Memecoins suffered sharp losses as $1.70B in crypto long liquidations wiped out positions in 24 hours.

Dogecoin, PEPE, and PUMP led the memecoin liquidation list.

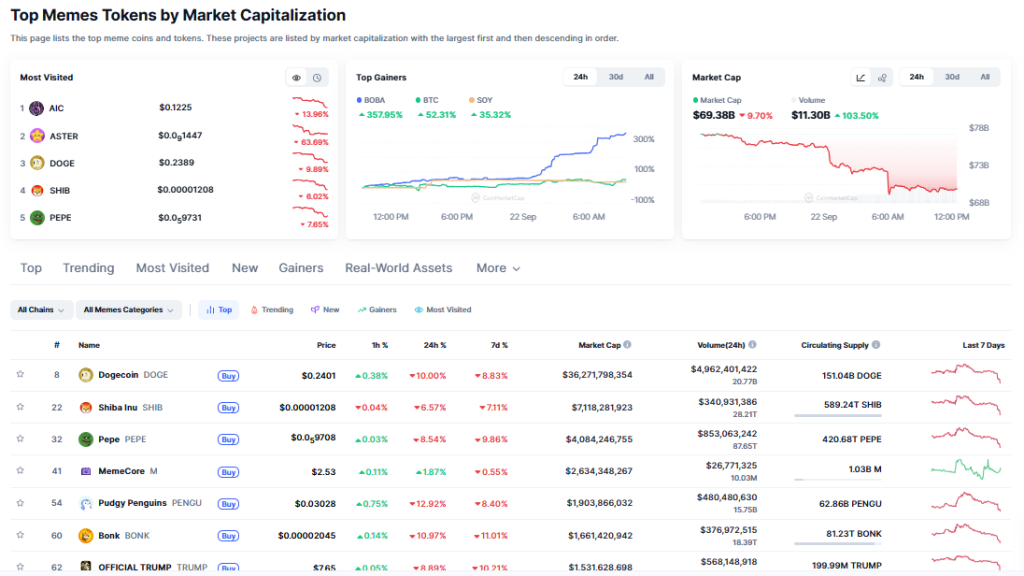

Meme market cap dropped 10% to $69.38billion as traders fled risk.

The entire crypto market, including the memecoins market, has faced one of its toughest days of 2025, with prices plunging as part of the largest crypto long liquidation of the year, underlined by Coinglass today.

The data revealed that with $1.70 billion in leveraged positions wiped out today, the prices of other top coins, altcoins, and even memecoin prices today reflect heavy selling pressure as broader macroeconomic uncertainty weighs on investor sentiment.

Heavy Liquidations Hit Memecoins

The biggest driver behind the sharp decline was a record $1.70 billion in long liquidations within 24 hours, the largest this year. In the top 20 Coinglass liquidation list, memecoins were hit alongside major tokens like Bitcoin, Ethereum, Solana, and XRP.

Notably, Dogecoin ranked fifth overall, with over $60 million in liquidations, even after recent ETF excitement around the DOJE product on the CBOE exchange.

Other memecoin liquidations were also severe in the top 20 list. PEPE lost over $5 million, while PUMP, a Solana-based launchpad known for creating successful memecoins, faced over $12 million liquidated in the derivatives market. This wave of liquidations sent shockwaves across the sector, dragging down spot prices.

Memecoin Price’s Today and Market Declines

According to CoinMarketCap, the total meme market cap slipped 10% intraday to $69.38 billion. This reflected deep red across nearly all leading tokens. Dogecoin was the day’s biggest loser, while Shiba Inu, PEPE, PENGU, BONK, and TRUMP also recorded double-digit drops.

The memecoin price chart shows that the selloff has wiped out weeks of gains. Despite previous speculative rallies, current conditions reveal fragile sentiment.

Traders cite weak momentum and profit-taking as additional triggers behind the sharp downturn, compounding macroeconomic pressures.

Macroeconomic Pressures on Crypto

While the recent Fed rate cut was initially positive for risk assets, but the market quickly shifted its focus to upcoming U.S. economic data releases.

With Fed Chair Jerome Powell set to speak, alongside Q2 GDP and August inflation figures, traders are holding back from fresh positions.

Moreover, broader global dynamics play a key role. Rising bond yields have been a consistent headwind for Bitcoin and altcoins, often steering flows away from risky assets.

Analysts note that U.S. Treasury 2-year yields are sitting at a critical support level. If yields break lower, it could spark fresh shifts in global capital, influencing crypto markets, including memecoins.

Short-Term Sentiment and Key Levels

In the immediate term, several other memecoin’s remain under pressure. Despite the pullback, some traders argue that if bond yields ease and Fed policy turns more supportive, memecoins could also rebound.

However, for now, the largest liquidation event of the year highlights just how vulnerable these tokens are to broader market forces.

In the end, memecoins are navigating a volatile mix of heavy liquidations, macroeconomic uncertainty, and profit-taking. With traders eyeing key levels on the several memecoin price charts, the coming weeks will reveal whether this downturn is temporary or the start of deeper corrections.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.