April 11, 2025 13:27:58 UTC

BTC Open Interest Jumps $2.4B, Major Move Incoming?

Bitcoin’s open interest surged by nearly 10%—a $2.4 billion jump in just hours—indicating a potential major market move ahead. Historically, such spikes have preceded significant price volatility. Currently, BTC is trading at $82,107.52, up 0.38% in 24 hours. Its trading volume has also risen sharply by 31.60% to $46.23 billion. With a daily low of $78,456.13 and a high of $82,918.43, traders are closely watching for the next breakout.

April 11, 2025 13:16:27 UTC

Swedish MP Proposes Adding Bitcoin to National Reserves

A Swedish Member of Parliament has submitted a formal inquiry suggesting the inclusion of Bitcoin in Sweden’s national reserves. Citing global discussions and the United States’ recent moves, especially Donald Trump’s March 7 executive order, the MP highlighted Bitcoin’s potential as a strategic monetary asset akin to gold. Bitcoin’s being added to national reserves of countries is only going to fuel BTC’s foothold in the global financial market.

April 11, 2025 13:09:04 UTC

SEC to Host 2nd Roundtable Today

The U.S. SEC has scheduled its 2nd crypto regulation round table today in its efforts to keep up with the digital assets industry. In a recent shift, the SEC has withdrawn several enforcement actions against major crypto companies, including Coinbase, Kraken, Consensys, and Cumberland. Marketers are expecting the SEC to make amendments around regulatory clarity and shape the industry’s future.

April 11, 2025 12:54:57 UTC

Top RWA Projects by Total Value Locked: Ondo Leads the Pack

Real World Assets (RWA tokens) continue to gain traction in the crypto space, with Ondo dominating the sector at $998M TVL. Usual follows with $734M, trailed by Sky at $448M and Spiko at $247M. Other notable RWA projects include M0 ($182M), OpenEden ($162M), RealT and Centrifuge (each at $136M), Anzen ($125M), and Cygnus ($92.9M). As investor interest grows, RWAs are emerging as one of the most promising narratives of the current market cycle.

April 11, 2025 12:45:26 UTC

Whale Alert: 200M XRP Moved from Ripple, Price Unchanged!

According to Whale Alert, 200,000,000 XRP ($402.74 million) was transferred from Ripple to an unknown wallet. This, however, has made little to no difference in XRP’s price trend, as it is presently changing hands at $2.01 with a change of -0.54% in the past 24 hours and +0.07% in the past hour. Talking about its trading volume, the business for XRP went down by 0.51% to $2.01.

April 11, 2025 08:19:12 UTC

Global Stock Market Turmoil Deepens Amid Tariff Jitters and Bond Selloff

Global stocks slumped Friday as U.S. bond yields soared and the dollar weakened, reflecting growing fears of recession amid escalating global uncertainties. U.S. Treasuries saw weekly selloff worsening, while investors flocked to gold and the Swiss franc. Asia’s Nikkei tumbled 4.3%, though Taiwan and Hong Kong saw slight gains. Hang Seng rose 1.28% to 20,945.67, and India’s Nifty 50 climbed 2.13% to 22,875.20. That being said, uncertainty over global trade and inflation continues to hammer markets.

April 11, 2025 08:06:42 UTC

Pi Coin Price Drops 30% as Token Unlock Spurs Sell-Off

Pi Coin has plunged 30% over the past two weeks as 119 million tokens entered circulation, amplifying sell pressure and pushing the price below the key $0.60 resistance. Currently trading at $0.5974, PI shows only a modest 24-hour uptick of 0.63%, while trading volume has dropped by 45.56% to $154.61 million. Community sentiment is unstable, with top groups voicing frustration over delays, transparency issues, and questions about decentralization. If momentum weakens further, the price could dip to $0.5934 later today.

April 11, 2025 07:48:10 UTC

Gold Price Today Holds $3,223, While BTC Holds $81k

Gold price today hit a fresh high of $3,235. The record peak in gold price comes after U.S. President Trump announced a 90-day halt on many reciprocal tariffs. At the time of press, it is up 1.44% over the last day at $3,223.20. Now, talking about the digital gold (Bitcoin), it has fared well after Trump’s tariff pause and is now trading at $81k after a drop to $76k.

April 11, 2025 07:32:02 UTC

Helium (HNT) Jumps 9% After SEC Drops Securities Lawsuit

Helium’s native token HNT surged 9.42% to $2.98 after the SEC dismissed its lawsuit against Nova Labs, the developer of the Helium Network. The decision, made with prejudice, shields the project from future charges related to its 2019 token issuance. The positive legal development boosted investor sentiment, pushing Helium’s market cap to $536.09 million. Its 24-hour trading volume also rose 14.20% to $14.4 million, signaling renewed interest following the regulatory clarity.

April 11, 2025 07:21:06 UTC

9-Year HODL Ends: Whale Sells $22M in Ethereum

According to on-chain data by EtherScan, an Ethereum whale has sold 14,015 ETH worth $22 million after holding it for 9 years. The wallet executed the swap over 15 hours on Uniswap, converting ETH to USDC. This same trader had also sold during key market dips in 2022 and 2023. The move comes as Ethereum rebounds from a two-year low of $1,412, now trading at $1,548.99. The timing has sparked speculation of cautious sentiment among early investors amid market uncertainty.

