Bitcoin Cash price benefits from rising merchant adoption and renewed whale activity

BCH maintains its position as the fourth most-adopted crypto on Cryptwerk

Technical structure forms a bullish setup heading into Q1 2026

The Bitcoin Cash price is in talks as fresh data from Cryptwerk and on-chain activity point toward strengthening fundamentals. With BCH emerging as one of the most widely accepted cryptocurrencies for real-world payments, coupled with rising whale accumulation and a bullish Bitcoin Cash price chart, traders are turning optimistic.

BCH Becomes the Fourth Most Accepted Crypto for Payments

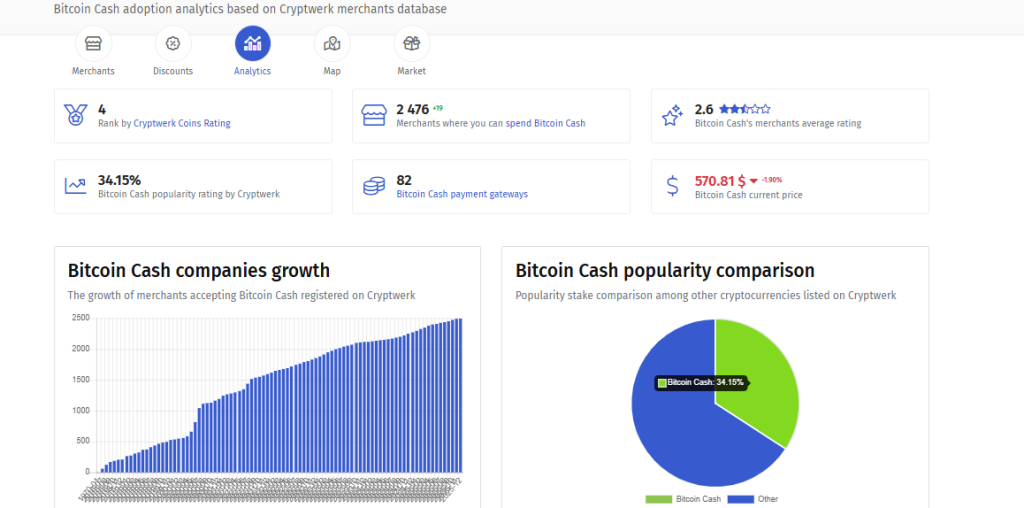

According to Cryptwerk’s latest merchant data, Bitcoin Cash now ranks as the fourth most adopted cryptocurrency for payments after BTC, ETH, and LTC. BCH’s rise is supported by 2,476 merchants that currently accept Bitcoin Cash as a form of payment, alongside 82 dedicated payment gateways.

This level of adoption demonstrates the token’s consistent focus on real-world utility. Since 2018, the number of businesses accepting BCH has grown steadily, making Bitcoin Cash crypto one of the most recognized assets for everyday transactions.

Moreover, BCH holds a 34% popularity share when compared with other cryptocurrencies listed on the platform, further reinforcing its relevance in practical use-cases.

