Decred price prediction 2025 grows stronger as governance and privacy narratives return.

DCR soars 340% from November lows, reaching $70 before profit-taking.

Cathie Wood’s 2018 view on Decred’s governance resurfaces, boosting sentiment.

Privacy coin rotation fuels DCR, DASH, and ZEC rallies in Q4.

The Decred price prediction for 2025 is being discussed more frequently due to a bullish rise following the Fed rate cut, which has turned DCR firmly bullish as the once-overlooked governance-focused cryptocurrency makes a strong comeback in Q4.

Following its official statement on November 4th, highlighting its proven decentralized governance model, DCR crypto surged over 150% in a day, signaling renewed investor confidence in privacy and governance-driven assets.

But the question remains: will this rally sustain itself and target $100 or higher, or will it succumb to bearish dominance due to frustrated investors’ portfolios’ lack of gains?. This also raises another key question: Will DCR crash due to the exit liquidity from investors who are seeking high returns? Let’s discuss what has happened and what could happen next in the Decred price prediction article.

Governance and Privacy Drive Decred’s Sharp Revival

Following the Fed’s recent rate cut, the Decred price remained strongly bullish this week in November, reflecting a notable rebound driven by renewed recognition of its governance strength.

The official Decred account reposted a 2018 statement from Cathie Wood, who had praised the project’s ability to address Bitcoin’s structural challenges through robust governance.

The post at times like these acted as a catalyst for DCR/USD, which mentioned that it has successfully demonstrated “true on-chain governance without a central authority,” as stakeholders have voted on everything from consensus rules to treasury allocations.

This reaffirmation of Decred’s governance model reignited investor sentiment, pushing the Decred price from $27 to $70 within a single day, from November 3rd to November 4th, marking a massive 150% surge.

The move also coincided with an uptick in other privacy coins like DASH/USD, XMR/USD, and ICP/USD, suggesting that Q4 2025 could be shaping up as a privacy coin-driven cycle after exchanges dominated Q3.

From Long Dormancy to Explosive Growth

Following its all-time high of $250 in 2021, Decred had seen a prolonged decline as investor interest shifted toward narratives like real-world assets (RWA), gaming, and AI.

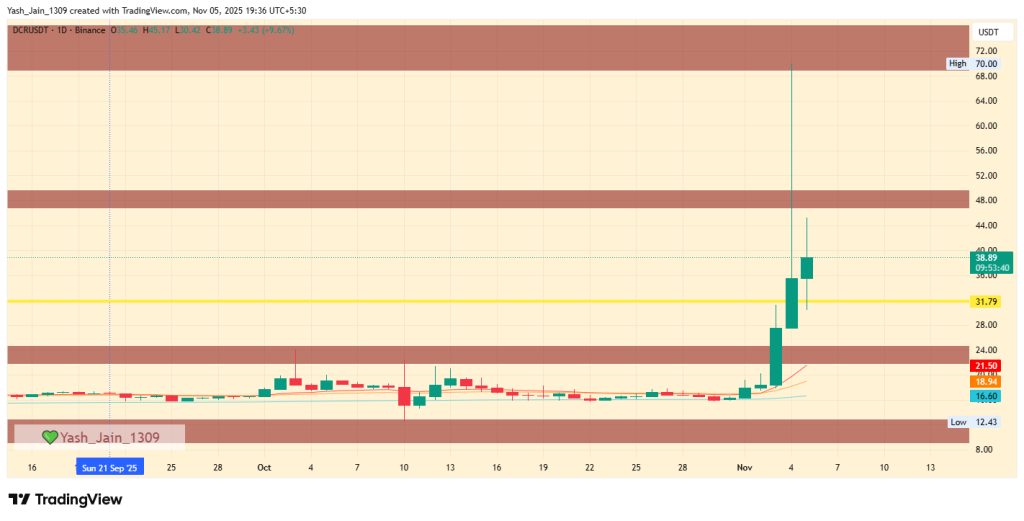

However, its resurgence in November signals a changing market tide. After rising recently from a low of $16 on November 1st, DCR crypto skyrocketed 340%, breaking through key resistance levels at $25 and $50, and eventually peaking at $70.

Interestingly, this explosive rally occurred despite a broader market downturn caused by uncertainty surrounding the Federal Reserve’s December rate cut decision. As Bitcoin dipped below the $100,000 mark and major altcoins faced sharp corrections, capital began rotating into privacy-focused assets like Decred crypto, seen as safer bets amid regulatory unease and market volatility.

Profit Booking and Key Levels to Watch

However, today when writing, this rapid ascent was followed by a wave of profit-taking, as long-term holders who had been underwater since 2021 used the rally as an exit opportunity.

Consequently, Decred price chart data shows that DCR crypto has retraced from $70 to $40, losing nearly 40% of its weekly gains.

However, even at current levels, the token maintains over 130% gains from its November low that’s indicating persistent buying pressure and growing market conviction.

If bulls manage to defend the $32 support zone, a renewed push toward $70 remains possible in the near term. Sustained accumulation and favorable sentiment could even propel the Decred price forecast toward $100 by year-end, further strengthening the long-term outlook for Decred price prediction 2025.

However, if $32 fails to hold, the next potential support lies near $25, marking a 65% retracement from recent highs.

Additionally, The technical indicators show current market growth. The EMA bands supported the rally, the Awesome Oscillator indicated a strong bullish move, and the RSI approached an overheated level near 90, affirming this trend. However, the high RSI suggests a potential decline or consolidation to cool off.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.