April 11, 2025 07:10:31 UTC

Uniswap Joins SEC Talks as UNI Price Eyes Key Resistance

Uniswap’s involvement in the SEC’s DeFi roundtable highlights its growing influence in shaping regulatory frameworks for decentralized finance. Despite this milestone, UNI’s price has dipped 1.80% in the past 24 hours to $5.16. Trading volume also fell 34.09% to $123.49 million, reflecting cautious sentiment. Technically, UNI faces resistance at $5.75, and a breakout above this level could drive the price toward $6.58.

April 11, 2025 06:46:14 UTC

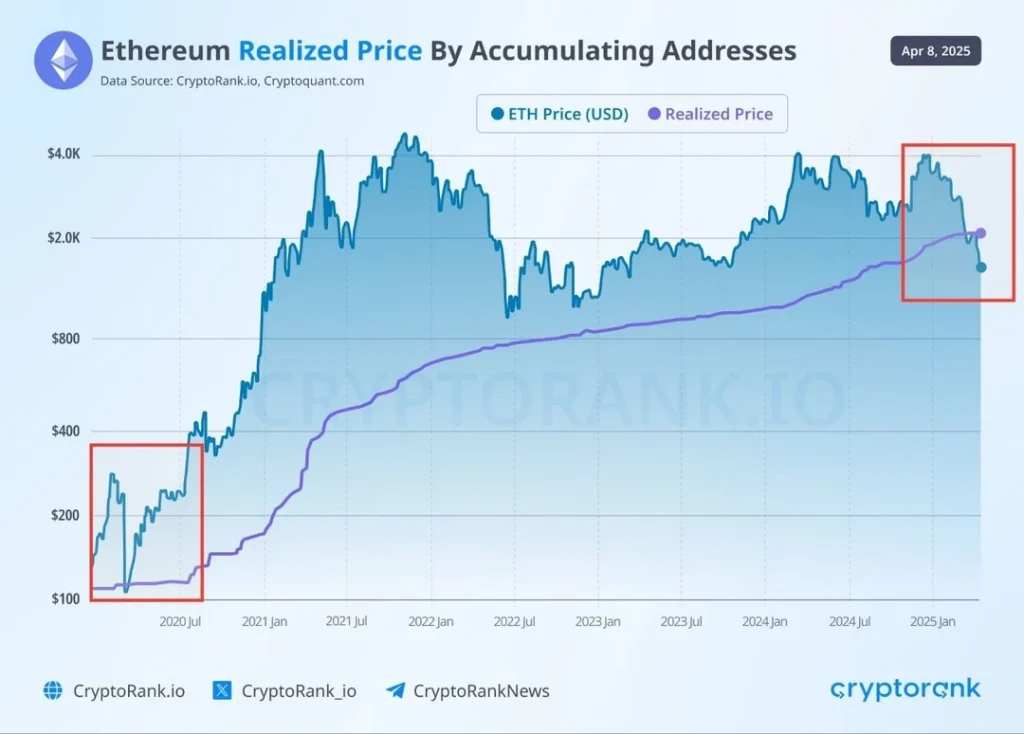

Ethereum Falls Below $2K Realized Price, a Rare Signal

Ethereum has fallen below its realized price of $2,000, a rare event last seen during the March 2020 crash, notes crypto analyst Carl Moon. ETH is currently trading at $1,553.06, down 3.46% in 24 hours. The drop comes as its trading volume slumped 39.72% to $20.25 billion, while its market cap stands at $187.62 billion. Market watchers are closely monitoring this level, as historically, such dips have marked accumulation zones before major rebounds.

April 11, 2025 06:24:32 UTC

What Is Happening In Crypto Market Today?

The crypto market today has taken a step down after yesterday’s uptick after the release of CPI data and the tariffs getting paused. Talking about numbers, the market capitalisation of the crypto business is down 1.16% to $2.58 trillion. The trading volume since yesterday has dropped by 37.50% to $102.16 billion. In the midst of all the hustle and bustle, the cautious sentiments have taken the “Fear & Greed” Index down to a fearful score of 21.

April 11, 2025 06:14:28 UTC

Onyxcoin (XCN) with 70% Price Surge Becomes Top Gainer Today

Onyxcoin (XCN), the 86th largest cryptocurrency, is today’s top gainer with a surge of 69.92%. It is currently changing hands at $0.01891, with its intraday trading volume of $456.08M, which is up 270.52% since yesterday. Talking about its 24-hour price bandwidth, it has ranged from the low of $0.01106 to the peak of $0.01952.

April 11, 2025 05:13:36 UTC

XRP Holds Ground at $1.99 as Ripple, SEC Move Toward Resolution

Ripple Labs and the SEC have filed a joint motion with the U.S. Court of Appeals for the Second Circuit to place the appeal proceedings on hold. The proposed deal reduces Ripple’s civil penalty from $125M to $50M. XRP has reacted calmly, trading at $1.99, down 0.39%, with a 24H volume of $4.12B, which is down by 51.77%. Talking about XRP’s next move, it could target $2.02 next.

April 11, 2025 05:13:36 UTC

Bitcoin Slips Despite CPI Surprise Fueling Crypto Rally?

Bitcoin is trading at $80,530, down 1.88%, despite a positive boost from the latest U.S. CPI data. Inflation rose just 2.4% in March—below the expected 2.6%—sparking a broader crypto market rally led by Ethereum and altcoins. Bitcoin’s 24-hour range was between $78,456 and $82,339, with a market cap at $1.59 trillion. However, trading volume plummeted 42.65% to $44.67 billion, suggesting a cautious investor mood despite the bullish macroeconomic signal.