Crypto Get Crushed Relative to Gold and S&P 500, Santiment Predicts a ‘Rubber-Band’ Rebound

The crypto and stock markets have recorded extreme fears of further capitulation.

Santiment noted that the crypto market will experience a huge bounce-back once selling pressure subsides.

Technical analysis shows that most crypto trading pairs are retesting critical bull market support levels.

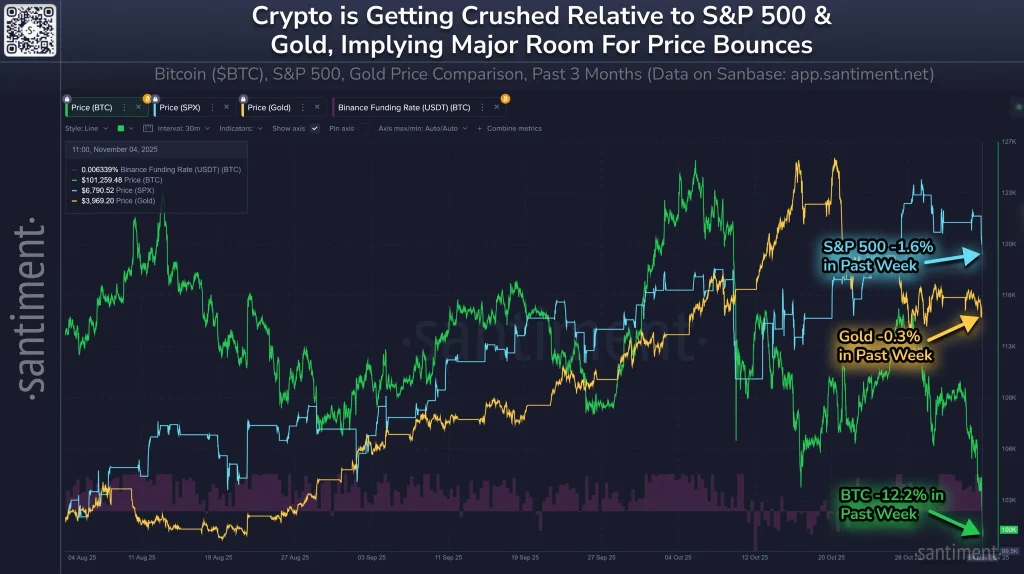

The multi-month correlation between the crypto market and the S&P 500 is fast slipping away. During the past week, the S&P 500 dropped approximately 1.6%, gold shed less than 1%, while the crypto market dumped over 12% during the same period.

The wider crypto market recorded significant losses during the last 24 hours led by Bitcoin, which teased below $100k on Tuesday.

Source: Santiment

What’s Next for Crypto Amid Significant Divergence from the S&P 500

According to Santiment, the crypto market is well-positioned to rebound after hitting oversold levels. A potential rebound for the S&P 500 is likely to influence the wider crypto market with a relief rally as traders bet on a midterm rebound.

Furthermore, the crypto market has accumulated significant positive fundamentals in the recent past including clear regulations in major jurisdictions amid high demand from institutional investors. Additionally, the upcoming Fed’s Quantitative Easing (QE) will build on the rising global liquidity, which is bullish for crypto.

“This sharp underperformance suggests that crypto markets may have become oversold. Extreme volatility in crypto often leads to a “rubber-band” effect, where traders’ capitulation can lead to a huge bounce-back once selling pressure subsides,” Santiment noted.

BTC price trends on ‘bear market’ levels; Here are Key Levels

From a technical analysis standpoint, the BTC/USD pair must rebound from its weekly 50 Simple Moving Average (SMA) to invalidate further capitulation.

Source: X

According to market analyst Aksel Kibar, BTC price, in the weekly timeframe, cannot fall below $98k as it will invalidate the midterm bullish sentiment.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.