Russia’s crypto bill hasn’t triggered immediate XRP buying pressure

XRP price is clinging to $1.41 after a sharp dip to $1.10

Technical structure suggests caution, not strong bullish conviction

This week started with Russia dropping a regulatory bombshell, and the market barely blinked. The XRP price is still hovering around $1.42 24 hours after Russia’s news came to light, which introduced this bill to legalize XRP and crypto access for all investors. On paper, this opens the gates for roughly 146 million people. In narrative terms, it sounds massive. In price action? Its influence is not so much. Traders, for now, seem unimpressed and are looking for XRP’s next possible move.

Russia Opens the Door, Market Hesitates

The bill instantly fueled social buzz, with XRP framed as a “math-based payment mechanism” quietly favored by elite financial circles since 2013, according to a leaked email from Jeffrey Epstein. The implication is clear that XRP crypto was designed for institutions, not for speculation. That contrast has reignited long-standing debates around crypto’s real utility.

But price doesn’t trade on ideology alone. Despite the headlines, XRP/USD hasn’t seen an aggressive inflow. Instead, it’s choosing to follow broader markets trend and as a result its hovering just above $1.41 support, suggesting traders are watching, not chasing.

XRP Price Chart Sends Mixed Signals

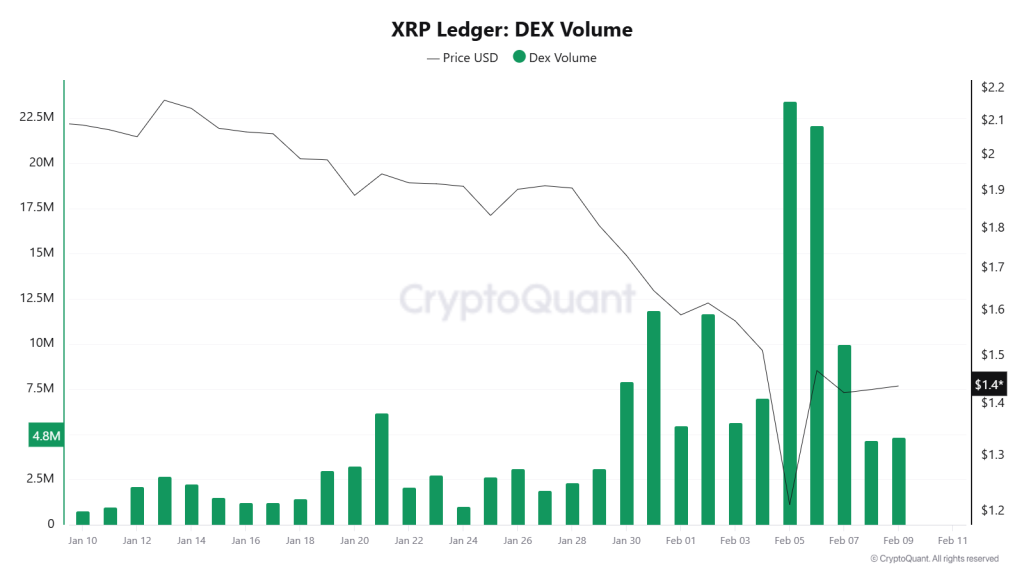

Over-analysing the past 30-day data and the XRP price chart makes things murkier. Just days ago, XRP/USD briefly dropped to $1.10, marking its lowest level in months. That move triggered immense spikes in DEX activity and sparked a bounce that looked strong at first glance.

This illustrates that the fall was massive, but the recovery wasn’t impressive as it lacked follow-through. Structurally, the rebound appears mechanical rather than conviction-driven. Buyers stepped in, yes no doubt about their entry, but they entered very cautiously. Now, the situation suggests that if $1.41 cracks, the technical path back to $1.10 is wide open, and markets clearly know it.

Narratives Clash, Numbers Don’t Care

Social media optimism keeps pushing aggressive XRP price prediction targets; some are still north of $10 this year. But Skeptics remain louder than ever, arguing that those levels are detached from the current market structure.

For now, XRP price action suggests traders are waiting for proof, not promises. So what’s next? If support holds, XRP stabilizes and absorbs the news quietly, a steady recovery may come in the short term. But if it doesn’t, the downside narrative would accelerate quickly, as higher-timeframe charts are mostly bearish-dominant.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.