Chainlink price is consolidating despite reserves climbing to $9.3M.

Whale accumulation and wallet growth show rising institutional adoption.

A potential Chainlink ETF could act as the next big bullish catalyst.

The Chainlink price is at a critical point as fundamentals strengthen, but market action lags behind. With the network’s reserve surging to $9.3 million, whale accumulation rising, and ETF speculation heating up, LINK may be brewing something big, and it is highly likely it is setting up for a breakout.

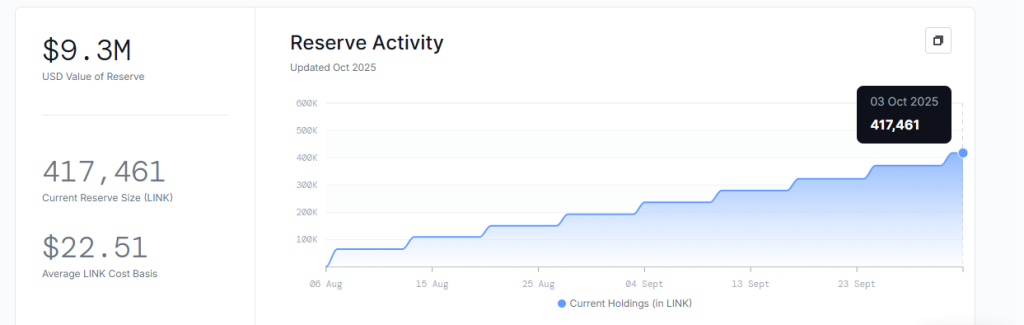

Chainlink Reserve Marks Milestone Growth

Chainlink has significantly expanded its Strategic Reserve, which is funded through both on-chain and off-chain revenue. As of early October, the reserve stands at 417,461 LINK, valued at over $9.3 million, with the average cost basis recorded at $22.51 per LINK. The most recent inflow came on October 2, adding over 46,000 tokens.

This expanding reserve highlights growing institutional adoption and long-term sustainability. However, while reserves climb, Chainlink price today sits near $22.30, still trailing its year-to-date high of $27, signaling that market sentiment has yet to fully align with on-chain strength.

Adoption Expands Across DeFi and RWAs

In September, Chainlink’s BUILD program welcomed DualMint, aiming to connect local businesses with decentralized finance via tokenized real-world assets (RWA). This expansion signals deeper adoption for Chainlink crypto beyond DeFi and into traditional sectors.

At the same time, onchain metrics show positive underlying fundamentals. Whale accumulation continues, exchange reserves are declining, and new wallet growth is accelerating.

In fact, more than 1,900 fresh addresses were added in a single day, a clear indication of rising demand for oracles and integrations across financial ecosystems.

Chainlink Price Outlook Amid ETF Speculation

The broader market narrative adds another layer of optimism. With altcoin ETFs like Solana, XRP, and DOGE already in play, the focus now shifts to a possible Chainlink ETF.

Companies such as Grayscale and Bitwise have already submitted applications, and approval could be a major trigger for institutional flows.

From a technical perspective, Chainlink price USD remains above the rising channel’s middle band, reinforcing bullish structure. If the $22 support holds, momentum could push LINK toward the $44 level, with a longer-term Chainlink price prediction pointing at a potential move back toward the 2021 all-time high.

At press time, Chainlink price today hovers around $22.30, with near-term resistance sitting between $27 and $30. Breaking this zone could ignite a stronger rally, while failure to hold the $20–$22 range may stall momentum. Still, fundamentals, adoption, and reserves collectively suggest that Chainlink price could be gearing up for its next leg higher.

FAQs

Analysts suggest a bullish outlook, with potential to reach $44 if key support holds. Long-term predictions point toward its previous all-time high from 2021.

Strengthening fundamentals like a growing $9.3M treasury and rising adoption suggest potential. However, the price currently lags behind this on-chain strength.

ETF speculation is heating up. Major firms like Grayscale have filed applications, and an approval could trigger significant institutional investment into LINK.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.