The 90-day tariff pause by the U.S. President has boosted the overall cryptocurrency market, especially the price of Ethereum (ETH), which has gained over 13% in an upward rally. This positive momentum in the crypto market follows a prolonged period of downward movement.

Ethereum (ETH) Current Price Momentum

At press time, the price of Ethereum was trading near $1,670, having recorded a surge of over 13% in the past 24 hours. Meanwhile, during the same period, its trading volume skyrocketed by 85%, indicating heightened participation from traders and investors compared to the previous day.

Ethereum Technical Analysis and Upcoming Levels

This surge in ETH’s price has halted Ethereum’s continuous decline. According to expert technical analysis, ETH has formed a bullish engulfing candlestick pattern at a key support level of $1,440. If the current market sentiment remains unchanged, there is a strong possibility that ETH could rise by 11% to reach the $1,850 level in the coming days.

Despite Ethereum’s bullish outlook, it is still trading below the 200-day Exponential Moving Average (EMA) on the daily time frame, indicating that the asset remains in a downtrend.

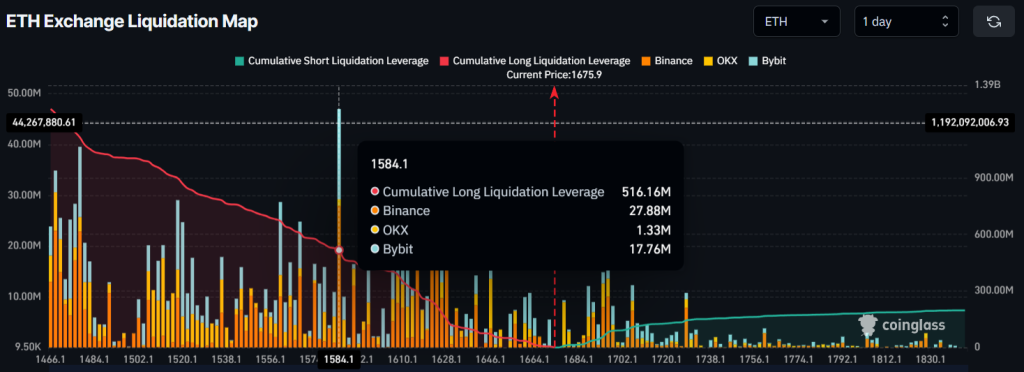

Considering the current market sentiment and Ethereum’s upward momentum, traders are strongly betting on the bullish side, according to the on-chain analytics firm Coinglass.

Traders’ $516 Million Worth of Bullish Bet

At present, the ETH long/short ratio stands at 1.03, indicating strong bullish sentiment among traders and suggesting that long positions are higher than short positions.

In addition to this, traders are currently over-leveraged at the $1,585 level on the lower side (support) and $1,696 on the upper side (resistance), having built $516 million and $80 million worth of long and short positions, respectively, over the past 24 hours.

These on-chain metrics clearly indicate that traders are currently dominating the market and have strong interest and confidence in Ethereum.