Chainlink price prediction 2025 points to a bullish reversal possibility, if support holds near $13.50 to $14.50.

Chainlink’s partnership with S&P Global strengthens its on-chain data credibility.

The growing Chainlink Reserve and declining exchange supply ratio hint at a potential supply-driven rally.

The Chainlink price prediction 2025 has become a focal point as the token consolidates within a tight range between $16.5 and $18.5. Despite a quiet October, the broader technical setup and strengthening fundamentals suggest LINK could be preparing for a major bullish reversal heading into November.

LINK Trades in a Tight Range but Prepares for Reversal In November

As of writing, Chainlink price today stands near $17.95, reflecting a modest 0.30% daily rise and a market cap of $12.17 billion. The Chainlink price chart (LINK) shows persistent sideways movement, yet analysts point toward an ascending wedge pattern that has been active since late 2023.

This wedge structure has repeatedly defined the asset’s trajectory, with a recent rejection near its mid-band in September leading to profit-taking and a gradual pullback. The current setup indicates the LINK price could break down from the symmetrical triangle and retest the $13.50–$14.50 support zone, aligning with the wedge’s lower boundary. Historically, such areas have triggered strong rebounds in Chainlink’s market cycles.

Chainlink Price Prediction November 2025 Outlook: Accumulation Before an Upswing

If Chainlink price forecast 2025 holds true, the upcoming November could be a turning point. Analysts expect that once LINK touches the key support area, it could initiate a recovery phase aiming for $27.86, the year’s high based on Coinbase chart, before potentially advancing toward $46 by the first half of 2026.

The pattern implies a period of accumulation through the end of October, followed by rising demand during the last two months of the year. This aligns with the typical market rotation observed when long-term holders begin accumulating during periods of low volatility.

Ecosystem Strength: Partnerships and Reserve Expansion

While Chainlink price USD has moved sideways, the ecosystem continues to gain traction. In October, Chainlink partnered with S&P Global to bring its Stablecoin Stability Assessments (SSAs) on-chain through Data Link, marking one of the month’s most significant collaborations.

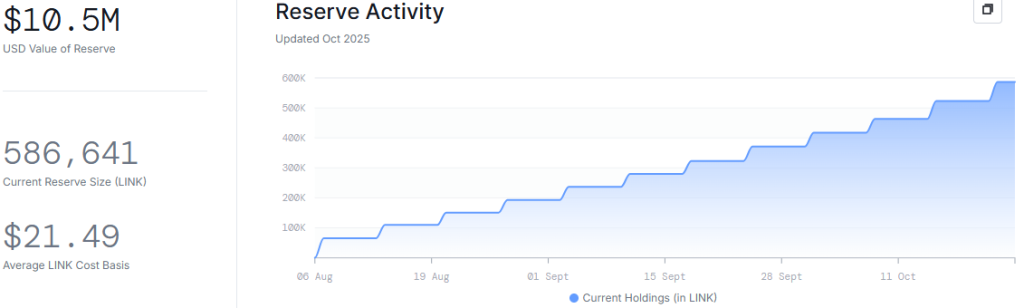

Moreover, the Chainlink Reserve, a growing strategic pool funded via protocol revenues, has expanded notably since August. Recent data shows a total of 586,641 LINK worth approximately $10.5 million, highlighting growing confidence in the protocol’s financial foundation and sustainability.

Supply Metrics Indicate a Bullish Structural Shift

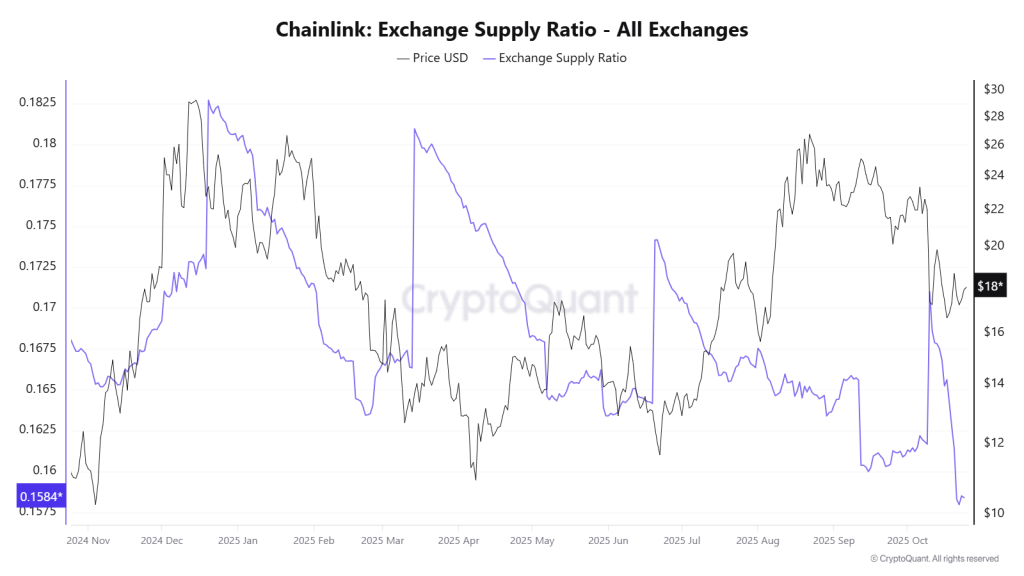

On-chain indicators also support the bullish Chainlink price prediction 2025. The Exchange Supply Ratio has been declining steadily, signaling that long-term holders are removing their tokens from exchanges. This trend reduces potential sell pressure and raises the likelihood of a supply shock, where reduced availability drives prices higher.

If this metric continues dropping, Chainlink could experience accelerated upward momentum once demand resurfaces especially with ecosystem growth and strategic reserves backing its long-term outlook.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.