Why Are Bitcoin, Ethereum and XRP Prices Crashing Today? Fed Uncertainty Sparks Crypto Selloff

Crypto selloff intensifies: Bitcoin, Ethereum, and XRP drop sharply as forced liquidations hit amid Fed uncertainty and rising geopolitical tensions.

Technical breakdowns drive losses: BTC falls below $87k, ETH breaks $2,800 support, and XRP heads toward $1.40, signaling bearish continuation across markets.

Macro risks fuel volatility: Elevated leverage, risk-off sentiment, and weak demand keep crypto under pressure until key support levels are reclaimed.

The broader crypto market is under heavy pressure today, with Bitcoin, Ethereum, and XRP posting sharp losses as a broad selloff sweeps across digital assets. Bitcoin has fallen nearly 6%, while Ethereum and XRP are down close to 7%, marking one of the most aggressive downside moves in recent weeks.

The decline has rapidly shifted from orderly selling into a liquidation-driven rout. As leverage built up during earlier consolidation phases was unwound, prices slipped below critical technical levels almost simultaneously. That failure triggered forced liquidations, accelerating losses and pushing sentiment firmly into risk-off territory.

Liquidations Wave Accelerates as Fed Uncertainty and Geopolitical Risks Hit Crypto

The sharp crypto selloff today gained pace as macro pressure intensified across global markets, with Federal Reserve policy uncertainty and rising geopolitical tensions acting as key catalysts behind the liquidation surge.

Markets turned risk-off after renewed signals that U.S. interest rates may remain higher for longer, dampening expectations of near-term monetary easing. At the same time, escalating geopolitical tensions added to broader market anxiety, pushing investors away from high-risk assets such as cryptocurrencies.

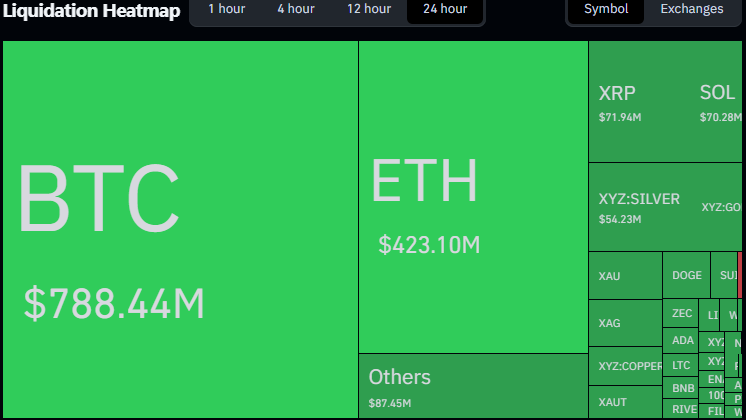

This macro shock hit an already overleveraged crypto market. Once Bitcoin slipped below key technical levels, forced liquidations rapidly took control of price action. Derivatives data shows more than $1.2 billion in crypto positions liquidated in a short time frame, with long positions accounting for the overwhelming majority of losses.

- Bitcoin liquidations: approximately $788 million

- Ethereum liquidations: around $423 million

- XRP liquidations: roughly $71 million

Over 90% of liquidations came from long positions, confirming that bullish bets had become overcrowded near recent highs. Once prices moved against those positions, liquidation cascaded amplified losses across exchanges, accelerating downside momentum.

Bitcoin Price Analysis: Breakdown Signals Further Decline Ahead

Bitcoin’s price chart structure has decisively turned bearish. For the past few months, it has been capped inside a range, but it has broken the range today with sharp volumes, highlighting a breakdown. The trendline breakdown alongside the horizontal support zone of $87000, implies a strong structural weakness on the daily chart. This breakdown invalidates the higher-low structure and signals a shift into distribution rather than accumulation.

Now, Bitcoin price is trading at $82k mark, below both support zone and short-term moving averages, with volume rising on the downside, implying weakness. If Bitcoin price fails to reclaim $87k region quickly, downside risk remains active toward $80k, with the structure allowing for an extended move toward $75k in the short-term.

Ethereum Price Analysis: Loss of $2800 Support Deepens Bearish Bias

Ethereum’s price chart confirms growing downside risk after a clean break of the $2800 support zone. That level had acted as a key demand zone during multiple pullbacks, but sellers overwhelmed bids during the latest selloff. Currently, ETH price is now trading below a compressed consolidation range, with the breakdown occurring alongside rising liquidation volume. The former support around $2800 has flipped into resistance, reinforcing bearish bias.

The next major demand zone lies between $2500 and $2400, where historical accumulation and ETF-related flows previously emerged. Until ETH reclaims $2800 decisively, any bounce is likely to remain constructive rather than trend-reversing.

XRP Price Analysis: Support Failure Confirms Bearish Continuation

XRP’s price chart structure also points to further downside, as it broke below a long-support base and is heading toward the channel lower region of $1.40, implying a bearish continuation. XRP price remains trapped within a descending channel with lower highs and lower lows swings formation. With weakening demand and loss of support zone, the downside risk increases now. The lack of accumulation suggests broader risk aversion toward altcoins, keeping XRP vulnerable to continued selling pressure.

In the early 2026, XRP price faced strong rejection from $2.40 and trapped buyers. Thereafter, continued selling pressure forced buyers to exit from their positions, resulting in a severe decline. Until XRP price sustains above $2, the bearish structure continues to push XRP toward lower regions.

Market Outlook: Why the Selloff is Accelerating

The current selloff reflects a convergence of fragile technical structure, elevated leverage, and weakening macro risk appetite. Following the Federal Reserve’s latest policy stance, markets have reassessed expectations around liquidity and rate cuts, pressuring speculative assets across the board. While forced selling has reduced some excess positioning, price action suggests the reset is still in progress. The recovery depends on Bitcoin reclaiming $87,000–$88,000, Ethereum recovering $2,800, and XRP regaining its broken base. Until those levels are reclaimed, volatility is likely to remain elevated, with rallies facing supply rather than attracting fresh risk capital.

FAQs

Crypto is falling due to forced liquidations, Fed rate uncertainty, geopolitical tensions, and weakening investor risk appetite.

Bitcoin is down ~6%, Ethereum and XRP near 7%, driven by a broad market selloff and liquidation events.

Overleveraged long positions, falling below key support levels, triggered $1.2B+ in rapid liquidations across major coins.

Recovery depends on Bitcoin, Ethereum, and XRP reclaiming key support. Until then, volatility and bearish pressure remain high.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.