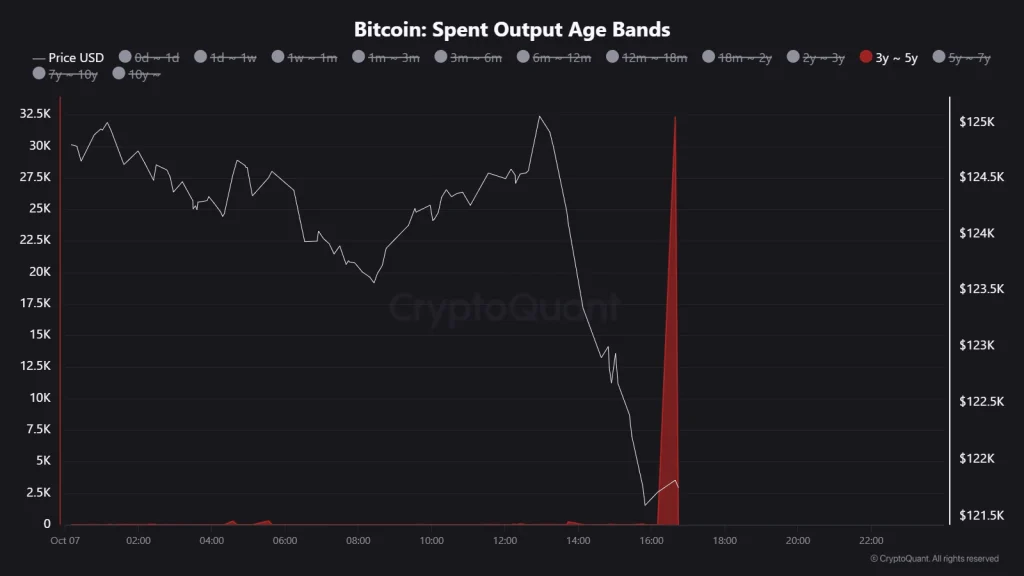

On-chain data analysis shows over 32k BTCs were moved today by whales that were dormant for 3-5 years.

More than $635 million was liquidated in the last 24 hours, mostly involving long traders.

BTC price is yet to correlate to gold’s parabolic rally amid the rising supply of global money.

Bitcoin (BTC) price experienced a flash selloff on Tuesday after hitting its all-time high (ATH) of above $126k on Monday. The flagship coin dropped over 3% in the past 24 hours to reach a range low of about $120,681 before rebounding to trade about $122k at press time.

The wider altcoin market – with the exclusion of Binance Coin (BNB), PancakeSwap (CAKE), and a few other altcoins – dropped in tandem with Bitcoin. As such, the total crypto market cap had slipped 3.5% to hover about $4.16 trillion at press time.

Major Reasons Why Bitcoin Price Dropped Today

High Leveraged Flush

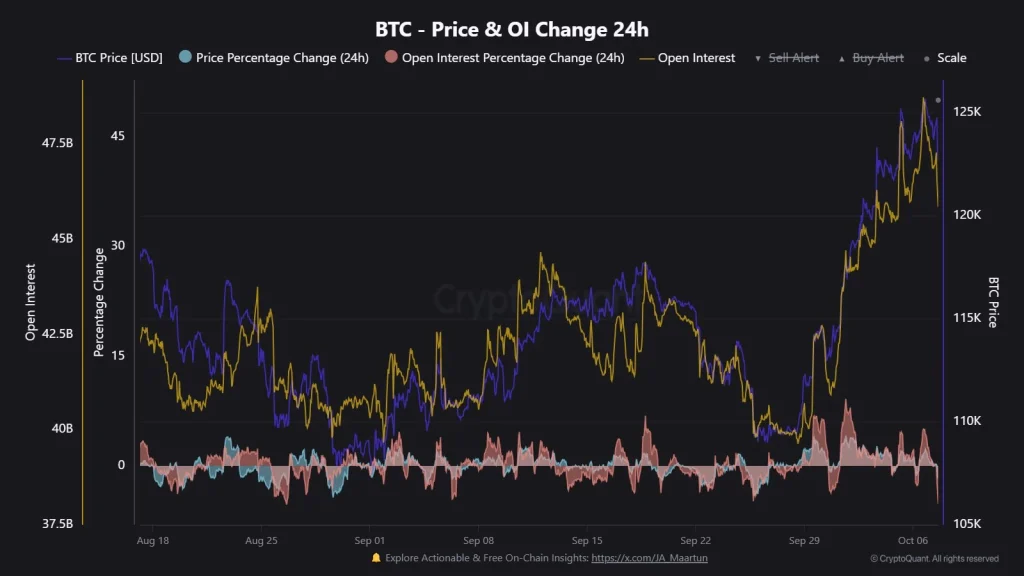

Following the sudden crypto drop on Tuesday, more than $625 million was liquidated from leveraged traders, with the majority involving long traders. According to market data analysis from CryptoQuant, Bitcoin’s Open Interests (OI) dropped over 5%, the biggest single-day wipeout in six weeks.

Old Whales Reawakening

After BTC price surged to a new ATH on Monday, on-chain data analysis showed an increase in profit-taking. According to data from CryptoQuant roughly 15k BTC, valued at nearly $2 billion, was deposited into crypto exchanges during the last 24 hours.

On Tuesday, the largest Bitcoin whale movement in 2025 was recorded, whereby wallets that were dormant for 3-5 years moved 32,322 BTCs valued at about $4 billion.

What’s Next for BTC Price?

Bitcoin price has been under the influence of high demand from institutional investors, a supportive macroeconomic backdrop, and amid the ‘Uptober’ bullish sentiment.

From a technical analysis standpoint, BTC price is well-positioned to rebound towards its parabolic phase in the coming weeks. Moreover, BTC price is the digital gold, and the gold price has been in a parabolic rally since mid-August. Additionally, the global money supply has increased gradually in the recent past, which is bullish for Bitcoin and the wider crypto market.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.