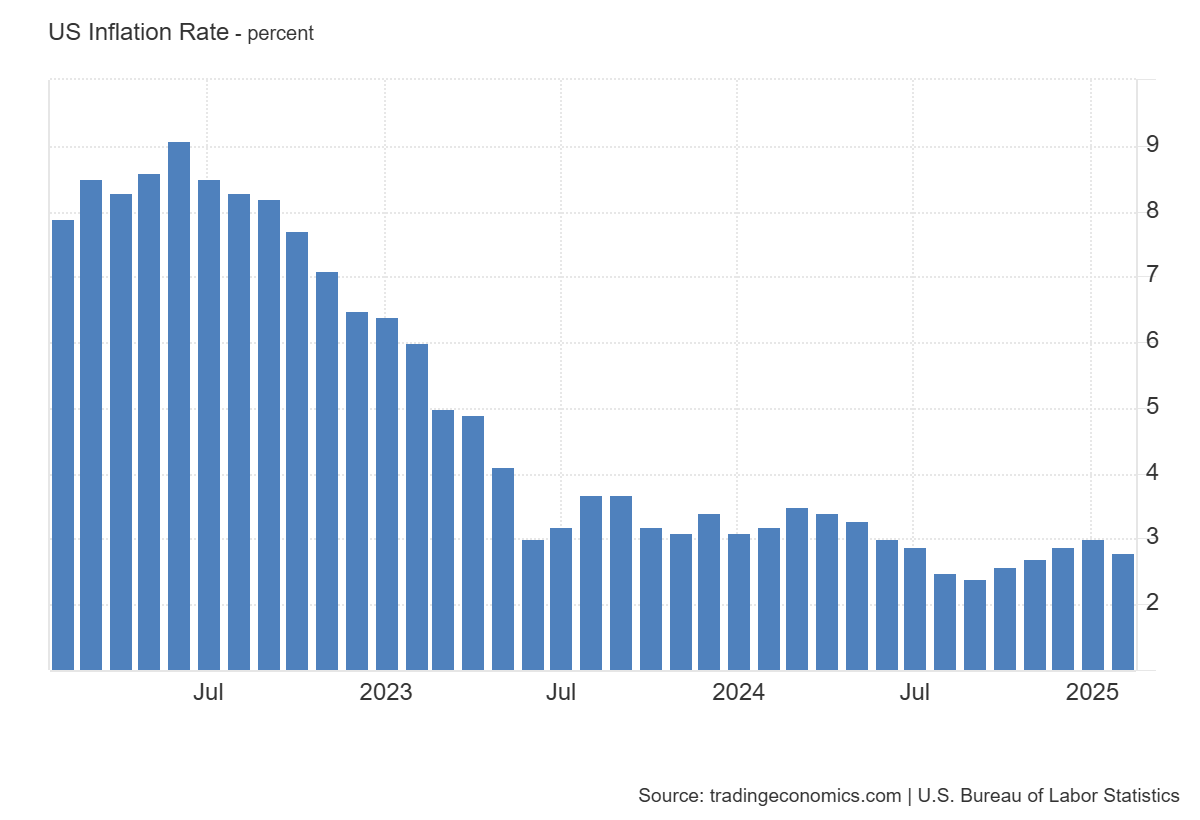

In April 2022, the federal funds rate was just 0.5%. However, inflation surged to 8.6% by May and peaked at 9.1% in June—the highest level in over a decade. To fight rising prices, the Fed began increasing interest rates.

