Solana price breaks one of the key support zones, which has been offering a strong base since April

Meanwhile, the interest of whales and the market participants has been rising consistently as the sentiment shifts away from Bitcoin

Following a bearish monthly close, sellers have tightened their grip on the crypto markets. Bitcoin price slipped below $107,500, breaching a crucial support level near $108,000, while Solana price plunged to $176, losing its strong October base between $178 and $180. The weak start to November has left traders cautious, as the SOL price dropped over 8% amid low trading volume and fading bullish momentum.

The total crypto market capitalization also declined as traders booked profits after the recent rally. With this pullback, Solana has officially entered a weekly downtrend, and if selling pressure persists, the token could soon revisit its key demand zone near $165. This zone has historically served as a strong rebound area, potentially halting further downside and fueling a fresh move toward the $200 resistance in the coming sessions.

- Also Read :

- Bitcoin Volatility Squeeze: Is BTC Gearing Up for a Breakout Above $112K or a Drop Below $100K?

- ,

What’s Next for the Solana (SOL) Price Rally?

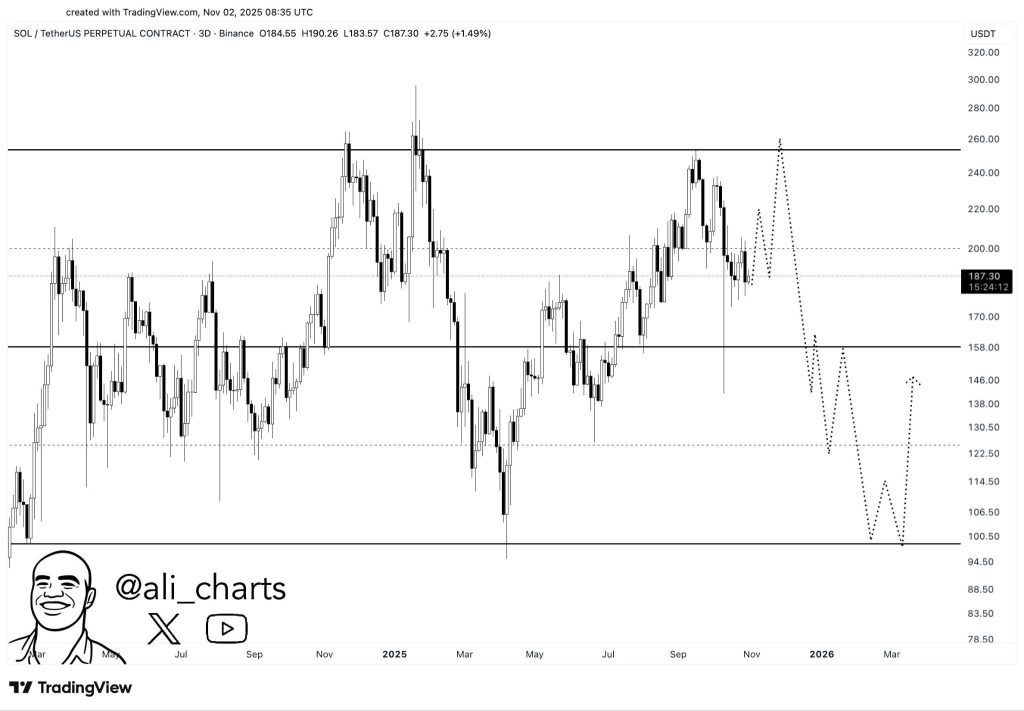

Solana’s price action has entered a decisive phase as the token consolidates near $187 following a sharp pullback from recent highs. The chart reveals a clear structure of lower highs, indicating growing bearish momentum after repeated rejections around $240. With the recent breakdown below $180, SOL is testing crucial mid-range support levels, leaving traders watchful of a potential deeper correction. The broader market sentiment appears cautious, suggesting volatility could intensify if Solana fails to reclaim the $200 resistance soon.

The chart shared by a popular analyst, Ali, illustrates Solana’s multi-month range between $100 and $260, highlighting a possible downward trajectory if the $158–$165 support fails to hold. The dotted projections suggest a potential short-term rebound toward $200 before a continuation of the downtrend, possibly dragging SOL toward the $130–$100 zone by early 2026. The setup implies a lower-high structure consistent with bearish continuation, unless buyers manage to break above $200 decisively—an outcome that could re-establish bullish strength and challenge the upper resistance near $240.

Wrapping It Up!

Traders remain cautious amid broader crypto market weakness, as Bitcoin’s decline below $108,000 continues to weigh on altcoins. A rebound in BTC above $110,000 could provide a much-needed lift to Solana’s recovery and restore confidence among bulls. Until then, SOL may continue consolidating within a narrow range, awaiting a clear breakout signal.

Solana’s short-term outlook remains bearish, but its long-term fundamentals continue to offer hope for a rebound. The $165 demand zone will be critical in determining the next major move—holding above it could reignite buying pressure and set the stage for a retest of $200. However, if market sentiment worsens and BTC remains weak, SOL could face further downside before a sustainable recovery emerges.

FAQs

Solana fell below $180 as sellers took control amid weak market sentiment, low volume, and Bitcoin’s decline under $108,000.

A rebound is possible if Solana holds above $165 and Bitcoin climbs past $110,000, helping restore bullish confidence.

In the short term, Solana is bearish. However, long-term fundamentals remain strong, leaving room for a recovery if momentum returns.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.