MYX price rebounds 85% in November, yet remains nearly 80% below its September all-time high.

Trading activity and earnings stay resilient despite market turbulence.

TVL weakness and liquidation clusters create near-term resistance.

The MYX price has staged an impressive 85% rebound in November, offering a glimmer of optimism after a steep collapse from its September highs. Although MYX crypto remains nearly 80% down from its peak, the ongoing recovery and strong on-chain activity have renewed investor attention, particularly as volume and user engagement remain intact.

MYX Price Recovers Strongly After Severe September-to-November Crash

After plunging from its $19.19 all-time high on September 11 to $1.74 on November 3, MYX experienced one of the sharpest corrections among major DEX tokens. The move wiped out significant market value and rattled investor confidence, as the drop followed a powerful pump that many traders viewed as excessive and potentially manipulated.

However, November brought a notable shift. The MYX price today has surged more than 35% and 85% from its monthly low, pushing past the psychological $3.00 mark. Even so, its market cap is currently around $713.71 million that reflects how far the token still stands from prior valuations.

On-Chain Strength Persists Even as MYX Price Chart Shows Heavy Damage

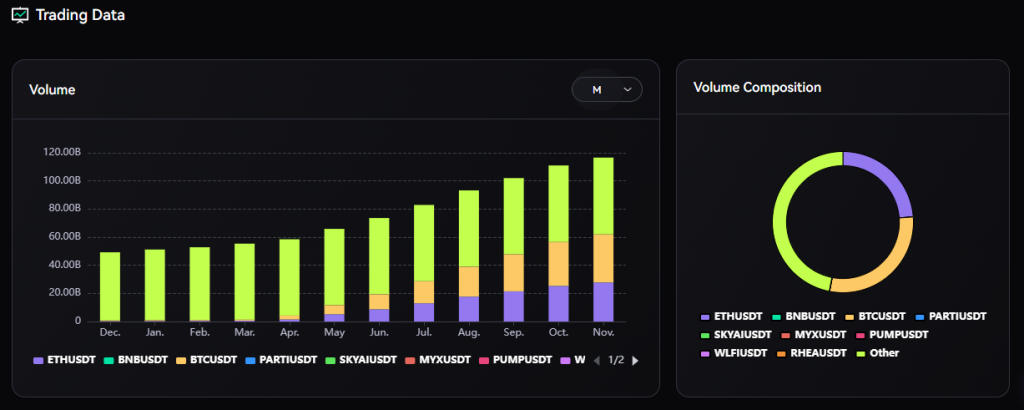

Interestingly, while price action deteriorated sharply over the past two months, MYX crypto’s underlying usage data remained resilient. DEX traders did not abandon the platform; instead, user numbers continued rising, demonstrating that the downturn did not meaningfully disrupt the protocol’s core traction.

Monthly trading volume and earnings for the DEX also grew, highlighting sustained utility regardless of the MYX price USD volatility. This divergence between on-chain fundamentals and market performance has become a central narrative throughout November.

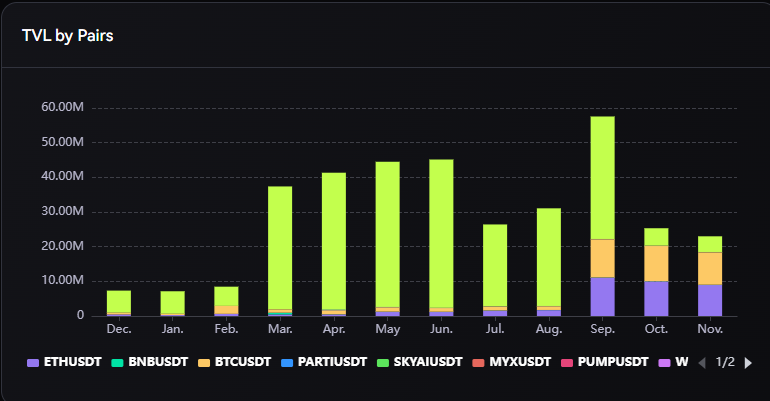

TVL Declines Sharply Since September Peak but Other Metrics Hold Firm

Despite stable user activity, one metric suffered heavily: total value locked (TVL). After hitting a $57 million high in September, the TVL trend reversed, falling to $22.98 million in November. This indicates capital outflows from liquidity pools even though trading activity stayed strong which seems to be an unusual split in typical DEX behavior.

Yet, the renewed November uptrend could motivate liquidity providers to re-enter, especially if the MYX price chart continues stabilizing above key levels.

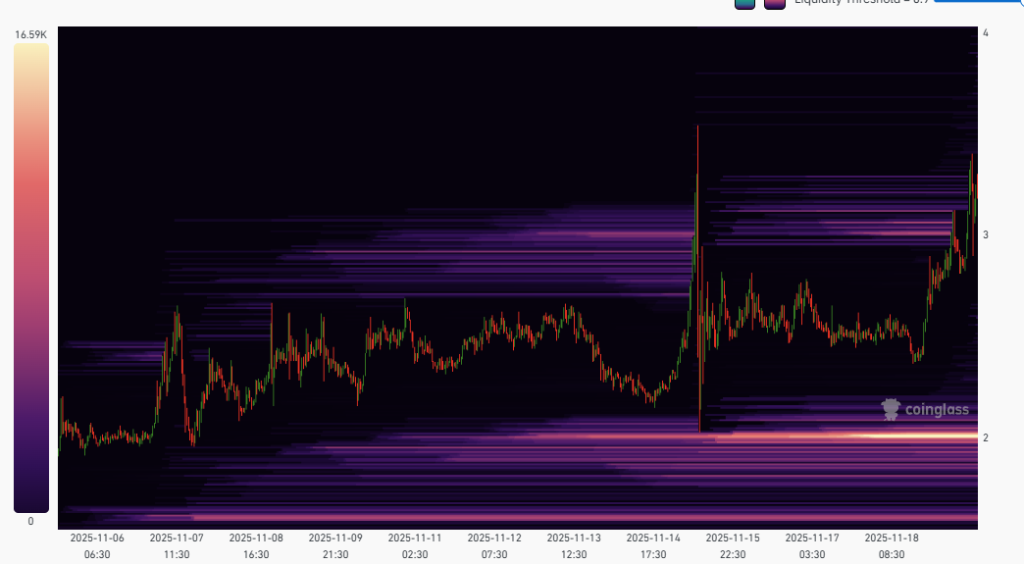

Liquidation Zones Slow the Rally, but Upside Still Appears Open

Liquidation heatmap data from the past two weeks shows MYX navigating through dense clusters of leveraged positions. These zones have caused temporary pauses in the recent rally as the price encounters pockets of resistance.

Nevertheless, with the MYX price flipping $3, the chart now shows a relatively open runway. A popular viewpoint in the market suggests that if MYX can reclaim $4, an advance toward $8 could become feasible before year-end.

FAQs

MYX has rebounded 85% in November, trading above $3, after a sharp drop from its $19.19 September all-time high.

The recovery shows resilience in both price and on-chain metrics, suggesting potential upside if momentum continues.

Investing in MYX Finance in 2025 is a high-risk, high-reward proposition. While its innovative platform and potential for continued growth are attractive, the token’s recent extreme volatility, risks from large token unlocks, and allegations of market manipulation warrant caution. It’s crucial for potential investors to conduct their own thorough research and consider their risk tolerance.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.