The crypto market faced a major setback as over $500 million in positions were liquidated, following a sharp decline in Bitcoin and Ethereum prices. After showing strong gains in July, both top cryptocurrencies lost momentum, triggering a wave of sell-offs. As both Bitcoin and Ethereum are now hovering around new monthly-lows, there’s an increased chance of another decline in the coming hours.

$500M Liquidation Triggers Fresh Price Lows

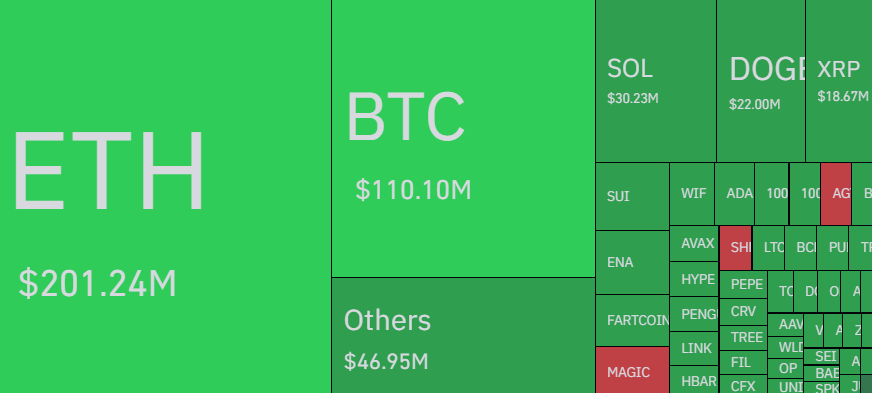

The cryptocurrency market has endured a major flush-out over the past 24 hours, with total liquidations surging to $527.75 million. The move was heavily leaned toward long positions, which accounted for $468.75 million of the total, while shorts saw a far smaller $59 million in losses, according to data from CoinGlass.

Ethereum emerged as the biggest casualty, with a staggering $201 million in positions wiped out — $177 million of which were long bets. Bitcoin followed with $110 million in liquidations, dominated by $106 million in longs. Together, these two top cryptocurrencies made up nearly 60% of the market’s total liquidations.

Also read: BlackRock Sees Zero Outflows Amid Market Correction As $152M Exits Ethereum ETF

The spike in liquidations comes amid continued market volatility, with Bitcoin hovering around $113,200 and Ethereum trading near $3,474. Both assets have posted weekly losses — down 4.14% for BTC and 6.9% for ETH, signaling strong selling pressure.

Bitcoin Price Analysis

Bitcoin’s price has dropped back to the neckline of an inverse head-and-shoulders pattern, a key level that traders are watching closely. As of writing, BTC price trades at $113,068, declining over 2% in the last 24 hours.

If the price bounces strongly from this level, it could show that buyers are trying to turn it into support. A move above the 20-day exponential moving average (EMA) at $115,444 could push the price toward $123K. Sellers will likely put up strong resistance there, but if buyers break through, Bitcoin could climb to $130,000.

On the downside, the support between the trend line and $110K is expected to see strong buying interest. However, if Bitcoin falls below this range, selling pressure could increase, potentially dragging the price down to $105,000 and even as low as $100,000.

Ethereum Price Analysis

Ethereum closed below the $3,500 support level, suggesting that short-term traders are taking profits. As of writing, ETH price trades at $3,478, declining over 4.18% in the last 24 hours.

The price has now dropped below the 20-day exponential moving average (EMA) at $3,636, a key resistance level to keep an eye on.

If it bounces strongly from current level, buyers may try to push ETH/USDT above $3,636. A successful move might send ETH price to $4,000, though sellers are expected to defend that level strongly.

If Ethereum holds below the 200-day EMA, it could drop to the 50% Fibonacci retracement level at $3,300, and possibly down to the 61.8% level at $3,000.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.