NEAR Protocol Price Prediction 2025 turns optimistic as explosive network activity, rising TPS rankings, and massive user growth strengthen long-term momentum.

Monthly active addresses, transaction volume, and fees show remarkable expansion despite muted price action.

Strong accumulation near the $2 zone could position NEAR crypto for a potential 350% rally toward $10 before 2025 ends.

NEAR protocol that ranks among the Top 10 networks by TPS, yet its token is underperforming. However, it has now reached a critical juncture that could prove to be a decisive make-or-break point. This makes NEAR Protocol Price Prediction 2025 opinions more important at this crucial time for investors and traders alike. As its on-chain activity has drawn renewed attention to the NEAR/USD topic, investors are closely watching the network’s accelerating usage metrics, which continue to rise despite a stagnant market trend.

With trading volume, active users, and fees hitting multi-year highs, NEAR’s foundation appears stronger than ever, suggesting its price may eventually catch up to its underlying growth. This suggests that the NEAR Protocol price may surge significantly this time. Continue reading to know more.

NEAR’s Adoption Surges as Usage Skyrockets Across the Ecosystem

While the NEAR protocol price today may not fully reflect the network’s fundamentals, its adoption metrics highlight a powerful long-term trajectory. Trading volume surged from $24 million in March to $1.7 billion in October, marking a dramatic 7,000% increase that signifies expanding capital flow into NEAR-based applications.

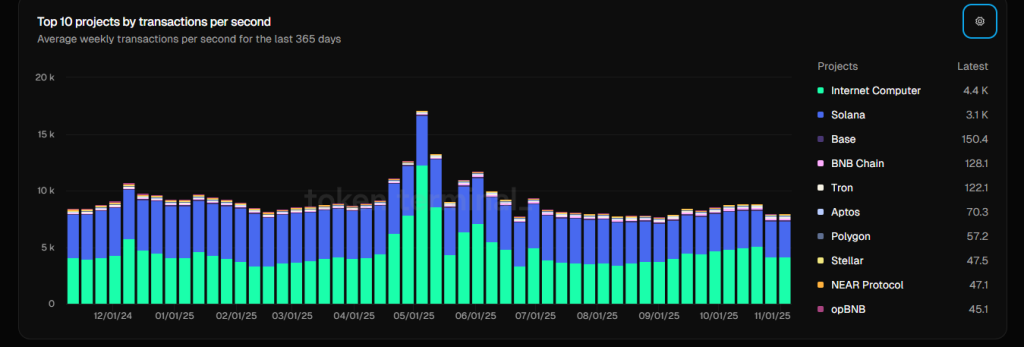

Similarly, Token Terminal ranks NEAR crypto among the top 10 blockchains by transactions per second (TPS), placing it 9th at 47.1 TPS, based on average weekly transactions per second over the last 365 days. This positions the network among the most efficient smart-contract platforms globally.

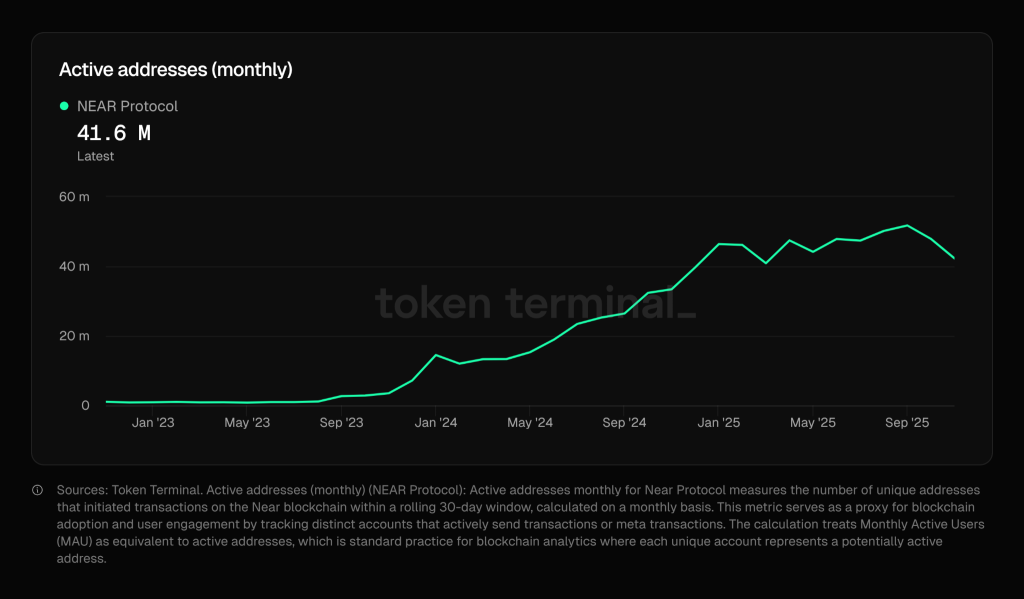

Meanwhile, monthly active addresses have grown from 3.5 million in November 2023 to 42.3 million in November 2025, demonstrating a remarkable rise in user adoption over two years. Even during periods when NEAR protocol price USD underperformed, the network’s ecosystem continued flourishing with consistent user engagement.

Fees, Users, and Network Strength Highlight True Fundamental Growth

One of the most notable signs of strengthening fundamentals is fee generation. Over the past three years, total accumulated fees have reached $22.7 million, with October 2025 recording a single-month high of $3.641 million. In just the first seven days of November, fees have already reached $1.521 million, indicating persistent and accelerating usage.

These rising fee flows support the broader NEAR protocol price forecast, suggesting that ecosystem demand is not only real but compounding over time. As more users transact, build, and deploy applications on NEAR, the long-term value narrative becomes increasingly compelling.

Technical Structure Points to a Critical Reversal Zone

Despite strong fundamentals, the NEAR/USD price has remained under pressure, grinding lower toward the crucial $2 support range. Yet, this level may be forming one of the most important accumulation zones in its recent history.

Investors appear to be strategically accumulating NEAR at current levels, treating this zone as the “final chance before the plane departs.” If NEAR holds at $2 and sentiment strengthens, the NEAR protocol price chart suggests a potential 350% surge toward $10 similar to the explosive momentum seen in early 2024.

However, if consolidation persists and the token briefly slips below $2, the likely outcome is an extended accumulation phase through the end of 2025, shifting any major bullish breakout into early 2026.

As momentum, adoption, and usage continue expanding, the NEAR Protocol Price Prediction 2025 narrative increasingly aligns with long-term growth rather than short-term noise.

FAQs

NEAR’s adoption is rising due to higher TPS, surging active users, and increasing fees, all showing real ecosystem demand even as the wider market remains flat.

Price lags usage because market sentiment is weak, but on-chain growth suggests NEAR may be in a long accumulation phase before reflecting its fundamentals.

A move toward $10 is possible if NEAR holds support and momentum returns, though a longer consolidation could delay major upside into 2026.

Rising TPS, record fees, and expanding active users show strong ecosystem health, supporting NEAR’s long-term value outlook beyond short-term price swings.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.