MYX price surges 75% as breakout from falling channel ignites momentum.

Heavy leverage around $20 may trigger a short squeeze toward $26.

Exchange token narrative and new listings fuel MYX crypto demand.

The MYX price has surged nearly 75% this week, climbing to $17.40 and approaching its $19.19 all-time high. With shorts being liquidated and leverage building near $19, traders now eye the possibility of MYX price today extending toward $26 as bullish momentum accelerates.

Breakout From Falling Channel Lifts MYX Price

On the 4-hour MYX price chart, the token recently broke out of a falling channel pattern, igniting a wave of fresh buying pressure.

The move followed a sharp dip near $11 this weekend, where market liquidity was swept and weak hands were shaken out. That liquidity grab allowed traders to reposition with new longs, fueling the breakout.

Moreover, the chart shows that this week alone, MYX posted a 75% gain, while intraday gains reached 52%. This confirms that strong bullish momentum has returned to MYX crypto.

That said, if the current trend sustains. Then the initial target at $20 remains in focus, and flipping that level could open the door to the $26 mark in the coming sessions.

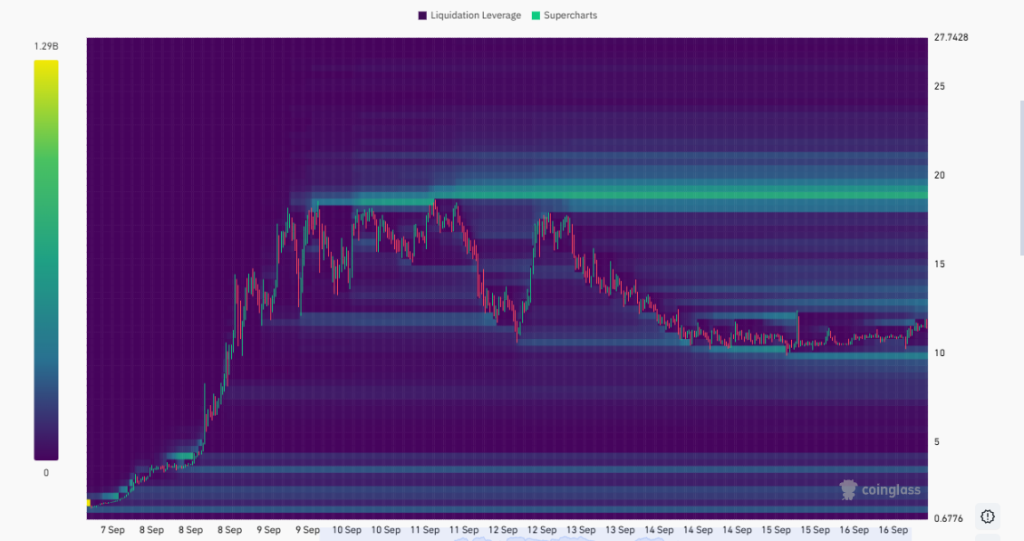

Liquidation Cluster at $19-$20 Becomes Price Magnet

Data from Coinglass indicates that the $19-$20 range holds the highest concentration of leveraged positions, effectively becoming a magnet zone for price action.

As price approaches this area, ongoing liquidations of short positions could accelerate upside pressure, creating a short squeeze scenario.

This chart firmly aligns with the broader MYX price forecast that sees the breakout rally extending.

Once $20 is breached, traders suggest momentum could quickly carry MYX price USD to fresh highs, possibly setting up a new record above $26.

Exchange Token Narrative Adds Fuel to Rally

Importantly, this surge is not solely driven by speculative longs. MYX is benefiting from the ongoing exchange token rally this altseason, where platforms offering leveraged trading have seen rising adoption.

MYX, being an exchange token itself, is capitalizing on this trend through aggressive market pair listings and high-leverage offerings.

Recent examples highlight this growth strategy. On September 5th, MYX listed WLFI/USDT, which triggered a sharp market reaction.

It followed up with RHEA/USDT, and most recently added LINEA/USDT on September 15th, which helped spark this week’s breakout.

The expanding trading options have driven higher liquidity and user activity, reinforcing the bullish backdrop for MYX price prediction models.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.