Stellar price trades near key support despite lingering bearish structure on higher timeframes.

On-chain data suggest downside pressure is fading as positioning shifts.

After weeks of muted price action and repeated failures near resistance, Stellar (XLM) price still appears trapped in a bearish-looking structure. The lack of momentum has kept traders cautious, especially as broader crypto markets struggle to sustain direction.

However, Stellar price is doing what markets often do before a big rally. Moreover, beneath the calm surface, the data is starting to shit. XLM price is holding firm near the demand zone around $0.20, and positioning across derivatives suggests that market may be leaning too heavily in one direction.

The question now is not why Stellar (XLM) looks weak, it is whether the market is misreading what comes next.

Stellar (XLM) Price Holds Key Levels as Price Tightens

XLM’s current price behaviour points to compression rather than continuation of the broader downtrend. After sliding toward the $0.20 region, Stellar price held strength and stabilized near the demand zone around $0.18-$0.22, a zone that has quickly emerged as short-term structural support.

This shift matters as the market is absorbing supply pressure rather than distributing it. That dynamic is now visible on XLM’s price chart, where volatility is lowering and momentum has flattened instead of further bearishness. On the upside, $0.25-$0.26 marks the immediate zone where price expansion could gain traction. A clean move beyond this zone would put $0.30 back in focus.

Beyond that, the structure opens toward the $0.30-$0.35 region, where previously supply is concentrated. As long as XLM price holds above the $0.20 support zone, the setup favors a bullish resolution over a renewed breakdown.

Why On-Chain Data Are Worth Watching Now

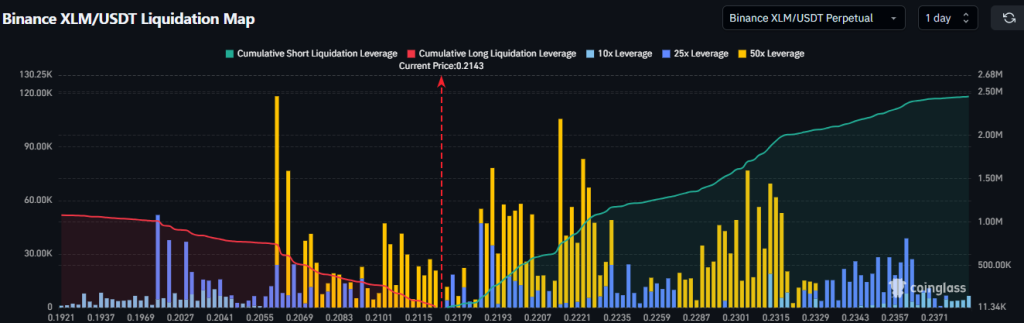

On-chain data provides the clearest signal that something is brewing behind the surface. The Binance XLM/USDT liquidation map shows a growing concentration of leveraged short positions stacked around $0.23-$0.25. This creates a short-side liquidity pocket that could be triggered if XLM price pushes higher, forcing short sellers to cover.

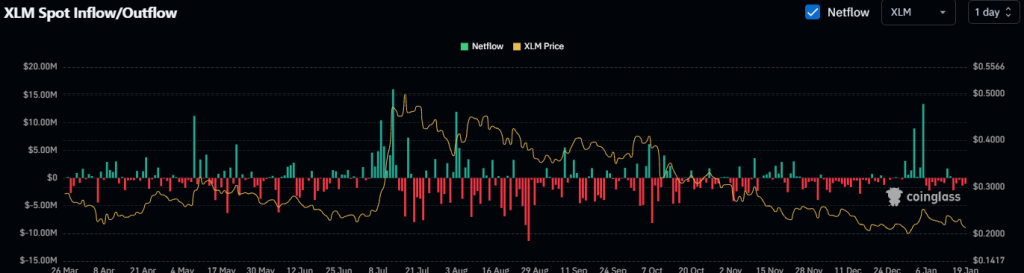

At the same time, spot flow data reinforces the bullish thesis. After months of exchange inflows during the distribution phase, recent sessions show reduced net outflows. The fewer tokens moving to exchanges typically signal weakening intent to sell, often seen during accumulation or base-building periods. Historically, XLM has responded sharply when declining spot outflows align with leveraged short exposure.

In short, XLM may still look heavy on the chart, but the underlying data suggests the market is longer positioned aggressively bearish. For now, Stellar sits in waiting mode, but if price begins to move into short-heavy zones, the reaction could be sharper than the current calm suggests.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.