0G price moons 75% in a day, hitting a fresh ATH of $7.31 before cooling to $5.87

Exchange listing limits supply, fueling volatility and short squeezes

Institutional backing and AI ecosystem growth bolster long-term outlook

0G, the native token of AI-focused Layer 1 blockchain 0G, has seen a meteoric rise in recent days. Built by 0G Labs, the project aims to bring decentralized AI on-chain through its modular setup that includes DeAIOS, the 0G Chain, and 0G Storage. With a total supply of 1 billion tokens, the token was recently launched on major exchanges and participated in the BingX Listing Carnival, offering rewards worth up to $110,000.

Why is 0G Price Up Today?

Three factors explain this explosive move:

1. Exchange Strategy & Supply Control

Binance’s September 21 listing created turbulence, but with only 2 million tokens (0.2% of supply) distributed to BNB holders and withdrawals disabled, circulating liquidity was heavily restricted. This limited supply fueled a 20% rebound within minutes of the listing, aided by trading bots and short squeezes. The next test lies in withdrawal activations—once liquidity increases, the $5.60 support could come under pressure.

2. Enterprise Partnerships

Institutional interest added fuel to the rally. FLGC’s $3.66 billion ZeroStack initiative involved purchasing 0G tokens at $3 each, 48% below current levels, anchoring a strong valuation base. In parallel, a collaboration with China Mobile to develop AI training nodes strengthens 0G’s utility narrative and reduces near-term selling pressure, as institutional allocations remain locked.

3. Staking & Ecosystem Growth

Bitget’s September 22 Launchpool allows staking BGB and USDT to farm 0G, while HAiO’s upcoming iNFT music platform (launching September 26) could expand real-world adoption. While staking helps support demand, the 13% community reward allocation (130M tokens) raises dilution concerns. Still, long-term ecosystem expansion may offset short-term volatility.

0G Price Analysis

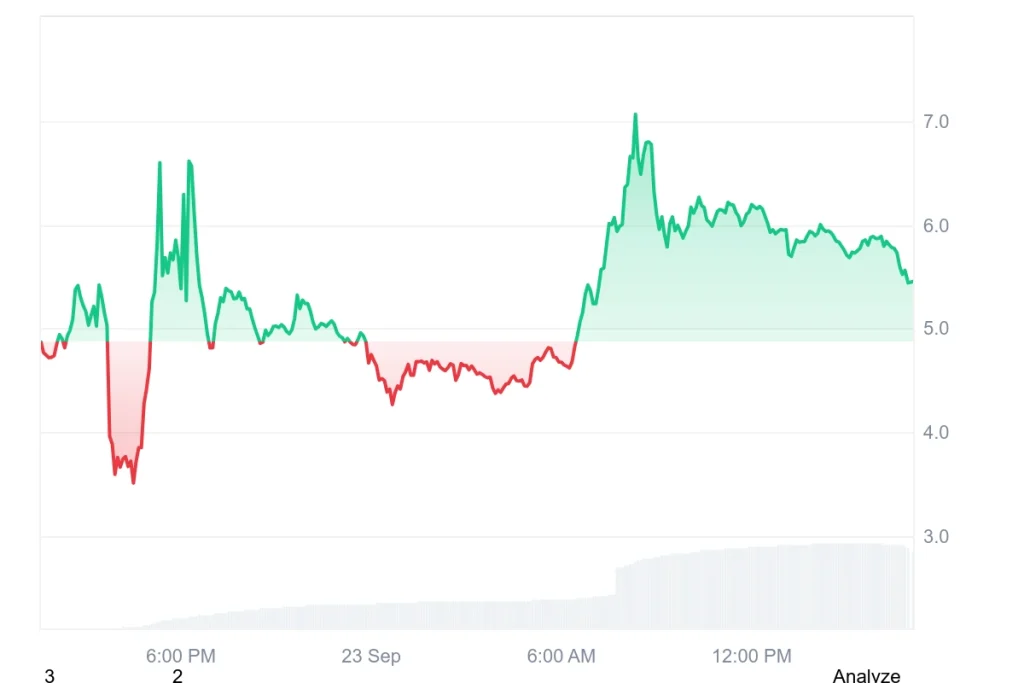

In the last 24 hours, 0G set both its all-time high of $7.31 and all-time low of $3.33, underscoring its extreme volatility. The surge has drawn massive attention, with 0G now trading at $5.87, marking a 75% daily gain and nearly 20% weekly growth.

Its market cap sits at $1.25 billion, while trading volume skyrocketed over 4000% to $3.33 billion in just 24 hours. The price is now consolidating near $5.87, with key support at $5.60 and resistance at $6.10.

Conclusion:

0G’s rally reflects a perfect storm of exchange tactics, strategic partnerships, and ecosystem growth. However, with institutions buying in at much lower prices and community token unlocks ahead, volatility remains high. The key question now: will HAiO’s September 26 launch spark sustained developer activity, or will profit-taking from airdrop unlocks weigh down momentum?

FAQs

The surge was driven by Binance’s restricted listing, institutional purchases, and strong AI-focused partnerships.

Support sits near $5.60, while resistance is seen at $6.10.

The HAiO iNFT launch on September 26 and token unlocks from community rewards could shape short-term price action.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author's own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.