Filecoin Price Prediction 2025: Is FIL/USD Preparing for a Breakout or Another 50% Fall?

Filecoin price prediction 2025 hinges on whether FIL/USD can sustain above $2.50 after its last week's 200% surge.

Filecoin’s EVM based contract transaction growth and new Cardano partnership are key bullish catalysts.

Meanwhile, the bearish risk is high if its shows a failure to hold above 200-day EMA band that could trigger a 50% decline toward $1.

The Filecoin price prediction 2025 is drawing attention after the token witnessed a remarkable 200% surge last week, jumping from $1.20 to $3.90 before correcting sharply. While the recent pullback has erased 45% gains and raised concerns, but the ongoing developments within the Filecoin crypto ecosystem could determine its long-term trajectory.

Filecoin Price Today and DePIN Sector Momentum

During the previous week, Filecoin price USD mirrored the broader trend of decentralized physical infrastructure networks (DePIN), particularly following Internet Computer (ICP), who is well regarded as another key player in the sector.

Both projects serve as vital components of decentralized computing; however, they differ fundamentally in purpose. While Filecoin focuses on decentralized storage, ICP operates as a full-stack decentralized cloud platform.

The correlation between these two assets became evident as FIL rallied after ICP, showing that market sentiment around DePIN technology is strengthening. This growing narrative could continue influencing Filecoin price prediction in the coming months.

On-Chain Activity and Technical Outlook

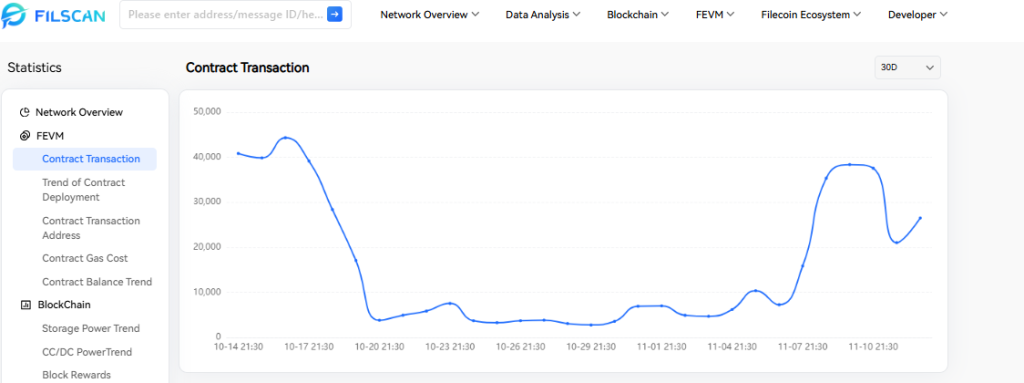

One of the key drivers of the rally was the spike in Filecoin’s EVM-based smart contract activity. According to Filscan data, contract transactions rose from 4,673 to 38,364 during the surge, indicating robust on-chain engagement.

However, this trend has cooled off, coinciding with a 45% price decline to $2.15. As of writing, FIL/USD has a market cap of $1.53 billion and a daily trading volume of $364.66 million.

From a Filecoin price chart perspective, maintaining support above the 200-day EMA at $2.50 is crucial. Sustaining above this level could pave the way for a rebound toward the $3.90 resistance zone and potentially a $10 target if bullish momentum revives.

Partnership with Cardano Could Strengthen Fundamentals

Despite the recent correction, fundamental progress remains strong. Filecoin recently announced a major partnership with Blockfrost and the Filecoin Foundation to integrate Filecoin storage as a backup layer for Cardano-based applications.

This collaboration enhances data redundancy and decentralization within Cardano’s ecosystem. This is seen as a key milestone that reinforces Filecoin’s role in cross-chain infrastructure.

If the market interprets this partnership as a sign of sustainable utility, Filecoin price forecast models may turn increasingly bullish.

Conversely, if sentiment remains weak, another 50% decline could push FIL back to $1, where accumulation and consolidation could occur until year-end.

Outlook for Filecoin Price Prediction 2025

Overall, Filecoin price prediction 2025 depends on whether FIL/USD can stabilize above its dynamic support and build momentum from its latest partnership-driven fundamentals.

As the DePIN narrative gains traction, Filecoin’s next breakout could be determined by how effectively it integrates its storage layer into other blockchain ecosystems.

FAQs

Filecoin is a key player in decentralized storage. Its long-term potential is tied to real-world utility, like its recent Cardano integration, making it a speculative but fundamentally strong project in the crypto space.

Filecoin could reach $10 by 2025 if bullish momentum returns, supported by strong DePIN growth and its partnership with Cardano.

The Cardano partnership boosts Filecoin’s utility by adding decentralized storage for Cardano apps, strengthening long-term fundamentals.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

![Why Is Crypto Crashing Today [Live] Updates](https://image.coinpedia.org/wp-content/uploads/2026/02/23165659/Why-Is-Crypto-Crashing-Today-Live-Updates-1-1-390x220.webp)