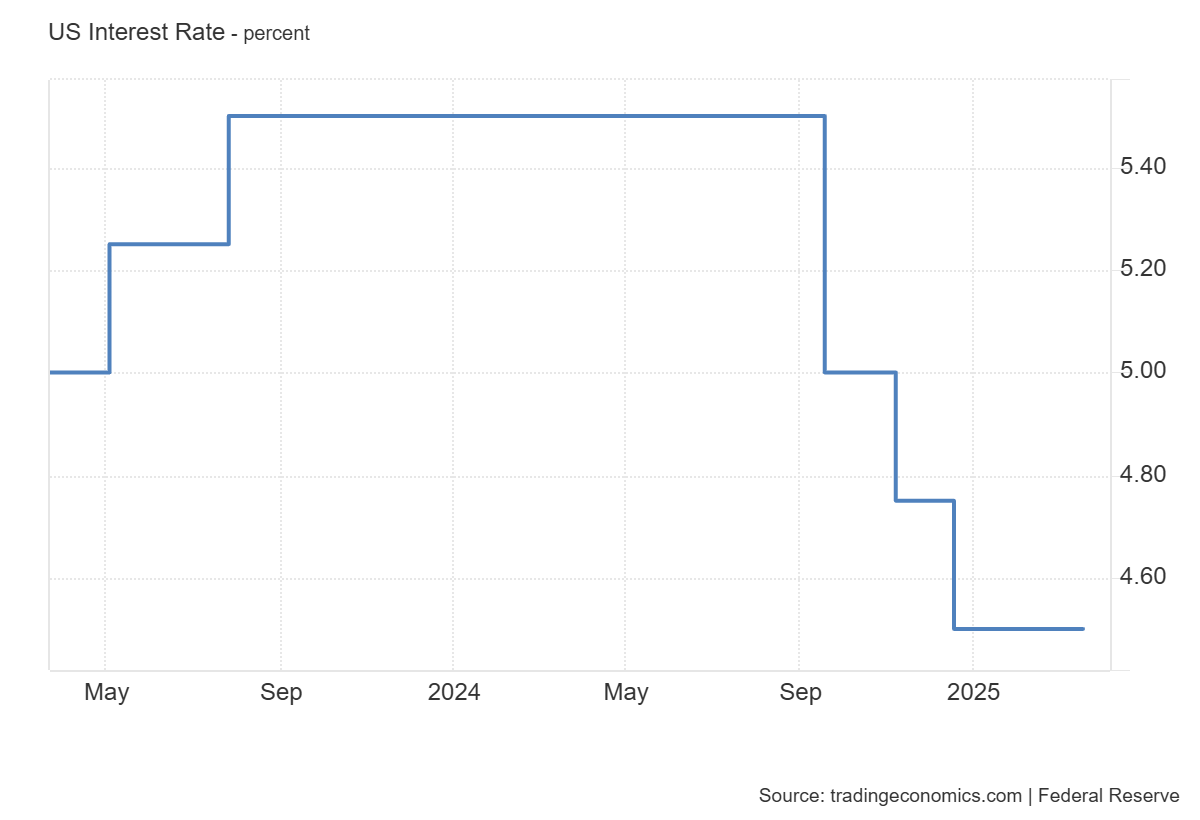

Between May 2022 and July 2023, rates steadily climbed, reaching 5.5% by mid-2023. The rate then remained unchanged until August 2024, as inflation gradually cooled.

By August 2024, inflation had dropped to 2.5%, prompting the Fed to shift its stance. In September, it cut rates from 5.5% to 5%. Another reduction in November brought it to 4.75%, followed by a final cut in December to 4.5%.

These cuts fueled Bitcoin’s rally. After the September rate drop, BTC surged 10% in just ten days, marking the start of a strong bull run.

Bitcoin’s Response to Recent FOMC Meetings

- March 2024: The Fed kept rates at 5.5%. Bitcoin initially surged to a new all-time high (ATH) before stabilizing between $71K and $61K in April.

- May 2024: No rate change. BTC showed minor signs of recovery.

- June 2024: Despite acknowledging lower inflation, the Fed kept rates steady. BTC fell to $58,360.67.

- July 2024: No change again. BTC plummeted, hitting a low of $48,919.60 in early August.

- September 2024: The Fed cut rates to 5%. Bitcoin soared 10%, kicking off a bull run.

- November 2024: Another 25 bps cut, combined with Donald Trump’s election victory, fueled BTC’s rapid growth.

- December 2024: The final rate cut (to 4.5%) pushed BTC to a new ATH of $108K.

2025: The Fed Pauses – Will Bitcoin Hold Its Gains?

At the January 2025 FOMC meeting, the Fed chose to keep rates at 4.5%, shifting to a “wait and see” approach. By then, Bitcoin had lost some bullish momentum but had still reached an ATH of $109K.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

The Fed may be on pause, but Bitcoin never really stops. Whether it’s another surge or a cooldown, one thing’s certain – volatility is part of the ride.

FAQs

As per Coinpedia’s BTC price prediction, 1 BTC could peak at $169,046 this year if the bullish sentiment sustains.

With increased adoption, the price of 1 Bitcoin could reach a height of $610,646 in 2030.

As per our latest BTC price analysis, the Bitcoin could reach a maximum price of $5,148,828.