On-chain data analysis shows heavy selling pressure from traders.

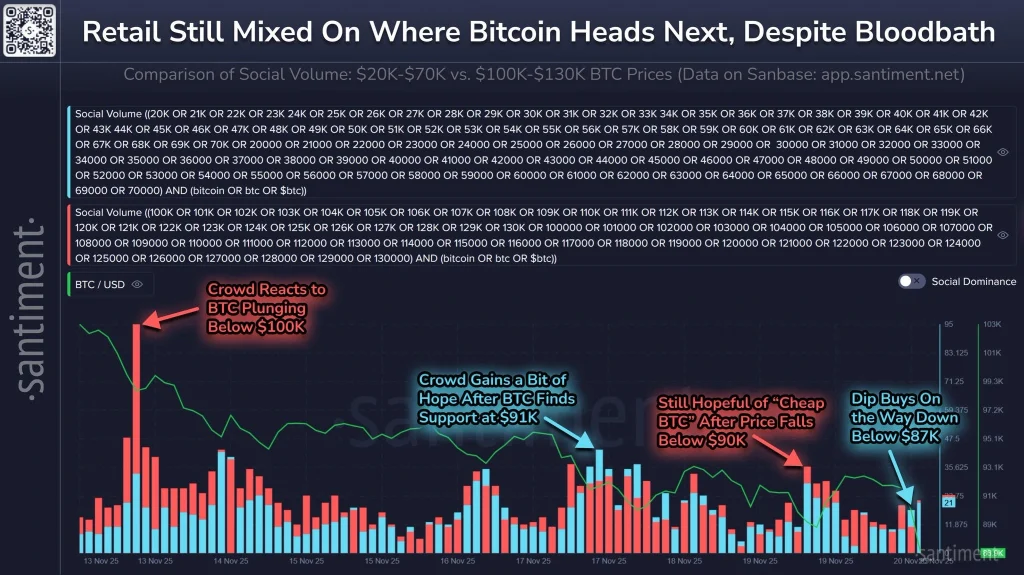

Santiment analysis shows retail traders are extremely bearish but noted that the market moves in the opposite direction.

The BTC/USD pair is currently sitting on a crucial support level amid bearish sentiment.

Bitcoin (BTC) price has extended its losses below $87k on Thursday, November 20, 2025. The flagship coin dropped over 5% during the past 24 hours to reach a new seven-month low of about $86.3k before rebounding to trade about $87.3k at press time.

The wider crypto market followed Bitcoin in losses, thus resulting in over $914 million liquidated from leveraged traders. Notably, more than $703 million involved long traders, thus further fueling bearish sentiment via a long squeeze.

Why Bitcoin Price May Rebound Heavily Ahead

Technical support: BTC price is currently retesting a crucial liquidity level

In the weekly timeframe, Bitcoin price has been forming a symmetrical rising channel since early 2023. Since hitting its all-time high of about $126k in October, Bitcoin price has been trapped in a correction mode, thus retesting the lower border of its macro rising channel.

Source: TradingView

Santiment’s inverse trading on retail behavior amid extreme fear of capitulation

According to market data analysis from Santiment, retail traders have shown increased predictions of BTC price falling below $70k. However, Santiment noted that the market tends to move in the opposite direction of the retail traders.

Source: Santiment

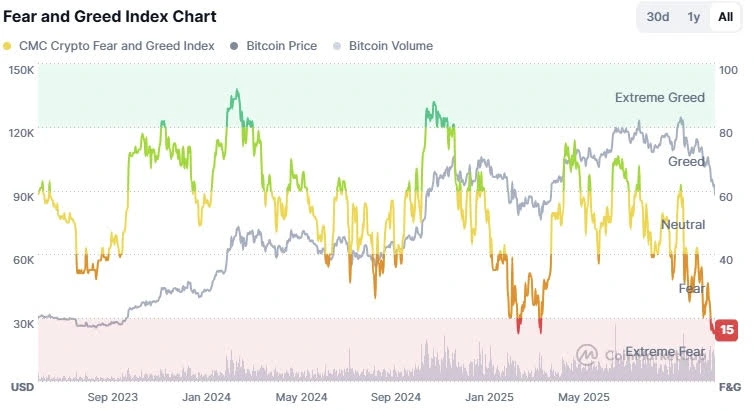

The midterm bullish sentiment is bolstered by the extreme fear of further crypto capitulation. Notably, CoinMarketCap’s Fear and Greed Index dropped to its yearly low of about 15/100.

Source: CoinMarketCap

The last time that this index dropped to such levels resulted in a bullish rebound in the subsequent few months.

Historical playout after the U.S. government shutdown

Following the reopening of the U.S. government, liquidity is expected to find its way to the crypto market amid the anticipated Federal Reserve’s Quantitative Easing (QE). As CoinPedia reported, the Bitcoin price is likely to experience a similar rebound to the post-U.S. government shutdown of 2019.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.