Ethereum Prepares for Potential Pullback as Whales Exit: Is a Deeper Correction Ahead for ETH?

In the past few days, the crypto market has seen strong gains, with Bitcoin’s price creating a new all-time high. But this rise triggered a profit-taking sentiment, which caused the market to temporarily peak. Ethereum, in particular, struggled to stay above its recent high as large investors started pulling back their money. As a result, there might be a short-term correction for ETH price ahead.

Ethereum Struggles in Meeting Buying Demand

A market-wide rebound, driven by Bitcoin hitting new all-time highs and better overall economic conditions, helped push Ethereum’s price up to an eight-week high of $2,731. However, it’s now having trouble attracting strong buying interest, as many short-term investors have already sold to lock in profits.

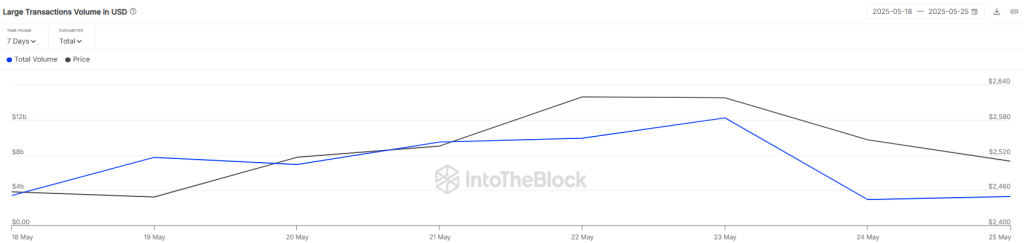

According to Coinglass, over the past 24 hours, more than $40.66 million in Ethereum positions were liquidated. Of this, 15.12 million from buyers and $25.54 million from sellers. Meanwhile, data from IntoTheBlock shows a sharp drop in large transaction volume, falling from $12.24 billion to $3.28 billion in just three days.

This suggests that big investors are stepping back, which is weakening the upward momentum in ETH’s price. With whales pulling back, sellers might gain the upper hand in the short term, possibly leading to a price correction.

Despite some recent price struggles, Ethereum’s defi activity continues to grow. The total value locked in Ethereum rose from $50.63 billion on April 26 to $62.7 billion by May 26, a jump of over 25% in just under a month.

Also read: What’s Next for Ethereum Price? Will the ETH Price Mark A New ATH in June 2025?

Some of the biggest gains came from platforms like Pendle, where deposits increased by over 50%, and Ether.fi and EigenLayer, both of which saw 48% growth. Ethereum still leads all blockchains in TVL, holding 54% of the market. For comparison, Solana holds 8%, and BNB Chain has 5% among Layer-1 networks.

This strong DeFi growth could help support ETH’s price and reduce the chances of a major drop, as many investors remain bullish about a rebound.

What’s Next for ETH Price?

Ether recently faced resistance around $2,731, resulting in a drop below the immediate Fib levels. As bears strengthen their dominance, buyers struggle in triggering a recovery rally. As of writing, ETH price trades at $2,535, declining over 0.6% in the last 24 hours.

The ETH/USDT pair might fall to the 100-day EMA (around $2,456), which is an important support level to watch. If the price bounces back strongly from that point, buyers may make another attempt to push past $2,750. If they succeed, the price could rise toward $3,000. There is some resistance around $2,870, but it likely won’t hold for long.

However, if the price drops below the 100-day EMA, this bullish outlook could change. In that case, the pair might fall further toward the descending trend line at $2,329. As the hovers below the midline, the chances of a bearish correction rise for ETH price.