Chainlink price trades lower alongside the broader market, slipping around 3% as risk appetite weakens.

On-chain data shows declining exchange reserves and muted selling pressure, suggesting a controlled pullback.

Chainlink price moved lower in the latest session, tracking the broader market’s downturn as Bitcoin and major altcoins faced renewed selling pressure. LINK declined by roughly 3% on the day, extending its short-term pullback as traders reduced exposure amid macro uncertainty. The move lower came without a surge in volume or aggressive downside momentum, indicating that sellers are acting cautiously rather than rushing for exits. While price action remains under pressure, market behavior suggests this decline is part of a broader risk-off rotation rather than a LINK-specific breakdown.

What Exchange Reserve and Spot Volume Bubble Data Reveal About Chainlink’s Selling Risk

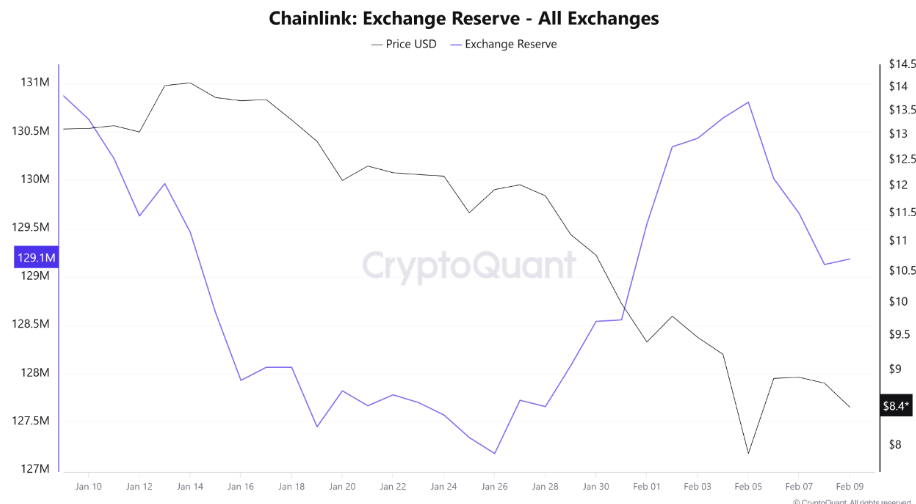

On-chain data from Cryptoquant paints a more balanced picture than price action alone might suggest. Exchange reserve metrics show that LINK balances on centralized exchanges have continued to trend lower, signaling that large holders are not aggressively moving tokens to sell. Historically, sharp drawdowns accompanied by rising exchange reserves often precede extended downside, as supply becomes readily available for distribution.

That pattern is not evident here. Instead, reserves appear stable to declining, implying that long-term holders are maintaining positions despite near-term weakness. This behavior suggests that selling pressure is coming primarily from short-term traders rather than from larger wallets rotating out of LINK exposure. In market structure terms, this aligns more with consolidation than with capitulation.

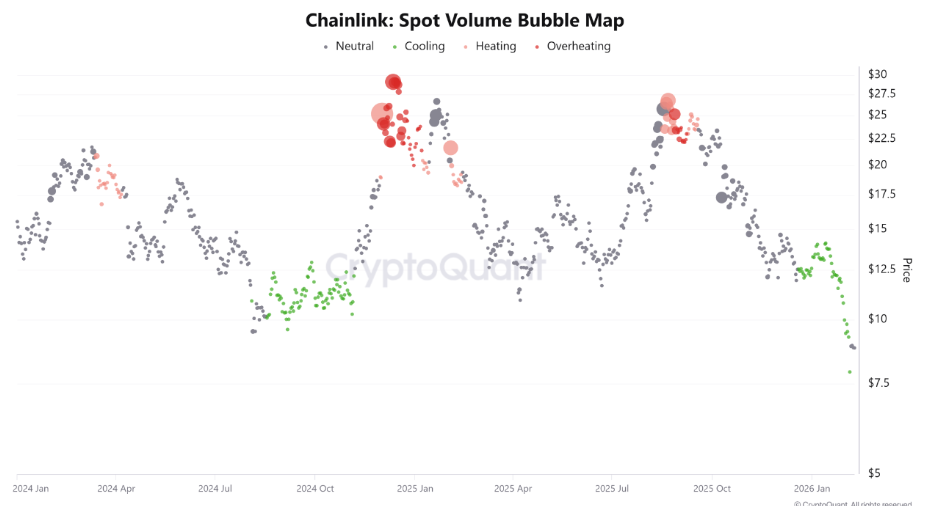

Spot volume bubble data adds further context to LINK’s pullback. Trading activity has cooled across major exchanges, with fewer large-volume buy or sell bursts compared to previous volatile sessions. This reduction in spot aggression typically reflects indecision rather than fear. Buyers are stepping back, but sellers are not accelerating either. Such conditions often emerge when price drifts into demand zones, allowing the market to rebalance positioning before a directional move resumes. Notably, this type of volume contraction tends to precede volatility expansion, though direction depends on how price reacts at key technical levels.

Chainlink Price Approaches Key Demand Zone: What’s Next?

Chainlink price is trading lower with the broader market today, but the decline has brought price back into a well-defined zone rather than into free-fall. The pullback has been orderly, suggesting distribution pressure in present, but not aggressive. Importantly, LINK has not printed a lower low on the higher timeframes, keeping the broader structure intact for now. However, LINK price is compressing near support after rejecting from a recent lower high.

For LINK, the primary support zone of $8 would act as a make or break zone. In case of a break below the zone, a significant downmove toward $7 followed by $6 may be seen ahead. Until the LINK token holds the $8 level, the recovery is imminent. At this stage, LINK is testing its crucial zone, not collapsing. The reaction around support will refine whether the move becomes a reset higher or a continuation lower.

FAQs

LINK’s recent decline is primarily tracking a broader crypto market downturn, driven by short-term trader risk-off sentiment rather than significant selling from long-term holders, according to on-chain data.

Market data shows exchange reserves are stable or declining, indicating larger holders aren’t aggressively selling. However, with price compressing near support, timing depends on the reaction at the $8 level.

On-chain metrics reveal that LINK exchange reserves are not rising sharply, suggesting this sell-off is driven by short-term traders, not long-term holder distribution—a sign of consolidation, not a major breakdown.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.