Ethereum Price Prediction September 2025: How High Could ETH Go?

-

ETH $ 1,946.68 (-2.13%)

ETH price surged to a new all-time high near $4,900 in August, with momentum pointing toward $5,500.

Rising Binance reserves suggest possible profit-taking and short-term selling pressure.

Whale purchases and technical setups fuel optimism for Ethereum’s September rally.

The ETH price rallied terrifically in August, setting a new all-time high near $4,900, after it broke out of the $3,700 to $4,000 supply range. The rally was fueled by massive ETF inflows, whale activity, and tightening supply conditions.

Now, in Q3’s last month, the once supply is now acting as a support area, and when writing ETH/USD is trying to sustain above this demand area. Now, after witnessing the August rally, experts have raised expectations for a September move toward $5,500, though risks of correction still remain.

Binance Reserves Hints at A Rise For ETH Price

The August sharp rally was supported by strong traders and investors’ interest, and even continuous inflows from Ethereum ETFs are evidence of that.

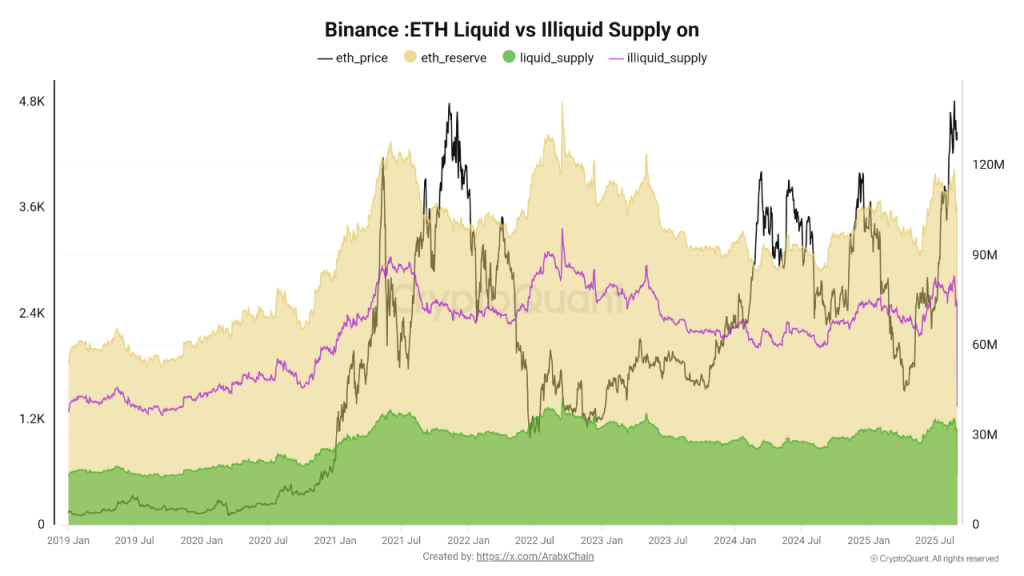

But many eyes are now looking for September gains. CryptoQuant insights reveal that Binance Exchange data show that reserves on Binance have climbed notably during August, suggesting an increase in coins moving to the platform. This often reflects a willingness by holders to sell into strength, hinting at short-term caution.

Despite this, the data strongly highlights that the majority of supply still remains illiquid, which is creating a strong structural shortage that supports long-term upside.

According to the ETH price chart, while some liquidity has returned to circulation, the imbalance still leans strongly on the bullish side.

Since the bullish narrative is strong for ETH, caution is still necessary, as the rise in Binance reserves and a slight uptick in liquid supply currently act as near-term cautionary signals. Because this trend could lead to continued profit-taking, pulling the ETH price close to $4K.

However, if exchange inflows slow and withdrawals increase once again and rapidly, the Ethereum price USD supply squeeze may intensify, which will reinforce the bullish conditions.

In that case, insights from CryptoQuant hint at a sustained move above $4,800 remaining key. If that is achieved, then it could pave the way for a push toward $5,200 to $5,500.

Conversely, failure to hold that level may trigger a correction back toward $4,200 or even $4,000 before momentum resumes.

Analysts’ Technical Setup Points to $5,500

From other analysts’ technical perspective, it also aligns with CryptoQuant’s projection to $5500, turning the ETH price prediction even more encouraging. for traders and investors.

Looking at the short range, it is currently retesting the breakout trendline of a falling wedge pattern in the first week of September, while the pattern was built in August on the day chart.

Such setups often attract new demand, and if confirmed, the breakout could propel Ethereum toward $5,500 in September.

Even the Whale activity supports and has further boosted sentiment. Recently, Ted Pillows mentioned that a fresh whale entered the market with a $100 million Ethereum purchase today, followed by additional buys of Bitmine’s $65.3 million worth of ETH.

These large-scale inflows demonstrate strong conviction among deep-pocketed investors, providing a floor of confidence for the market.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

As per our Ethereum price forecast 2025, the ETH price could reach a maximum of $5,925.

According to our Ethereum Price Prediction 2030, the ETH coin price could reach a maximum of $15,575 by 2030.

As the altcoin season begins, the short-term gains make Ethereum a lucrative buying option. However, the long-term promises of this programmable blockchain make it a viable long-term crypto investment.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.