Gold Eyes $5k/Ounce as Silver Crosses $101 for the First Time: Tom Lee Calls It a Leading Indicator for Bitcoin

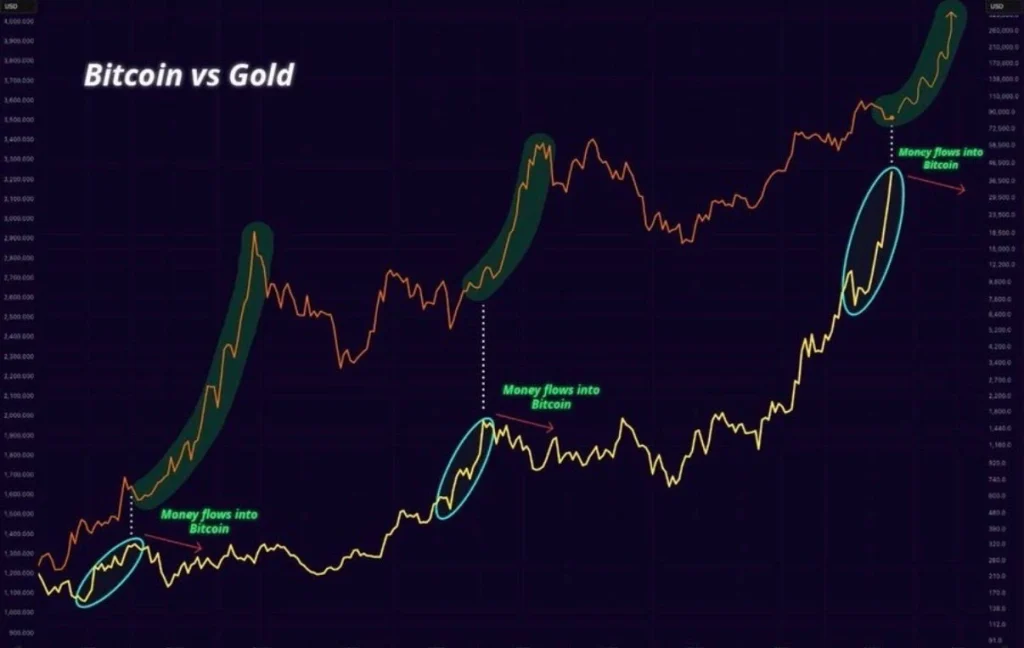

Bitcoin price and the wider crypto market have lagged behind the performance of precious metals.

BitMine’s Tom Lee believes that the Bitcoin price will catch up based on the mean reversion principle.

Bitcoin is expected to benefit from the regulatory clarity in the United States in 2026.

The precious metals industry has continued with a bullish explosion this week, while Bitcoin (BTC), the altcoin market dropped. During the past five days, the gold price surged 6.9% to trade at about $4,975 per ounce at press time.

Silver price gained 9.89% during the past five days to trade above $101 per ounce for the first time in its history. Meanwhile, Bitcoin price has dropped 5.44% to trade at about $90,305 at press time.

Tom Lees Calls Gold and Silver Surge a Leading Indicator for Bitcoin

According to Tom Lee, Chairman at BitMine, the parabolic surge of Gold and Silver is a leading indicator for Bitcoin. Lee pointed out the mean reversion principle, which states that a variable that deviates significantly from its historical average will, over time, move back to the same average.

While Gold and Silver have heavily benefited from the global geopolitical tensions, Bitcoin has lagged. The current Bitcoin price action has been compared to the post 2019 period that was heavily influenced by the Federal Reserve’s Quantitative Easing (QE).

What’s Next?

The next phase for Bitcoin and the wider altcoin market will be influenced by the regulatory outlook in the United States. The expected approval and enactment of the Clarity Act in the United States has been described as a major trigger for a bullish outlook in 2026.

Source: X

Moreover, capital rotation from Gold and the wider precious industry has already been kick-started by BlackRock’s IBIT. Since the beginning of 2026, BlackRock’s IBIT has recorded a net cash inflow of over $5 billion.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.