On-chain data shows whale institutional investors have aggressively accumulated Solana in the past week.

The SOL/USD pair must rebound from the support level above $164 to invalidate further capitulation.

The upcoming Fed’s Quantitative Easing will likely fuel further demand for SOL, especially through its spot ETFs.

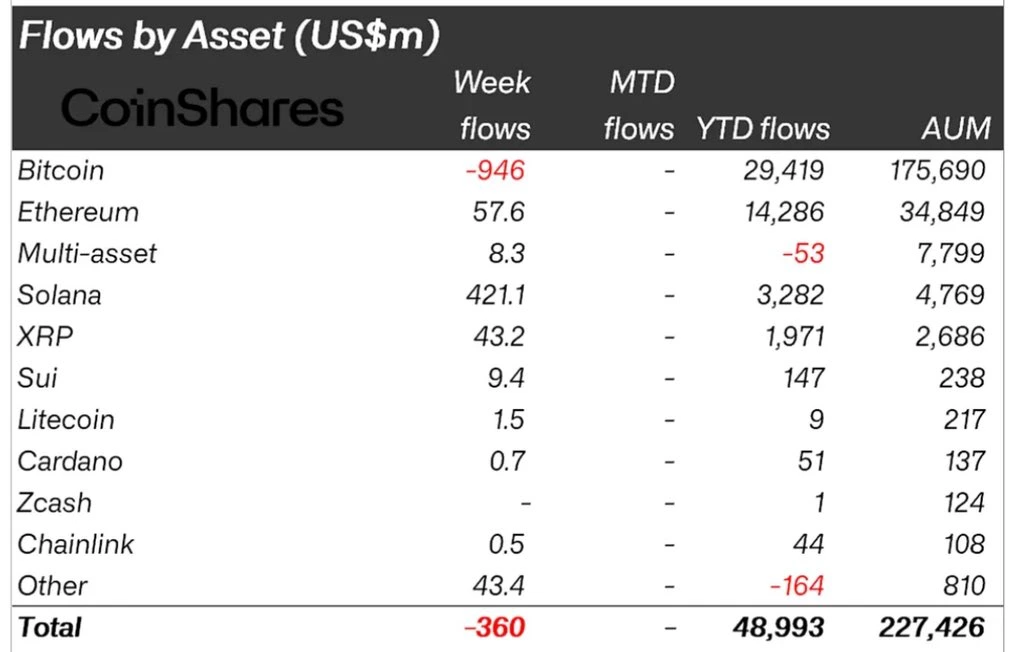

Solana (SOL) whales have aggressively accumulated in the past week amid midterm bearish sentiment. According to a weekly report from CoinShares, Solana led the rest of the crypto assets’ investment products, with a net cash inflow of about $421 million.

As such, Solana’s investment products’ year-to-date cash inflow is about $3.2 billion, thus their total assets under management at around $4.76 billion. Remarkably, Solana outshined Ethereum (ETH) and XRP, which recorded a net cash inflow of around $57.6 million and $43.2 million, respectively.

Source: CoinShares

Worth noting that Bitcoin’s investment product recorded a net cash outflow of about $946 million last week, thus weighing down on its bullish sentiment.

Why are Investors Buying Solana Amid Bearish Sentiment?

Spot SOL ETF Hype Increases market demand amid anticipated altseason 2025

The organic demand for Solana is heavily influenced by its spot SOL ETF hype in the United States. The recent listing of the Bitwise Solana Staking ETF has increased the odds of more similar products joining the market amid the ongoing U.S. government shutdown.

Capital rotation from Bitcoin to SOL will be much seamless through the ETF market, especially amid the anticipated altseason 2025. Moreover, the altseason 2025 is expected to be triggered by the onset of the Fed’s Quantitative Easing in December.

Ecosystem Growth and Network Resilience

The Solana ecosystem has grown in tandem with the mainstream adoption of digital assets. According to market data analysis from DeFiLlama, Solana’s total value locked has grown to over $10 billion, with its Stablecoin market cap at around $14.5 billion.

The Solana ecosystem has grown significantly in the recent past, fueled by its network resilience. In the past twelve months, the Solana network has not experienced any outage despite mainstream adoption.

What’s Next For SOL Price?

From a technical analysis standpoint, the SOL/USD pair has been approaching the apex of a multi-year ascending triangular pattern.

A consistent close above its prior all-time high will trigger further upside movement for SOL price in the subsequent months.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.