SEI price prediction 2025 turns increasingly bullish as Binance joins as a validator, reinforcing institutional-grade trust in Sei’s network.

Sei’s Giga upgrade aims to achieve 50x higher throughput for real-time financial and gaming apps.

Meanwhile, Rising stablecoin volume and growing DeFi adoption spotlight Sei’s strong fundamentals.

The SEI price prediction 2025 narrative has gained renewed strength after Binance joined SEI’s enterprise stack by officially becoming a validator on the SEI Network on November 6, 2025.

This move not only enhances network security but also signals a deepening level of institutional trust. As a global exchange leader, Binance’s participation underscores Sei’s positioning as a preferred settlement layer for institutional-grade finance, aligning with its mission to deliver real-time performance and reliability.

Currently, SEI price today stands around $0.1818, showing a 4% daily surge. This recovery momentum follows weeks of consolidation and comes amid technical patterns that could hint at a potential reversal on the SEI price chart under certain conditions met.

Sei’s Expanding Enterprise Ecosystem

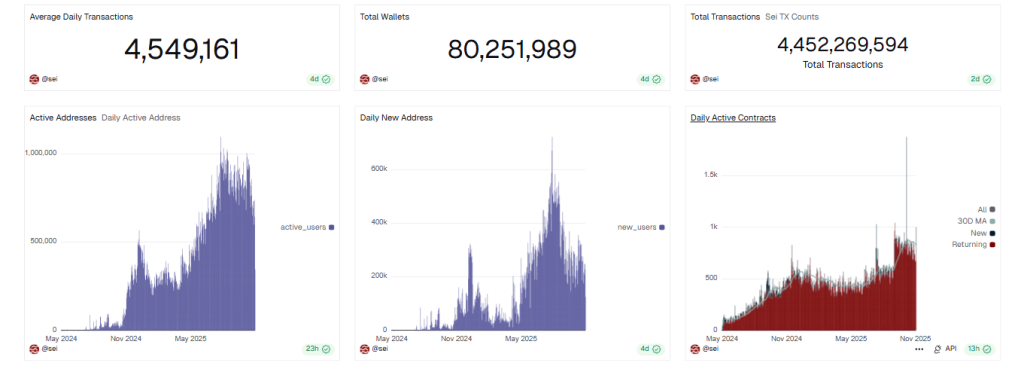

The official blog from SEI mentioned that the Network has rapidly evolved into a major player in enterprise blockchain. With over 80 million wallets and 4.5 million daily transactions, Sei’s infrastructure supports tokenized funds from global giants such as BlackRock, Brevan Howard, Hamilton Lane, and Apollo.

This institutional-grade ecosystem is further backed by partners like Circle, MetaMask, and Securitize, illustrating a robust foundation for long-term scalability and adoption.

The SEI price forecast also benefits from this ecosystem expansion, reflecting confidence in Sei’s ability to deliver reliable and scalable blockchain solutions for tokenization and real-time settlement.

Performance Edge and Giga Upgrade Impact

Technically, Sei remains one of the fastest EVM-compatible blockchains, boasting 400ms finality and block production optimized for high-frequency applications such as DeFi trading and on-chain gaming. Also, Process 10,000 transactions for as low as $0.05.

Its Giga upgrade aims to increase throughput to 200,000 transactions per second, enhancing the network’s competitiveness against leading EVM chains. This could be a major catalyst for SEI crypto demand and price momentum in the months ahead.

On-Chain Growth and Technical Setup

On-chain activity also supports bullish sentiment. Recent data shows Sei settling 20x more stablecoin volume than XRP, reinforcing its rising role in real-world asset tokenization.

The SEI price USD pair could test the $0.13 support level, possibly forming a double-bottom pattern that may propel the token toward the $0.70 target if bullish demand sustains. This will mark a 400% rise.

Meanwhile, Sei’s DeFi and infrastructure launches in november early such as Monaco’s Chainlink-powered trading layer and Carina’s fee-free DEX aggregator this further highlight its rapid ecosystem growth.

Additionally, Sei’s expansion into mobile gaming underscores its strength in high-frequency, user-facing applications.

Global Potential for Real-Time Finance

Beyond immediate metrics, Sei’s long-term vision connects to a broader transformation in global payments. With over 4.3 billion mobile users still facing delayed settlements, Sei’s infrastructure could bridge this gap, enabling real-time finance for billions.

This expanding utility reinforces why many investors consider the SEI price prediction 2025 increasingly optimistic.

FAQs

Binance joined SEI as a validator to enhance network security and support Sei’s mission of powering real-time, institutional-grade blockchain finance.

With partners like BlackRock, Circle, and MetaMask, SEI’s growing ecosystem builds trust, scalability, and strong fundamentals for long-term price growth.

Sei delivers 400ms finality and can process 10,000 transactions for $0.05, with its Giga upgrade set to reach 200,000 TPS for real-time performance.

If Sei maintains bullish momentum and adoption, SEI could rise toward $0.70, marking over 400% gains from current levels around $0.18.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.