CME to launch Solana options Oct 13, will boost institutional presence

Solana price climbs 9% in 7 days with $10.89B trading volume surge

TVL jumps 57%, QoQ to $12.27B, powered by Raydium and Jupiter

In the latest Solana news, CME Group is expanding its crypto lineup by launching options on SOL and XRP futures starting October 13, 2025. This comes on the back of record open interest of $895 million for Solana.

Wondering why it matters?

✔ Attracts more institutional capital into SOL and XRP

✔ Boosts trading volume and market volatility

✔ Signals growing confidence from major players beyond BTC and ETH

Against this backdrop, Solana has been on an impressive run, with its price action, TVL growth, and network upgrades all aligning to strengthen its fundamentals. Join me as I give you more insights on Solana network and SOL price in this analysis.

Key Drivers Behind Solana’s Rally

Drivers of the rally include:

- ETF momentum: SEC delayed decisions (BlackRock Oct 30, Franklin Templeton Nov 14), but Bloomberg analysts see 90–95% approval odds.

- Network upgrades: The Alpenglow consensus upgrade on Sep 3 reduced transaction finality to 150ms, improving DeFi usability. Earlier in July, SIMD-0256 boosted TPS by 20%, now averaging 1,700–1,800.

Overall, Solana’s mix of ETF optimism, institutional inflows, and technical improvements creates a supportive backdrop for price growth.

Solana TVL Stats

Solana’s TVL has surged to $12.27 billion, up 57% QoQ, marking its strongest growth phase since 2021. Successively, Raydium has grown 32% in monthly TVL, while Jupiter DEX is averaging over $500 million in daily trading volume.

This signals rising developer traction and user adoption. With SOL functioning as both a gas token and a staking asset, this growth directly fuels network demand. Institutional inflows, paired with ecosystem activity, underline why Solana continues to stand out in the DeFi space.

Solana Price Analysis

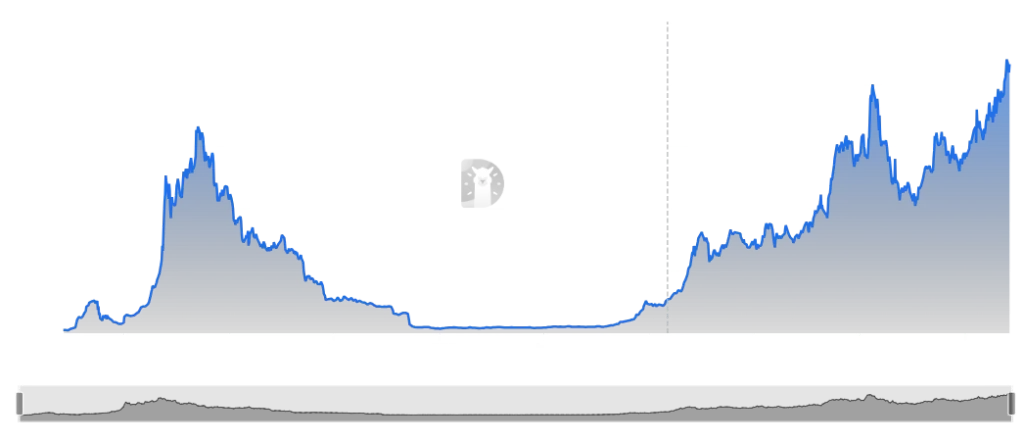

As of now, SOL price trades at $244.46, up 3.08% in the past day and 9.12% in the past week. Its market cap stands at $132.4 billion, with 24-hour trading volume surging 42.23% to $10.89 billion. The daily range has been between $232.77 and $247.47, while the all-time high remains at $294.33.

From the charts, SOL is hovering below resistance at $252.01. A breakout above this could open the path to $300, while strong support sits at $231.87. RSI is around 61.98, suggesting bullish momentum without being overbought.

FAQs

ETF approval optimism, network upgrades, and institutional inflows are key drivers.

If SOL clears $252 and sustains momentum, a push toward $294–$300 is possible.

Rising TVL reflects stronger ecosystem adoption, which increases SOL’s demand as gas and staking token.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.