SOL price circles around the oversold territory after dropping beneath key $149 support

ETF inflows fail to support SOL price as macro risk-off intensifies

Technical charts suggest $134.97 as next support as bearish momentum builds

Solana finds itself in the spotlight as yet another storm hits the crypto world. The price saw a sharp tumble, diving below major support levels while the entire market faces widespread fear. SOL price prediction now revolves around technical signals rather than optimism.

The culprit? Market-wide risk-off sentiment, ETF outflows from Bitcoin and Ethereum, and a lackluster $46M in SOL ETF inflows. Selling pressure surged after algorithmic traders responded to the drop below the crucial $144.50-$140.80 demand zone. Volatility is up, and traders are eyeing lower support levels as the market recalibrates expectations.

ETF Flows: Solana’s Tug-of-War

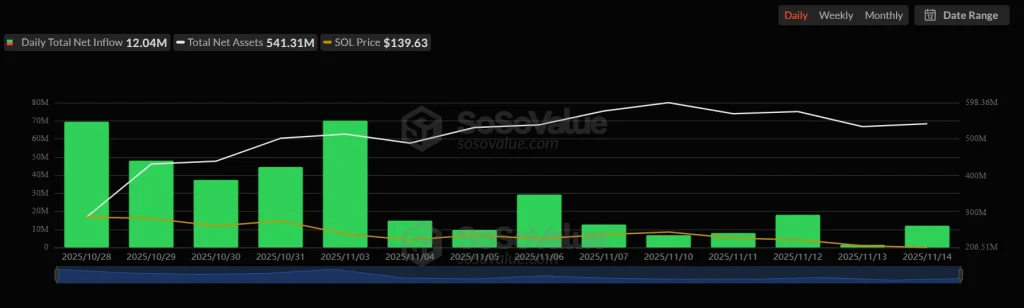

ETF inflows failed to ignite a sustained rally in Solana this week. According to Sosovalue data, daily net inflows into SOL ETFs reached $12.04M with total net assets at $541.31M, but these numbers pale in comparison with the $1.8B worth of Bitcoin and Ethereum ETF outflows that defined market sentiment.

Despite momentarily stopping the bleeding on October 28 and November 3 with inflows up to $70M, SOL could not sustain momentum. This suggests that ETF inflows alone can’t balance macro-driven selling pressures, especially as fear continues to sweep across risk assets.

Is $134 the Inevitable Target?

Looking at SOL price charts, technical indicators point to a challenging landscape for bulls. After falling beneath both its 7-day SMA at $147.97 and Fibonacci support at $149.96, SOL price sits at $140.71, down nearly 16% over the week. The daily RSI at 29.9 screams oversold, yet the MACD’s strong negative histogram of -1.99 signals growing bearish momentum.

Successively, momentum indicators and failed attempts to reclaim the $144.50-$140.80 zone make a further slide likely. I see $134.97 as the next major support, a level last tested in June. Resistance lines up for Solana price at $149.96 and $161.73. If selling persists and $134 breaks, the structure points toward a further drop near $129.

That being said, recovery hopes hinge on closing above $144.90, which could trigger a swift move to $149.96 within 3-4 trading sessions. If bulls regain control, a bounce back toward $150-$161 is possible, but for now, bearish control defines the narrative.

FAQs

Solana’s price decline is fuelled by extreme market fear, technical breakdowns below support levels, and insufficient ETF inflows.

RSI at 29.9 highlights oversold sentiment, while MACD at -1.99 bolsters bearish momentum. Key levels to watch include $134.97 for support and $149.96-$161.73 for resistance.

If bulls reclaim $144.90 in the next few days, a recovery to $149.96 or higher could materialize within a week. Otherwise, a break below $134 signals further downside.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.