Pi Coin Price Faces Bearish Storm As 263M Token Unlock Looms ,Can Bulls Defend $0.741?

Key Highlights

- 263 million PI tokens will unlock in June, with 233 million in July and 132 million in August.

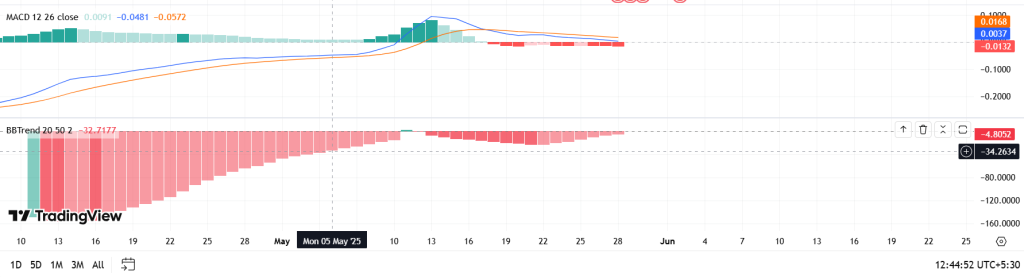

- Technical indicators remain bearish, with BBTrend at -34.26 and MACD signaling a downside.

- Price hovers near $0.7411 support; unlock pressure and exchange inflows raise risks.

- Sentiment remains mixed: Even though some small investors are still hopeful, recent token unlocks and insider activity are weakening confidence.

Unlock Wave Builds as Demand Weakens

Pi coin is trading near a critical level of $0.7411 amid a sharp increase in upcoming token unlocks. The protocol will release 263 million coins in June, 233 million in July, and 132 million in August — over 1.5 billion tokens over the next year.

On-chain data shows more PI tokens moving to centralized exchanges, suggesting potential sell pressure as demand appears to weaken. This imbalance between rising supply and fading buyer interest has placed Pi vulnerable.

Insider Concerns, Rug Pull Fears, and Privacy Issues Add Fuel

Market sentiment has also been hit by concerns raised in a recent CCN report. It highlights a possible insider dump of 12 million PI tokens around the May peak, fueling speculation of a potential rug pull, coinciding with a sharp price drop.

Meanwhile, Pi Network’s app has drawn criticism for collecting excessive user data without clear opt-ins, raising questions about privacy practices and decentralization.

Other concerns include unclear tokenomics, delays in utility rollout, and a lack of transparency around circulating supply — all common red flags in suspected rug pull scenarios.

PIUSD Ichimoku Cloud Analysis: Bearish Momentum Dominates

The Ichimoku Cloud on the 1-day chart paints a clear picture of where the market stands — and it’s not in favor of bulls.

Price action is firmly below the red cloud (Kumo), suggesting that the broader trend is under downward pressure.

The Tenkan-sen (blue line at $0.7767) and Kijun-sen (red line at $0.7950) are flat and sitting above current prices. This alignment shows market indecision and low short-term momentum, with no sign of a bullish crossover yet.

Looking ahead, the cloud remains thick and red, extending through mid-June. The bearish Kumo twist, where Senkou Span A remains below Span B, confirms resistance is likely to stay strong unless there’s a shift in market momentum.

RSI sits at 47.25, below the neutral midpoint, further confirming the downward pressure on the Pi coin value in USD. MACD shows a bearish crossover with red histogram expansion — confirming growing downside momentum.

BBTrend has dropped steeply to -4.89 from a prior +4, reflecting a sharp reversal in sentiment that mirrors recent weakness in the pi price today.

PI/USD EMA Stack and OBV Signal Weakness

PI trades below its major EMAs:

- EMA 20: $0.7435

- EMA 50: $0.8277

This alignment acts as resistance, capping recovery attempts. The On-Balance Volume (OBV) remains flat at -$12.73M, showing no signs of new accumulation by large investors.

Pi Coin Price Levels to Watch

- Support: $0.7411, $0.6598, $0.5722

- Resistance: $0.7950, $0.8692, $1.3050

If PI loses $0.7411, it risks falling to $0.6598 or even $0.5722. A recovery above $0.7950 could open the door toward $0.8692 and $1.3050.

Pi Coin is currently trading at $0.7368, down 2.12% on the day with a 24-hour volume of $97.52 million and a market cap of $5.34 billion. The current price is approximately 55% below its May high of $1.6760, reflecting the broader loss of bullish momentum following its peak.

Pi Crypto Price Outlook — Analyst Prediction

Given the unlock timeline, bearish technicals, and ongoing on-chain sell pressure, analysts anticipate continued downside risk in the near term. If Pi Coin $0.7411 breaks, price could slip toward $0.6598. Conversely, reclaiming $0.7950 may revive short-term bullish interest.

Conclusion

With large unlocks scheduled, bearish technicals, and ongoing exchange flows, Pi Coin is under pressure. Unless bulls reclaim $0.795 and reverse momentum, further losses remain likely.

Trend Bias: Bearish

Catalyst Risk: Token unlocks and on-chain selling

Key Support: $0.7411

Conclusion: Rising Supply Meets Weak Demand — Pressure Builds

With more than a quarter billion coins set to unlock next month and technicals firmly in bearish territory, Pi Coin faces growing downside risks. Exchange flows suggest that some holders are preparing to exit, and without strong demand to absorb the new supply, $0.741 is shaping up to be a make-or-break level.

Until bulls reclaim $0.795 and key trend indicators flip bullish, the broader outlook for Pi remains defensive.