Bitcoin price has retested a crucial resistance level around $92k following this week’s bullish rebound.

The bullish sentiment for precious metals led by gold and silver has weighed down on BTC’s uptrend.

Renewed demand for BTC by institutional investors ahead of the Fed’s QE is a major bullish signal for December.

Bitcoin (BTC) price has recorded heightened volatility on Friday fueled by the CME Group outage. The flagship coin surged as much as $93k before dropping to reach a daily low of around $90.2k.

Bitcoin Price Eyes $100k in December Fueled By Robust Fundamentals

According to the BTIG firm, the Bitcoin price is well-positioned to rebound toward $100k in December. The firm noted that BTC price typically bottoms around November 26 and strengthens into year-end.

The firm noted that the Bitcoin price is likely to strengthen further in the next few weeks after hitting oversold levels. Moreover, Bitcoin’s daily Relative Strength Index (RSI) dropped to an oversold level last week following the extreme selloff.

Institutional Buying Pressure Supports Bullish Thesis

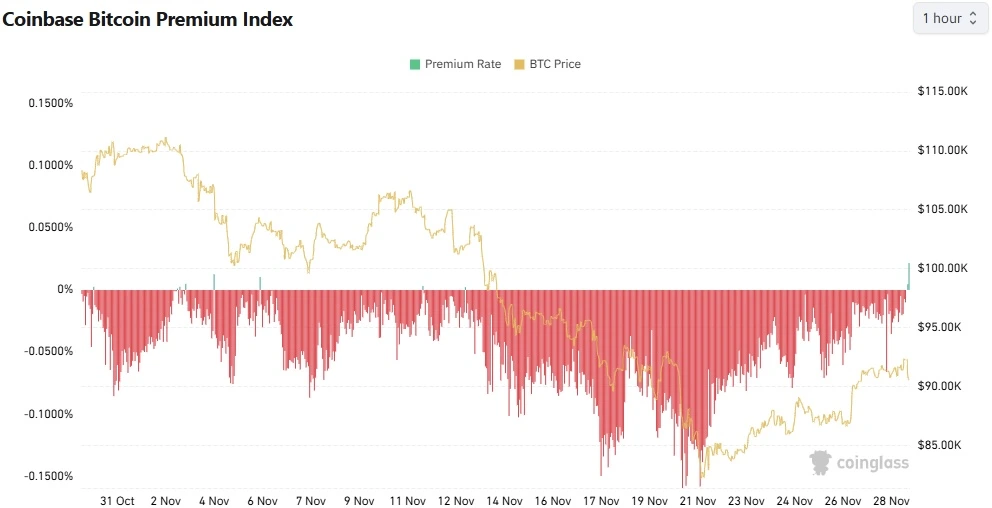

BTC price is well-positioned to continue in a bullish outlook in the near future fueled by the renewed demand from institutional investors. The rising demand for Bitcoin by institutional investors is evident from the Coinbase BTC Premium index, which turned positive on Friday after a prolonged negative period in the last few weeks.

Historically, a positive Coinbase BTC Premium index has been associated with a bullish outlook and vice versa.

Source: CoinGlass

Upcoming Fed’s QE amid anticipated Rate Cut signals fresh liquidity flow

Bitcoin price is also likely to rally towards $100k in December fueled by the Federal Reserve’s monetary policy change. Next week, the Federal Reserve will kickstart its Quantitative Easing (QE),

As such, the capital inflow to the Bitcoin market will likely surge amid the rising global money supply.

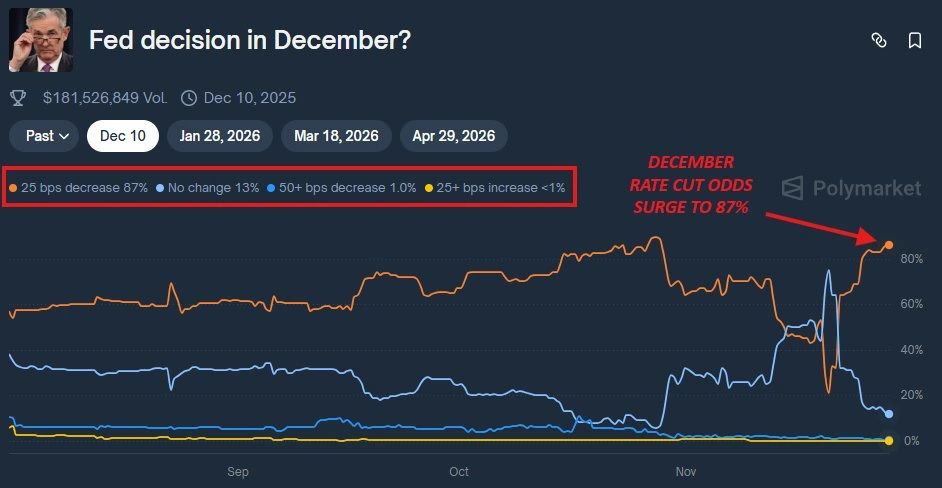

Source: Polymarket

Meanwhile, Polymarket traders are betting an 87% chance that the Fed will initiate a 25 bps rate cut in December.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.