Aster token surged over 2500% in weeks, becoming a strong Hyperliquid competitor.

Analyst Michael van de Poppe highlights $2 as critical level for Aster’s next move.

Crypto expert see $1.60–$1.80 accumulation zone holding above could rally beyond $3.

Aster, the main competitor to Hyperliquid, has become one of the most talked-about tokens in the decentralized perpetual exchange (DEX) space, particularly amid 2025’s so-called “DEX war.”

Crypto analyst Michael van de Poppe has highlighted the token’s current trading zone, noting that the token has entered a make-or-break phase that could determine its short-term trajectory.

Meteoric Rise for a New Token

Launched only a few weeks ago, ASTER has already seen a meteoric rise of more than 2500%, catching the attention of retail traders. Following praise from Binance founder CZ on X, the token quickly hit an all-time high of $2.31.

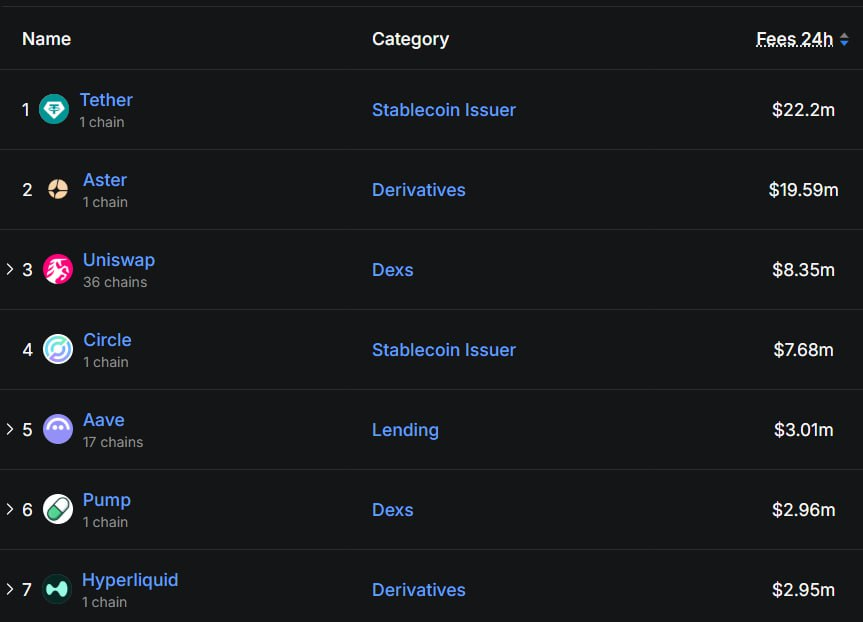

Trading volumes are now competing with top perpetual DEXs, Aster’s debut looks like a breakout success story. Aster is just $3 million away from overtaking Tether in daily fee revenue.

If this happens, it would mark another major milestone for the young project.

Make-or-Break Phase for ASTER

Looking at Aster’s current trading zone, Van de Poppe noted that ASTER has repeatedly bounced from the same support area, earlier delivering gains of 15% and 35%.

The analyst highlighted the $2 level as crucial, it separates consolidation from potential expansion.

A confirmed breakout above this mark could push ASTER to new all-time highs, while a drop below the current support might pull it down toward $1.25, where buyers could step in again.

Aster Price Prediction $3

Adding more bullishness to the analysis, popular trader BitcoinHabebe, says ASTER is ideal for buying between $1.60 and $1.80. This range is called accumulation, where buyers slowly build positions before a price rise.

ASTER is showing these signs, and if momentum continues, the next target could be $3 or higher.

As of now, the Aster price is trading around $1.79, reflecting a slight drop seen in the last 24 hours.

FAQs

Aster is a decentralized perpetual exchange token that has surged over 2500% since launch, quickly gaining traction in the DEX market.

Analysts suggest that if buyers keep accumulating around $1.60–$1.80, ASTER could rally toward $3 or even set new highs.

Since debuting only weeks ago, ASTER has climbed over 2500%, fueled by strong trading volume and growing investor attention.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.