Ripple’s On-Demand Liquidity (ODL) expansion is reshaping cross-border payments, enabling faster, more cost-effective transactions for financial institutions worldwide.

With Ripple securing high-profile partnerships and driving adoption in key markets, some market participants suggest XRP could climb to $30.

Meanwhile, PlutoChain ($PLUTO), as a hybrid Layer-2 solution, might be setting the stage for new network upgrades on Bitcoin.

By potentially expanding Bitcoin’s utility and introducing advanced functionalities, it may address some of the network’s most pressing limitations.

Let’s take a closer look.

Ripple’s ODL Expansion – The Path to $30 XRP and the Future of Cross-Border Payments

As of January 23, 2025, XRP is trading at $3.14, experiencing a slight decline of 1.26% from the previous close. The intraday high reached $3.27, with a low of $3.14.

This minor dip follows a recent surge where XRP surpassed the $3 mark, influenced by investor optimism surrounding Ripple’s legal developments.

Ripple’s On-Demand Liquidity (ODL) could be a major new upgrade for cross-border payments. It gets rid of the need for pre-funded accounts and makes transactions almost instant.

ODL uses XRP as a bridge currency, making it easier and cheaper for financial institutions to convert currencies.

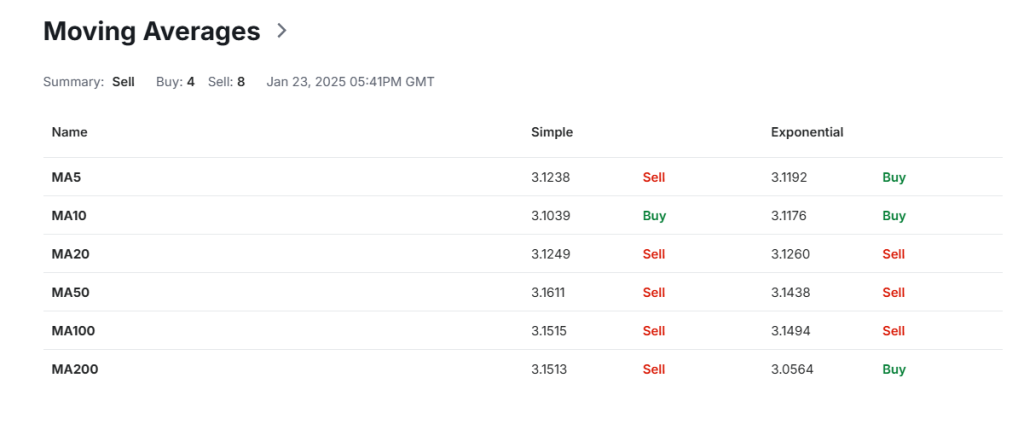

From a technical analysis perspective, XRP has established a support level of around $3.00, with resistance observed near $3.50.

The 50-day moving average is trending upwards, indicating sustained bullish momentum. Based on this analysis, it seems that breaking through the $3.50 resistance could create a rally towards $4.40, based on a Fibonacci extension pattern.

Crypto Patel shared that XRP has just surpassed a $163 billion market cap, marking a 650% rise from its previous value of $0.42. The price hit an all-time high of $2.83, with experts predicting it could soon reach $3.

The surge is driven by growing adoption, innovative features, and discussions around a potential ETF. He advises taking 70% profit while holding the remaining for the riskier ride ahead.

Could PlutoChain’s Layer-2 Tech Upgrade Bitcoin with Smart Contracts and New Features?

PlutoChain ($PLUTO) is building a Layer-2 solution that could improve Bitcoin’s capabilities.

The goal is to potentially add smart contracts and decentralized apps (dApps) to Bitcoin, which has been limited by its slow 10-minute block time.

This has made Bitcoin less useful for complex applications compared to faster networks like Ethereum or Solana.

PlutoChain offers a block time of just 2 seconds on its own chain. This could allow developers to create high-performance dApps while still using Bitcoin’s secure network.

Early testnet results show over 43,200 transactions per day, a good sign for real-world use.

Another feature that could make PlutoChain stand out is its governance model. Rather than having a single authority make decisions, users can influence protocol updates, keeping the system decentralized and in tune with the community.

It’s also been audited by trusted firms like SolidProof, QuillAudits, and Assure DeFi, adding credibility to its security.

Additionally, PlutoChain is compatible with the Ethereum Virtual Machine (EVM), which could bring new opportunities in decentralized finance (DeFi), NFTs, and AI.

It could unlock new possibilities for Bitcoin, turning it into more than just a store of value by adding smart contracts, dApps, and more.

The Bottom Line

Ripple’s ODL expansion may prepare XRP for significant growth, with the potential to reach $30 as it transforms cross-border payments.

As Ripple continues to drive adoption and forge key partnerships, the future looks promising.

At the same time, PlutoChain’s hybrid Layer-2 solution could enhance Bitcoin’s capabilities and overcome its transaction speed limitations.

PlutoChain might bring a future where blockchain networks become more scalable, efficient, and widely adopted.

——————————————

The information in this article does not represent financial or investment advice. Always research carefully before participating in the crypto market. Risks are inherent in forward-looking statements, which may not be revised.

Disclaimer and Risk Warning

The content on Coinpedia's sponsored page is provided by third parties and is intended for promotional purposes. Coinpedia does not endorse, guarantee, or take responsibility for the accuracy, quality, or effectiveness of any services, products, or information presented in these sponsored materials. The inclusion of sponsored content does not imply Coinpedia’s approval or support. Readers are advised to exercise due diligence and conduct their research before making decisions or taking action based on the information presented in sponsored content.