HYPE price soars 24% weekly, tapping a fresh all-time high at $57.34

Paxos proposes USDH stablecoin with buyback utility for HYPE holders

VanEck’s ETF filing fuels optimism, but RSI flags overbought signals

Hyperliquid price is crossing into uncharted territory with a new all-time high of $57.34. In just seven days, the token is up more than 24%, with a single-day surge of 2.47% pushing its market cap to $19.01 billion. Trading volumes have shot up nearly 40% in 24 hours, suggesting heightened interest and deep liquidity.

As someone following this rally closely, I see a mix of strong fundamentals and technical triggers shaping HYPE’s price run. But with momentum indicators flashing warnings, the question is whether HYPE can sustain its speed or if a cooldown is next. Join me as I take you through the factors that led to the surge and the potential price targets.

Why is Hype Price Up Today?

Several catalysts explain why the HYPE price has shot up big this week:

- Paxos USDH Proposal: On September 8, Paxos unveiled plans for USDH, a compliant stablecoin built for Hyperliquid. With 95% of reserve interest earmarked for HYPE buybacks.

- Lion Group Holding Conversion: The Nasdaq-listed firm revealed it would reallocate $600 million worth of SOL and SUI into HYPE, citing Hyperliquid’s infrastructure as a driver of long-term growth.

- ETF and ETP Developments: Asset manager VanEck is pursuing a Hyperliquid spot staking ETF in the U.S. while simultaneously launching an ETP in Europe.

Onchain & Derivatives Overview

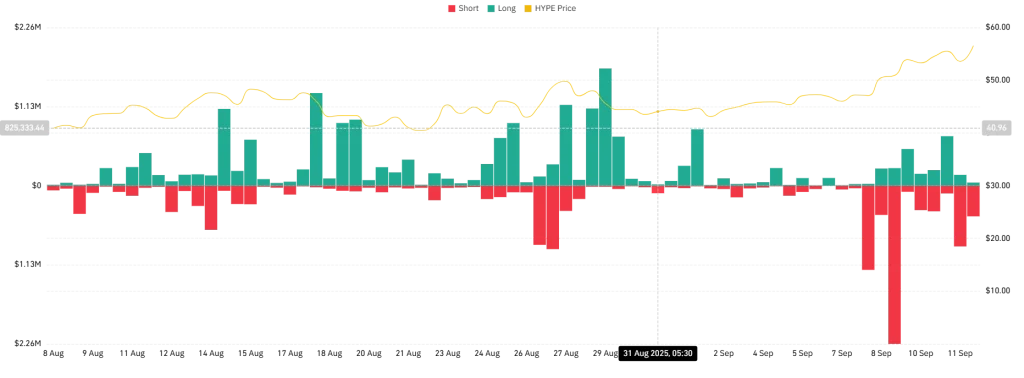

Liquidations have played a key role in HYPE’s latest surge. The chart by CoinGlass shows a cluster of short liquidations in late August, which helped fuel upward momentum as sellers were forced out. More recently, a wave of long liquidations around September 10 highlights the risks of chasing overbought levels. With $3.08 billion in longs and $3.21 billion in shorts. Successively, even modest price swings could trigger sharp liquidation cascades, amplifying volatility in the short term.

Hyperliquid Price Analysis

At the time of publication, HYPE is trading at $57.18, well above its 7-day SMA of $51 and 30-day EMA of $46.95. The move is technically impressive, confirming a strong bullish trend, but it also comes with caution flags. The 7-period RSI sits at 83.91, placing HYPE firmly in overbought territory.

Resistance now looms at $61.68, the Fibonacci 127.2% extension. A decisive breakout there could clear the path for Hype price toward the $73.84 target, aligning with the 200% Fibonacci level. On the downside, immediate support sits around $49.70, with deeper cushions near $40.33.

What reassures me here is liquidity. With turnover at 3.23% and volume rising nearly 40% daily, Hyperliquid appears well-equipped to absorb selling pressure if profit-taking kicks in. That said, chasing the rally at these levels requires tight risk management.

FAQs

Yes, the RSI at 83.91 signals overbought conditions, suggesting a short-term pullback or consolidation is likely.

HYPE faces resistance at $61.68. A breakout above could target $73.84 in the medium term.

The Paxos USDH proposal and VanEck’s ETF plans are giving HYPE legitimacy, while Lion Group’s $600M conversion highlights growing institutional confidence.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.