AVAX price leaps 8.8% in a week, rides high on ETF speculation and network growth

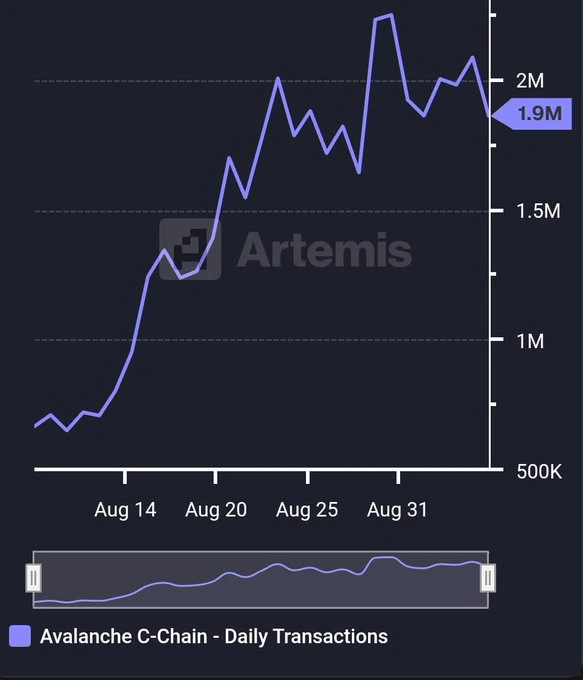

Avalanche C-Chain daily transactions hit a record 1.9M, tripling in mere 30 days

Key resistance sits at $27.89, with RSI leaving room for more upside

Avalanche Price Today

| Cryptocurrency | Avalanche |

| Token | AVAX |

| Price | $9.2436 |

| Market Cap | $ 3,991,109,294.53 |

| 24h Volume | $ 325,380,320.5812 |

| Circulating Supply | 431,771,961.1772 |

| Total Supply | 463,441,061.1772 |

| All-Time High | $ 146.2179 on 21 November 2021 |

| All-Time Low | $ 2.7888 on 31 December 2020 |

Avalanche price has been on an impressive run, adding 4% in gains since yesterday to trade at $26.94. Its market valuation has risen to $11.37 billion, while trading volume spiked nearly 44% to $1.02 billion. With a daily range between $25.67 and $27.05, AVAX is now sitting above crucial technical levels and drawing attention from both retailers and institutions.

The rally comes at a time when ETF speculation is brewing high and Avalanche’s network activity is accelerating fast. Let’s break down what’s happening both on-chain and on the charts in this short-term AVAX price prediction.

On-Chain Activity

Avalanche’s fundamentals have improved significantly over the past month. In a recent AVAX news, the C-Chain processed 35.8 million transactions in August, marking a record high. While daily transactions nearly tripled to 1.9 million in the last 30 days. This spike in activity signals growing developer and enterprise adoption. Toyota’s blockchain lab, for instance, is already testing vehicle finance solutions on Avalanche.

At the same time, RWA volumes surged 58% month-over-month, underscoring Avalanche’s focus on institutional use cases. However, it’s worth noting that active addresses dipped 10% last week, hinting at reduced retail activity. This mix of rising enterprise demand and falling small-holder participation could add volatility to price action.

Another bullish metric is the $300 million increase in AVAX’s stablecoin supply over the last 7 days, putting it second only to Ethereum in net growth. That kind of liquidity injection usually translates to more on-chain activity and potential support for higher token valuations.

AVAX Price Analysis

Looking at the AVAX tradingview chart, the token seems to be poised for continuation. The token broke above its 23.6% Fibonacci retracement at $25.64 and is trading above all major moving averages, for instance 7-day SMA is at $24.88, and 30-day SMA is at $24.29.

Successively, the MACD histogram has flipped positive, while the RSI-14 sits at 75.24, which might cool off in the short term, but the broader trend remains constructive.

The immediate resistance to watch is the 127.2% Fibonacci extension at $27.89. A clean breakout above that could open the path toward the $30 psychological level. On the downside, support for AVAX price sits around $25.64 and $24.29, which align with recent Fib levels and moving averages.

FAQs

AVAX is gaining on ETF speculation, rising stablecoin supply, and record on-chain activity, including 35.8M transactions in August.

The next key resistance is at $27.89, the 127.2% Fibonacci extension. If broken, AVAX could target $30.

Yes, daily transactions nearly tripled in 30 days, and RWA volumes jumped 58%, showing strong enterprise and institutional traction.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.