Merchant Distribution Shows Real-World Bitcoin Cash Utility

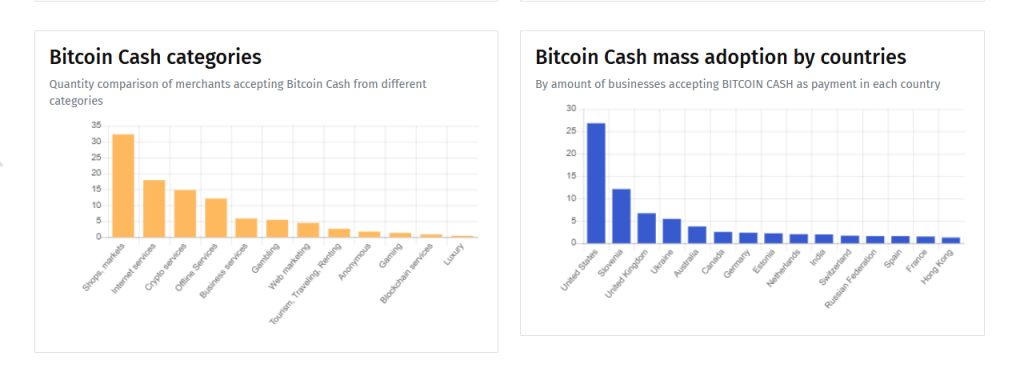

A deeper look at sector-specific adoption reveals which industries rely on BCH the most. Shops, online markets, and internet-based services remain the strongest categories for Bitcoin Cash price USD transactions. Conversely, luxury services show the least adoption, highlighting BCH’s role as a payments-driven network primarily used for accessible, everyday spending.

Country-wise, the United States, Slovenia, and the United Kingdom lead the rankings for the highest number of BCH-accepting businesses. This geographic spread underscores Bitcoin Cash’s reach beyond crypto-native hubs and into broader commercial ecosystems.

Whale Activity Suggests Growing Confidence in BCH

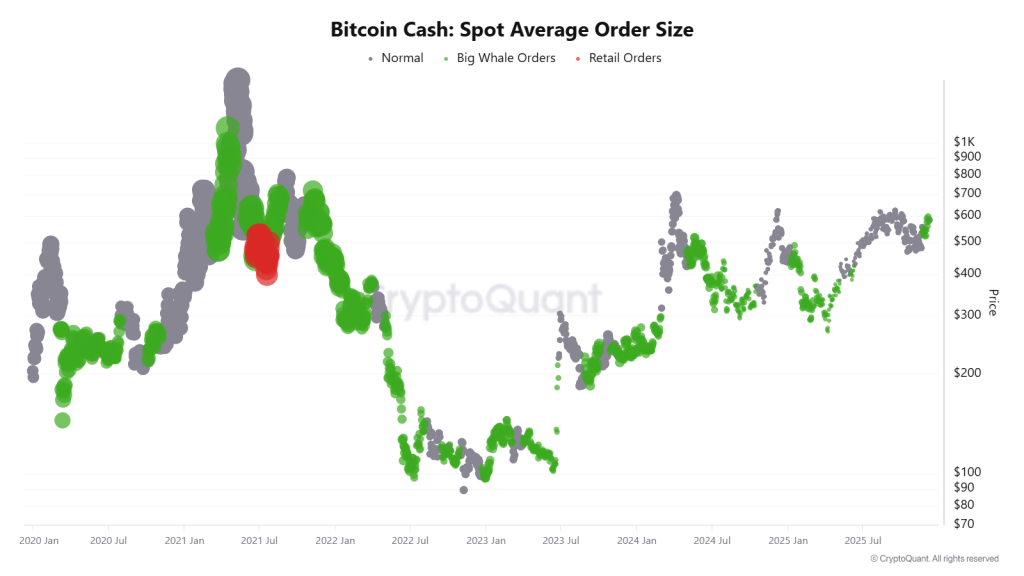

Beyond merchant-based utility, on-chain data reveals that BCH whale orders have dominated order books for several years. These large holders have accumulated sizeable amounts over time, and recently, whale activity has increased once again.

This renewed participation indicates strategic positioning ahead of the next bull market. The acceleration in accumulation implies rising confidence in the medium-term Bitcoin Cash price forecast as market structure prepares for potential expansion.

Bull Flag Breakout Points to a Strong Bitcoin Cash Price Prediction

On the technical front, Bitcoin Cash price action throughout Q4 2025 has formed a clear bull-flag structure. In December, this pattern successfully broke out, and the price is currently holding the upper boundary as support.

If this strength continues, the Bitcoin Cash price prediction points toward a potential rise to the $690–$700 range in December is reflecting a possible 20–25% surge based on bullish momentum. Furthermore, a confirmed close above this range could set up a strongly bullish outlook moving into Q1 2026.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.