Bitcoin led the broader cryptocurrency market in a mild rebound amid widespread fear of further capitulation.

The gradual return of whale investors has rejuvenated the potential for a crypto market rebound.

The altcoin market has remained strong relative to Bitcoin in the recent selloff.

Dave Portnoy, the founder of Barstool Sports, has bought the crypto dip with over $2 million. Portnoy said that he purchased $1 million worth of XRP, $400k worth of Ethereum (ETH), and $750k worth of Bitcoin (BTC) on Monday, November 17, 2025.

“Last night I bought $2,000,000 in crypto. When there’s blood in the streets, I’m like a Great White Shark,” Portnoy said.

Is Crypto Ready for an End-of-Year Bull Run?

Santiment vouches for a crypto market rebound amid the capitulation of retail investors

According to Santiment, the crypto market is nearing its bottom and on the verge of a bullish rebound. Santiment pointed out that retail traders – focused on Bitcoin, XRP, and Ethereum – have been capitulating.

Source: Santiment

In the past, Santiment has noted that the capitulation of retail traders has been a sign of potential crypto market recovery.

Dead-cat rebound traits: Bitcoin and altcoins signal potential midterm weakness

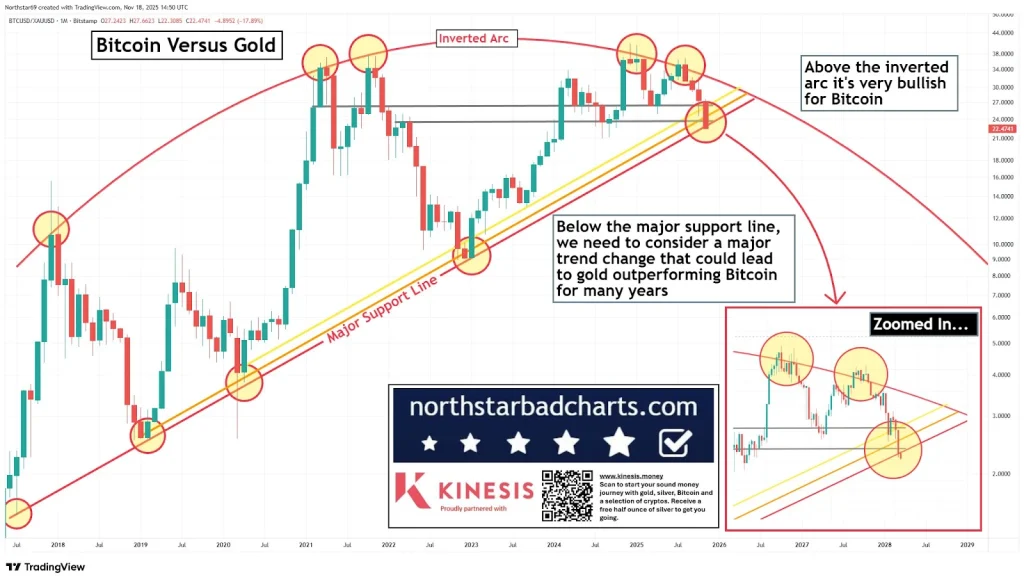

BTC vs Gold

Bitcoin has continued to correct against gold in the recent past. Amid the anticipated capital rotation from gold to Bitcoin, market analyst Kevin Wadsworth, noted that the Bitcoin price against gold must rebound in the coming weeks to avoid losing its 8-year support line.

Source: X

The Altcoins are still trapped in a mid-term correction amid the spot ETF bonanza

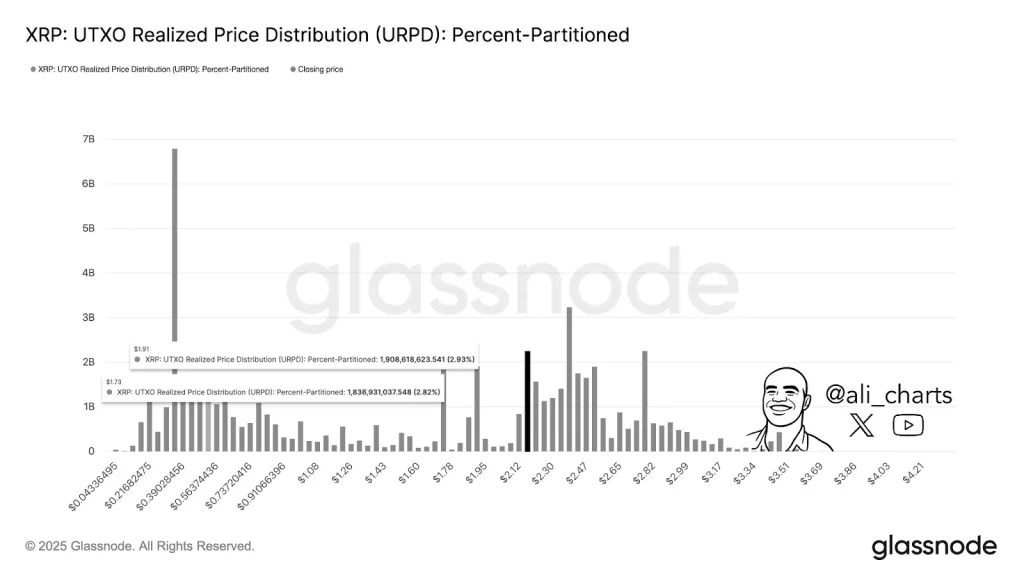

The wider altcoin market has yet to form a bullish reversal pattern amid the ongoing listings of spot crypto ETFs in the United States. For the XRP price, crypto analyst Ali Martinez believes it may drop as far as $1.9 before rebounding towards its all-time highs.

Source: X

Bigger Picture

The crypt market has underperformed other major global commodities due to macro backdrop uncertainties. The wider crypto market suffered low fresh capital inflow from whale investors during the longest United States government shutdown, which recently ended.

With the recent bilateral agreement between China and the United States, among other major economies, global economic activities are expected to surge. Furthermore, the global money supply has been increasing and will accelerate once the Fed’s Quantitative Easing (QE) starts early next month.

As such, market traders are anticipating a fresh crypto bull market in the coming few months, akin to the crypto summer of 2017.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.