Bitcoin Price Rebounds Above $69k: Here are Two Reasons Why BTC May Rally to $85k Before $58k

The Bitcoin price has been trapped in a range-bound choppy consolidation in the past four days.

Onchain data shows Bitcoin whales are buying again after a period of selloff.

Wall Street analysts believe that the Bitcoin price is already in a macro bear market akin to 2022.

Bitcoin (BTC) price has rebounded towards $70,000 on Tuesday, February 10, during the North American session. The flagship coin rebounded from a demand zone around $68.5k in the past two days, thus aiming to retest its supply zone around $71,250.

Nonetheless, Bitcoin price has suffered a significant decline in its Open Interest (OI), thus fueling the bearish sentiment. According to market data from CoinGlass, BTC’s OI has dropped from above $90 billion in October 2025 to hover about $45.7 billion at press time.

Two Main Reasons Why Bitcoin Price May Retest $85k

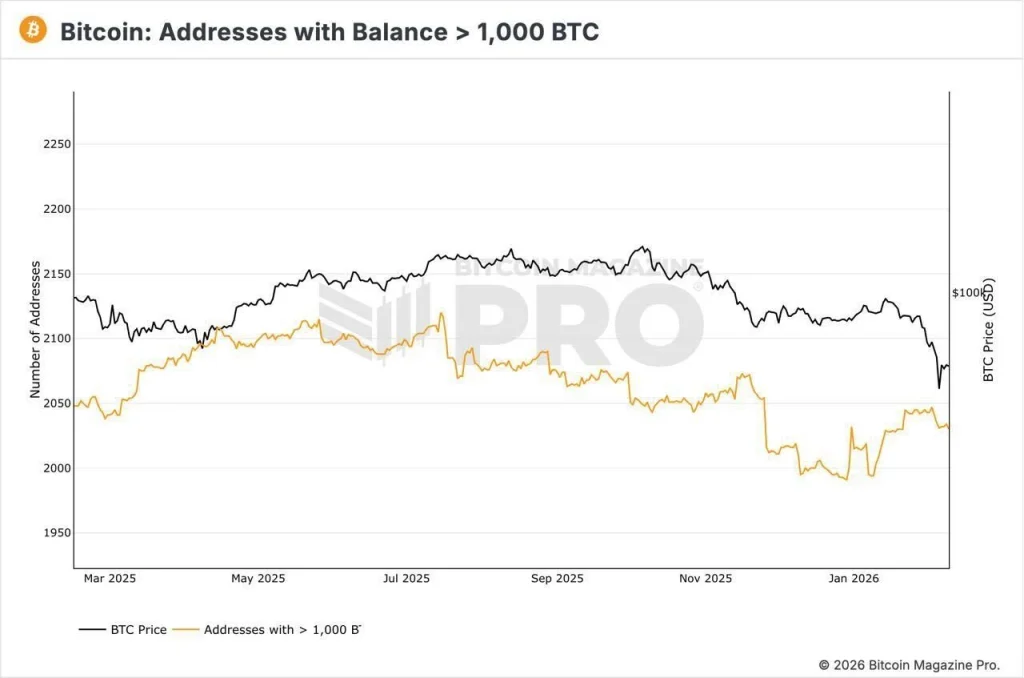

Renewed interest from whales

According to onchain data analysis, Bitcoin whales with an account balance of above 1000 BTC have been accumulating year-to-date. Moreover, Bitcoin addresses with an account balance of 1000 have surged by 50 in the past few weeks.

Source: X

With onchain data showing the retail traders still reluctant to buy BTCs at current levels, amid extreme fear of further capitulation, the odds of a Bitcoin price rebound remain palpable.

BTC Price Aims to Fill Unfilled CME Gap

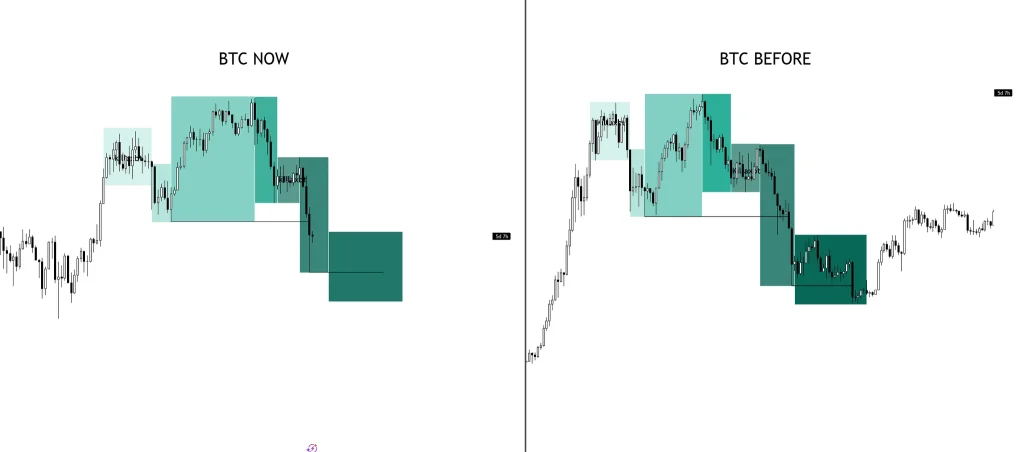

The main reason why Bitcoin price may rebound to $85k is due to its unfilled gap above $79k and below $85k. Historically, any gap in the Bitcoin CME Futures formed has been filled.

With the BTC price forming a potential bull flag after a notable selloff to around $60k, the flagship coin is likely to rally towards $85k soon.

What’s the Bigger Picture?

Although BTC price may rebound towards $85k soon, the intense fear of further capitulation is palpable. Furthermore, more crypto traders are predicting a similar Bitcoin capitulation in the coming weeks to the 2022 bear market.

Source: X

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.