Today’s gains were driven by positioning and spot demand, with leverage staying controlled and volatility contained

Capital rotated within crypto instead of exiting the market, allowing Ethereum and XRP to outperform alongside Bitcoin

Crypto markets have turned bullish today, with the prices of top tokens like Bitcoin, Ethereum, and XRP surging above a certain juncture. The top 3 tokens remained elevated throughout the weekend, which helped them to clear a pivotal barrier. While the global headlines, including ongoing US-Venezuela tensions, remain in focus, broader risk sentiment stayed stable. This allowed specific factors to drive today’s upside, which is driven by a couple of them.

Derivatives Reset Reduced Downside Pressure

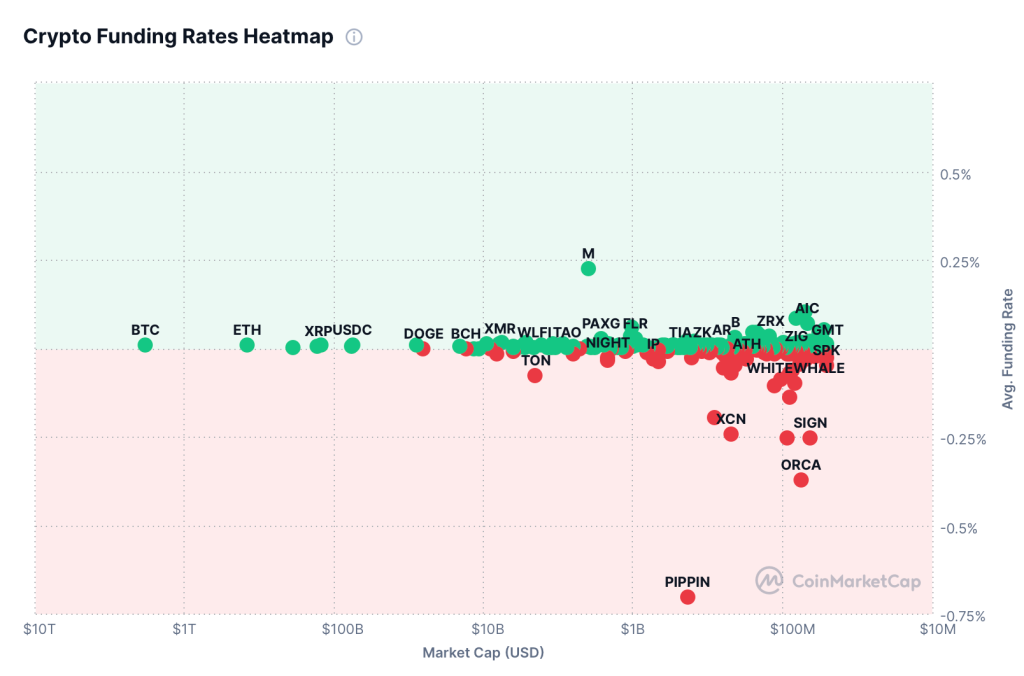

One of the most important changes over the past 24 hours has been a cooling in derivatives pressure. Funding rates across major perpetual contracts stabilized after earlier overheating, while open interest expanded in a controlled manner. Crucially, the move higher did not rely on aggressive short liquidations.

The above chart shows the funding rates, which have turned positive for Bitcoin, Ethereum, XRP, USDC, Dogecoin and other popular cryptos. This is crucial for the markets, as rallies led by forced liquidations often fade in no time. However, today’s gains were supported by voluntary risk-taking, which suggests traders were comfortable adding exposure rather than being defensive.

ETF Records Highest in 30 Days

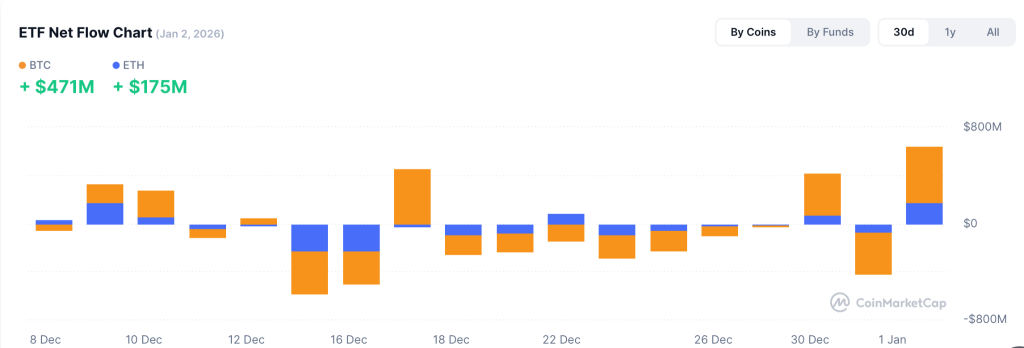

Rather than exiting the market, capital rotated within crypto. Bitcoin dominance paused, while Ethereum and XRP attracted incremental interest. At the same time, there was no notable move into stablecoins, reinforcing the view that traders were repositioning toward risk rather than reducing exposure. This suggests a shift in strength towards spot-led buying, while ETFs’ net inflow remained positive and was highest over the past 30 days.

The recent total inflows surged above $645 million, with Bitcoin contributing over $470 million and Ethereum $175 million. The internal rotation is a hallmark of a risk-on environment, where investors are looking ahead of Bitcoin to other altcoins. Moreover, aggressive accumulation of institutions has also played a vital role in keeping the volume within the cryptos.

Will the Markets Remain Bullish Throughout the Week?

With the geopolitical factors evolving, the traditional markets and the crypto markets are expected to remain volatile this week. Moreover, multiple events are scheduled this week, which could have a broader impact on the BTC price as well. With the US labour market and service inflation, with ISM services, JOLTS, and Friday’s NFP and wage growth, along with Fed rate-cut expectations, the upcoming week could drive more attention from the traders.

On the other hand, massive token unlocks of RWA are set in the next few days, led by Ondo with 194M tokens, SEI with 55M tokens and PLUME with 40% of float. According to Tokenomist, a major unlock includes HYPE, ENA, APT, LINEA and MOVE, each worth over $5 million. Besides, a small amount of SOL, DOGE, TRUMP, AVAX and ASTER is also on this list this week.

Looking ahead, continuation will depend less on headlines and more on whether these conditions persist. As long as leverage stays disciplined and spot demand holds, buyers retain the upper hand. However, any sudden return of aggressive funding, volatility spikes, or macro shocks could quickly change the tone.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.