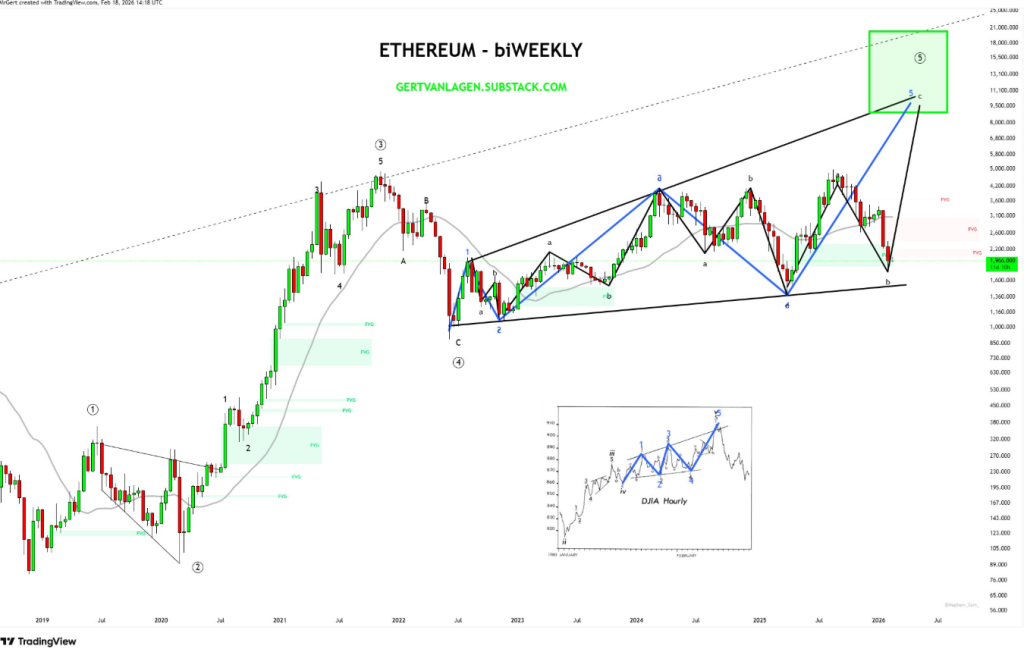

Ethereum price trades inside a multi-year expanding diagonal, with Wave-5 still unfolding.

ETH price continued to defend the $1750-$1900 support zone, as long-term targets of $9k-$18k remain in focus.

Ethereum price has slipped back toward the $1,900 region amid broader market hesitation, reflecting a cooling phase across major cryptocurrencies. Bitcoin remains heavy, risk appetite is selective, and volatility has compressed after weeks of uneven recovery attempts. Yet beneath the surface, ETH price structure continues to follow a far more disciplined roadmap than short-term fluctuations suggest.

Rather than signaling the start of a breakdown, the current Ethereum price pullback appears to be unfolding inside a much larger expanding diagonal formation that has guided the asset since the 2018 cycle low. The broader technical backdrop suggests that ETH price may be consolidating within Wave-5, the terminal leg of the structure ,rather than exiting its macro uptrend entirely. The key question now is whether Ethereum price is preparing for a final expansion phase that could eventually stretch toward the $9,000-$18,000 macro projection zone, or whether the structure begins to weaken before that thesis materializes.

Ethereum’s Price Long-Term Structure Remains Intact

The long-term Ethereum price chart outlines a five-wave expanding diagonal that began forming after the 2018 bear market bottom. Each wave has progressively widened in amplitude, creating higher highs and deeper corrective lows. Wave-1 marked the first structural recovery in Ethereum price. Wave-2 retraced sharply but respected the lower boundary. Wave-3 delivered the aggressive 2021 expansion that pushed ETH price to cycle highs. Wave-4 corrected deeply, yet it maintained the integrity of diagonal support. Ethereum price is now trading within Wave-5, traditionally the final impulse leg in a diagonal sequence.

Expanding diagonals often emerge in terminal phases of broader cycles. They do not resolve quietly; instead, they typically conclude with a volatility expansion that sweeps liquidity before exhaustion sets in. The absence of a decisive breakout so far suggests that the terminal expansion phase for Ethereum price may not yet be complete. Crucially, ETH price has not invalidated the structure. The lower boundary of the diagonal, currently projecting through the $1,850–$1,900 zone, continues to act as a technical floor for Ethereum price.

Where Ethereum Price Stands in the Final Wave?

Wave-5 is the technical focal point right now. The broader structure suggests Ethereum price is navigating the latter stages of a five-wave cycle, and current price action appears to be forming the internal subdivisions of that final leg. The key detail is behaviour, not just positioning. ETH is no longer trending impulsively downward. Instead, candles are tightening, range is compressing, and downside follow-through is limited. That typically signals that selling pressure is slowing rather than accelerating.

In classical expanding diagonals, the fifth wave frequently stretches toward and sometimes beyond the upper boundary of the formation before exhaustion. Based on the current diagonal trajectory and historical Fibonacci extension models, projected completion zones for Wave-5 range between $9,000 and $18,000, depending on volatility expansion and macro liquidity conditions. These projections are structural, not immediate targets, and assume the integrity of the diagonal remains intact.

If Wave-5 continues developing, Ethereum price is likely still in the corrective sub-wave phase before attempting a broader expansion. For upside continuation to gain credibility, ETH price must reclaim short-term resistance and show sustained acceptance above recent lower highs. Failure to hold the $1,850–$1,900 support corridor, however, would shift the structure into a deeper corrective scenario and delay the expansion thesis.

Final Thoughts

Ethereum price is positioned at a structural inflection point rather than in active breakdown mode. The broader multi-year formation remains intact, and despite today’s 1.5% dip, selling pressure has not accelerated in a disorderly manner. As long as this demand zone holds, the larger Wave-5 thesis stays valid, with long-term projection targets ranging between $9,000 and $18,000 based on historical extension models. A confirmed loss of support, however, would delay that trajectory and shift Ethereum price back into a deeper consolidation phase before any major upside expansion.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.