Dogecoin price is consolidating within a multi-month “solid base” structure seen twice before in its macro cycle.

Coinbase now accepts DOGE as collateral, adding a fresh liquidity catalyst to the technical setup.

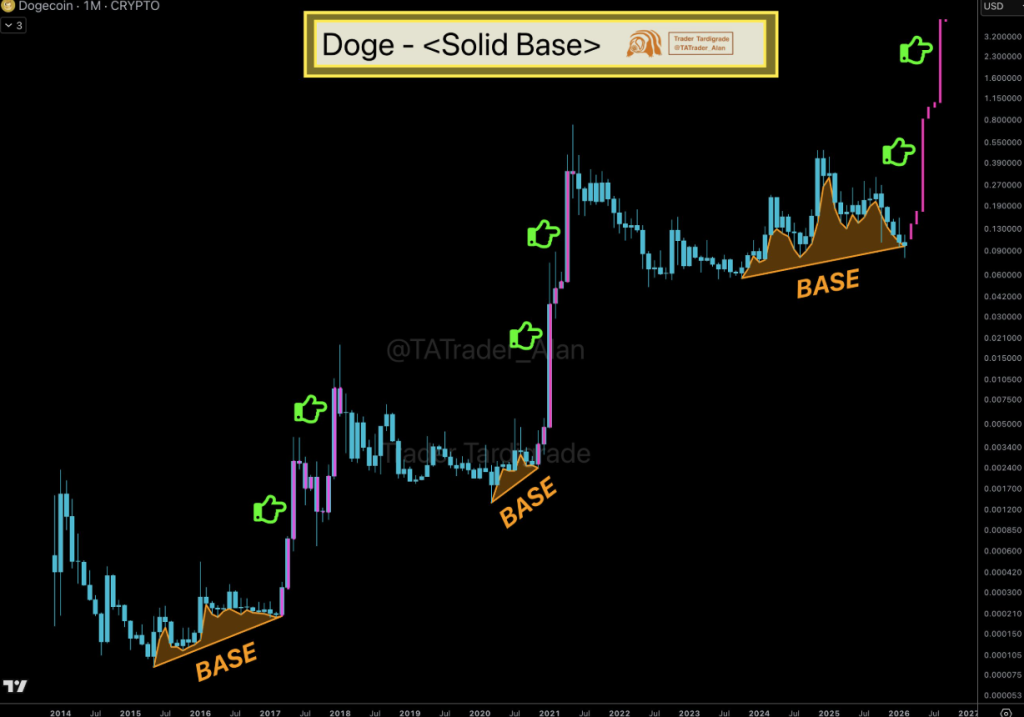

Dogecoin (DOGE) price is once again sitting in familiar territory. After months of sideways movement and volatility compression, the memecoin is carving out what appears to be its third large-scale base formation on the monthly timeframe, a structure that, historically, has preceded parabolic expansions. The broader crypto market remains uneven. Bitcoin has struggled to build sustained upside momentum, while altcoins rotate selectively. Yet beneath that choppy surface, DOGE price behavior is telling a different story: not impulsive decline, but controlled consolidation.

The question now is : Is Dogecoin (DOGE) about to repeat history?

The “Third Base” Structure: History Repeating?

On the monthly chart, Dogecoin has already completed two prolonged base formations in previous cycles. Both were characterized by extended sideways consolidation, volatility compression, and gradual accumulation, followed by sharp vertical expansions. In a recent analysis, DOGE’s current structure mirrors that setup closely. Dogecoin price has spent months coiling within a tight range, forming higher lows while upside remains capped. The volatility profile is compressing, and downside follow-through has weakened. This behavior typically reflects supply exhaustion rather than active distribution.

If this third base completes in similar fashion to prior cycles, the breakout phase historically unfolds rapidly once resistance is cleared. However, unlike speculative narratives, structure matters. The breakout confirmation would require Dogecoin to reclaim and hold above the immediate overhead resistance zone near $0.15–$0.16. A decisive monthly close above that region would shift structure from compression to expansion. Until then, DOGE remains in accumulation mode, not breakout mode.

Coinbase Loan Integration: A Structural Demand Shift?

Beyond the chart, a fresh fundamental tailwind has entered the equation. Coinbase has announced that DOGE can now be used as collateral to borrow up to $100,000 in USDC without selling holdings. This seemingly simple update carries meaningful structural implications. First, it reduces forced selling pressure. Holders who need liquidity no longer have to exit positions. Second, it introduces a new utility layer, DOGE is no longer just a speculative asset; it now participates in collateralized borrowing frameworks within centralized finance infrastructure.

That shift subtly changes supply dynamics. When large-cap tokens gain collateral status, it often signals institutional confidence in liquidity depth and volatility management. While this does not immediately trigger price appreciation, it strengthens the broader narrative around asset maturity. In a market searching for rotation themes, liquidity flexibility can become a silent catalyst.

Key Levels to Watch

With a third macro base nearing completion and Coinbase’s collateral integration adding a fresh liquidity angle, the setup is quietly aligning. If history rhymes, the current compression phase could transition into a larger expansion cycle.

For now, DOGE stands at a structural inflection point. Immediate support rests near $0.090-$0930, where recent demand reactions have emerged. A breakdown below that region would invalidate the base thesis and reopen downside toward the lower macro range. On the upside, $0.12-$0.15 remains the key trigger level. A breakout above $0.15 opens the door toward $0.17-$0.20 in the near term.

FAQs

DOGE is forming a third large-scale base. A breakout above $0.15–$0.16 could trigger rapid upward momentum.

If DOGE breaks above $0.15–$0.16, it could reach $0.17–$0.20 in the near term, following historical base breakout patterns.

With accumulation patterns, Coinbase collateral integration, and structural support, DOGE may see sustained gains if macro conditions remain favorable.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.