Pi network price climbs over 6% today ahead of its anniversary, outperforming a stable broader market.

Pause in mainnet migration eases immediate sell pressure, tightening short-term supply.

The broader crypto market is trading in a muted tone, with Bitcoin and major altcoins consolidating after recent volatility. In that relatively calm backdrop, Pi Network price is quietly gaining momentum. PI has advanced more than 6% on the day, extending its weekly recovery as traders position ahead of the project’s first anniversary on February 20.

With sentiment stabilizing across the market, PI’s strength stands out, particularly as structural supply pressure appears to be moderating. That raises a natural question: Is this pre-anniversary optimism, or the early stage of a broader breakout?

Mainnet Migration Pauses Reduces Immediate Supply Pressure

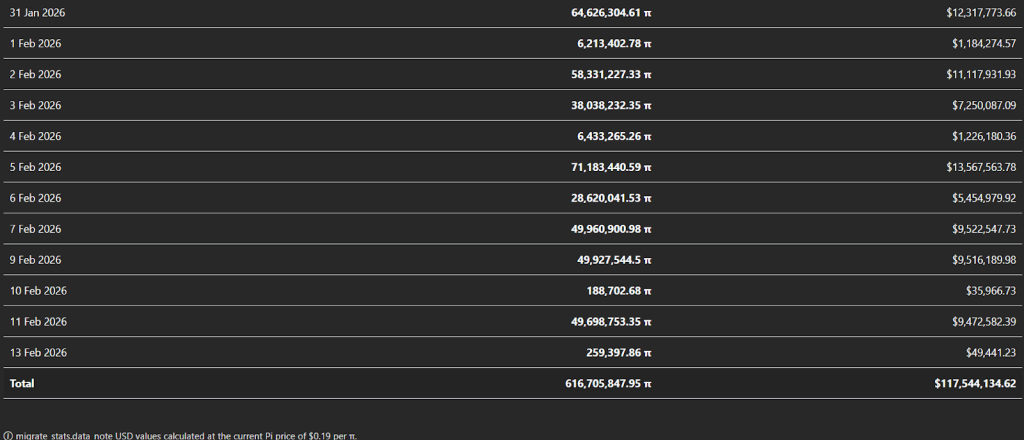

Recent PiScan migration statistics show a pause in daily mainnet transfers. Earlier in February, daily migration volumes were substantial, including 71.18 million PI on February 6 and 58.33 million PI on February 2. Those flows steadily expanded circulating liquidity. However, the most recent update shows migration activity cooling significantly, with the last recorded daily migration around 259,397 PI before activity effectively paused. In total, more than 616.7 million PI tokens have migrated to mainnet so far, representing roughly $117.5 million in value at current prices. That cumulative figure is significant, but the key variable now is flow direction, and it has slowed.

Mainnet migration enables users to move unlocked PI into the active ecosystem, potentially increasing exchange-side supply. A pause in that process reduces fresh token availability, particularly on centralized platforms. In markets where demand remains stable, even a temporary supply contraction can support price.

With the anniversary approaching, traders appear to be front-running the tightening liquidity conditions rather than waiting for confirmation.

PI Price Structure Tightens Beneath Major Resistance

Pi network price structure has shifted from a clear downtrend into a stabilization phase. The chart shows that PI previously formed consecutive lower highs and lower lows before finding demand near $0.16 region. The reaction from that zone was sharp, producing a strong impulsive move back toward the $0.19-$0.20 supply zone. The short-term moving averages are curling upward and beginning to compress beneath price, indicating improving momentum. However, PI price remains capped under horizontal resistance of $0.20, meaning breakout confirmation is still pending.

A decisive daily close above $0.20 would invalidate the recent lower-high structure and open a path toward the next supply block near $0.22-$0.25. On the downside, an immediate support zone around $0.180, below the band, would weaken the breakout setup and likely drag price back toward the $0.16 base.

Anniversary Momentum: Catalyst or Coincidence?

As February 20 approaches, market psychology becomes a factor. Anniversary events often renew community engagement and social momentum, even if they do not introduce fundamental changes. Combined with reduced migration inflows and improving technical structure, the setup places Pi Network price at a decision point. The coming sessions will determine whether this rally extends into a confirmed breakout above $0.20, or stalls once again beneath overhead supply.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.