PI Network (PI) price rises as MiCA filing confirms regulatory clarity, non-custodial design, and a pathway to public trading.

Whale accumulation intensifies despite broader market weakness.

Technical indicators and chart structure point toward a potential bullish continuation.

The PI Network (PI) price has gained fresh momentum as the project’s regulatory filing under the EU’s MiCA framework renews confidence across the community. With clarity on self-custody compliance, exchange-readiness, and a clear plan for market entry, PI crypto is witnessing increased excitement supported by whale accumulation and strengthening chart indicators.

PI Network (PI) Price Strengthens Following MiCA Regulatory Filing

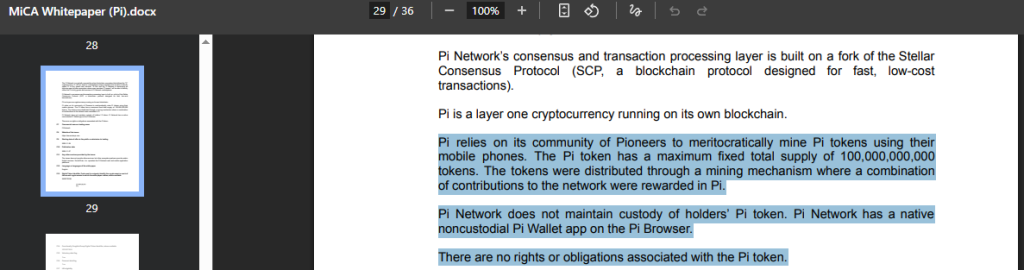

The project’s newly surfaced MiCA filing outlines Pi Network’s intention to qualify as a compliant crypto-asset within the European regulatory framework, marking a major step toward future listings on MiCA-approved exchanges.

The filing confirms that Pi Network operates through a non-custodial architecture, where users retain full control of their Pi Wallets and private keys which is meeting MiCA’s strict self-custody standards.

Also, the document lists host member states such as Germany, France, and Italy, suggesting plans for pan-European integration via exchanges like OKCoin and OKX, both licensed in Malta.

The filing further clarifies that Pi crypto had no initial coin offering, with tokens distributed solely through mining and participation. These details reinforce legitimacy and reduce regulatory uncertainties, strengthening sentiment around the PI price today.

Network Growth Boosted by Liquidity Plans and Venture Funding

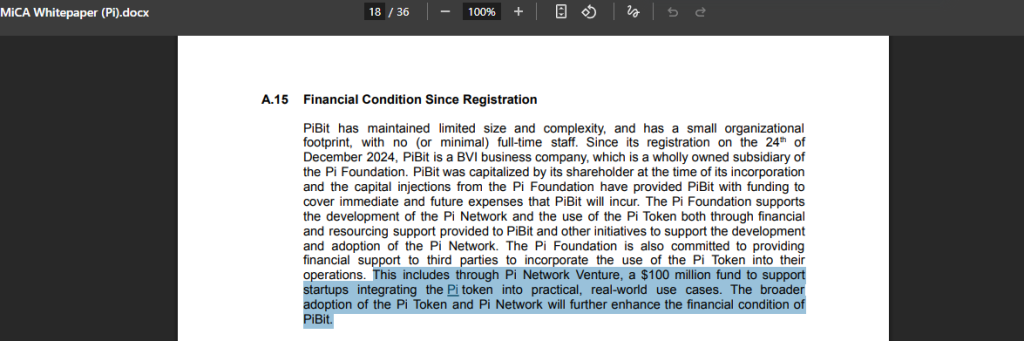

Beyond compliance details, the filing mentions upcoming secondary market liquidity pools and a $100 million Pi Network Venture fund designed to accelerate ecosystem development.

These initiatives signal long-term commitment to infrastructure expansion, which enhances the broader PI Network price forecast and continues to attract new interest.

Amid this backdrop, the PI/USD has seen a nearly 15% rise in 24 hours from $0.22 to $0.26 before cooling to around $0.2433. Despite the dip, the token maintains an uptrend that has persisted for 41 consecutive days on the daily chart.

Whale Accumulation Continues Despite Market Weakness

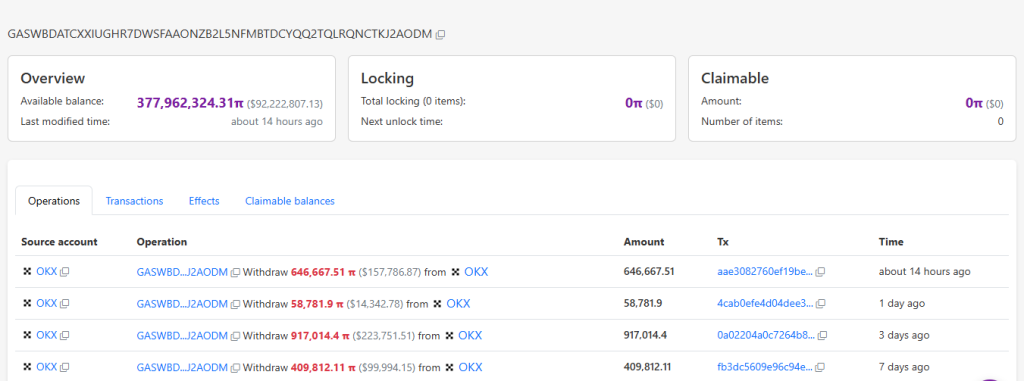

One of the strongest catalysts behind recent price stability is aggressive whale accumulation.

The largest PI holder recently added 58,781 coins on Wednesday and 646,667 coins on Thursday, following an earlier purchase of 917,000 on Monday.

This whale now holds approximately 377.962 million coins, valued at more than $92.2 million.

Such accumulation often signals confidence in long-term performance and can trigger a domino effect among other large holders.

In addition to regulatory advancements, developers are expanding Pi Network into the AI sector.

Following the launch of Pi AI Studio, the project recently invested in OpenMind, reinforcing its push toward AI-driven decentralized experiences. These developments support stronger sentiment surrounding PI Network price USD expectations for coming months.

Technical Indicators Suggest a Potential Bullish Breakout

From a technical standpoint, the PI Network price chart shows rising momentum. If the token flips $0.26, it could confirm a renewed bullish trend with the next major resistance at $0.3220.

Momentum indicators support this outlook like the MACD has crossed above the signal line with fresh green histogram bars, while the AO confirms strengthening bullish momentum.

Similarly, a rising CMF at 0.07 indicates positive capital inflows. The RSI at 57 continues trending upward, leaving further room before entering overbought conditions.

Combined, these metrics strengthen the case for an emerging recovery and form the basis of several PI Network price prediction discussions.

That said, the PI Network (PI) price is gaining renewed attention in the global crypto market. With momentum supported both fundamentally and technically, traders are evaluating whether a significant move may unfold soon.

FAQs

PI is rising due to its MiCA regulatory filing, stronger market confidence, growing whale accumulation, and expanding ecosystem plans.

The MiCA filing boosts trust by confirming PI’s self-custody design and outlining steps toward compliant listings on regulated European exchanges.

Yes, the filing signals exchange-readiness by naming EU member states and aligning PI with rules needed for future listings on licensed platforms.

If PI holds above key levels like $0.26, indicators suggest momentum could continue, with traders watching for a potential breakout toward higher ranges.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.