CRO price is seeing a sharp spike in whale activity, often a precursor to major volatility and trend shifts.

On-chain data signals increased ecosystem usage alongside positioning by large holders.

Technical indicators suggest CRO is testing a long-term support zone with both upside potential and downside risk.

The CRO price has recently entered a critical decisive phase as bullish on-chain metrics and technical signals have converged at a critical support area. A sudden surge in whale activity, combined with stabilizing momentum indicators, has placed Cronos crypto firmly on the radar of market participants watching for the next high-volatility move, which could be near soon.

Whale Activity Signals a Shift in Positioning

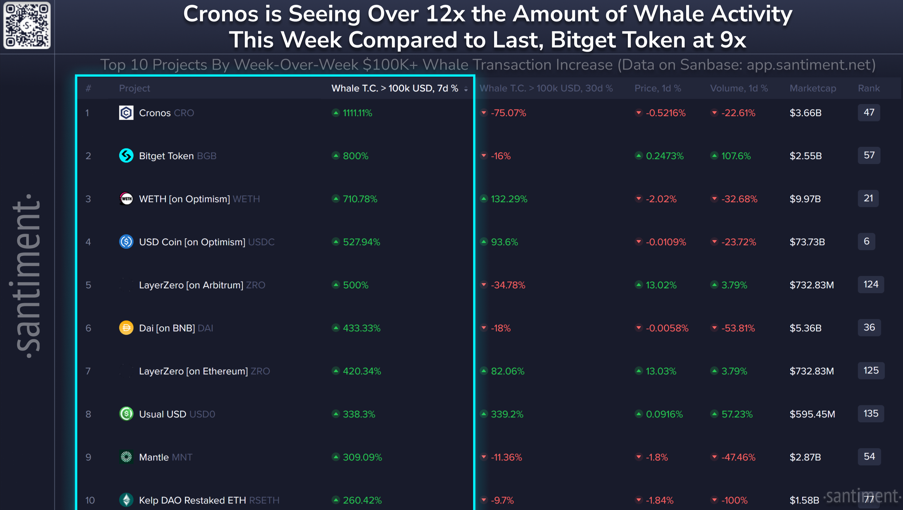

Over the past week, on-chain data has revealed a dramatic increase in whale transactions on the Cronos network, per the Santiment insights. The transaction counts that are exceeding $100,000 have surged by more than 1,100% week-over-week, which is crucially placing Cronos crypto among the top large-cap assets experiencing elevated whale interest. This spike have outpaced other similar activity seen in Bitget Token and even stablecoin flows like USD Coin on Optimism.

Historically, such changes in whale behavior have tended to coincide with periods of higher trading volume and increased network usage.

Consequently, the recent jump suggests that large holders may be repositioning within the ecosystem rather than exiting it.

CRO Price Chart Highlights Long-Term Support

Turning to the CRO price chart on the weekly timeframe, price action shows it is holding a well-defined ascending support trendline. This same level previously acted as a base for consolidation before triggering a rally exceeding 200%. Importantly, price has returned to this area after a prolonged correction, indicating that the current support levels carries historical significance.

At the same time, resistance levels from earlier rallies continue to slope higher, forming a ascending broadening structure. While this setup increases volatility risk, it also keeps the possibility of an upside expansion intact if demand strengthens. Therefore, CRO price USD movements around this support are being closely watched by spot market participants.

Momentum Indicators Suggest Selling Pressure Is Easing

From a momentum perspective, several indicators point to a cooling phase rather than aggressive distribution. The MACD histogram on the weekly chart has begun to fade on the red side, suggesting that bearish momentum is weakening.

In addition, the Chaikin Money Flow remains deeply negative near -0.29, highlighting an oversold and undervalued condition.

Meanwhile, the Relative Strength Index hovering near 39 indicates that selling pressure may be nearing exhaustion.

Together, these signals imply that if price continues to hold support, a base-building process could unfold. In that scenario, CRO price prediction models increasingly factor in a potential recovery phase rather than further immediate downside.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.